Get the free Irish Tax Institute - Dedicated to tax

Show details

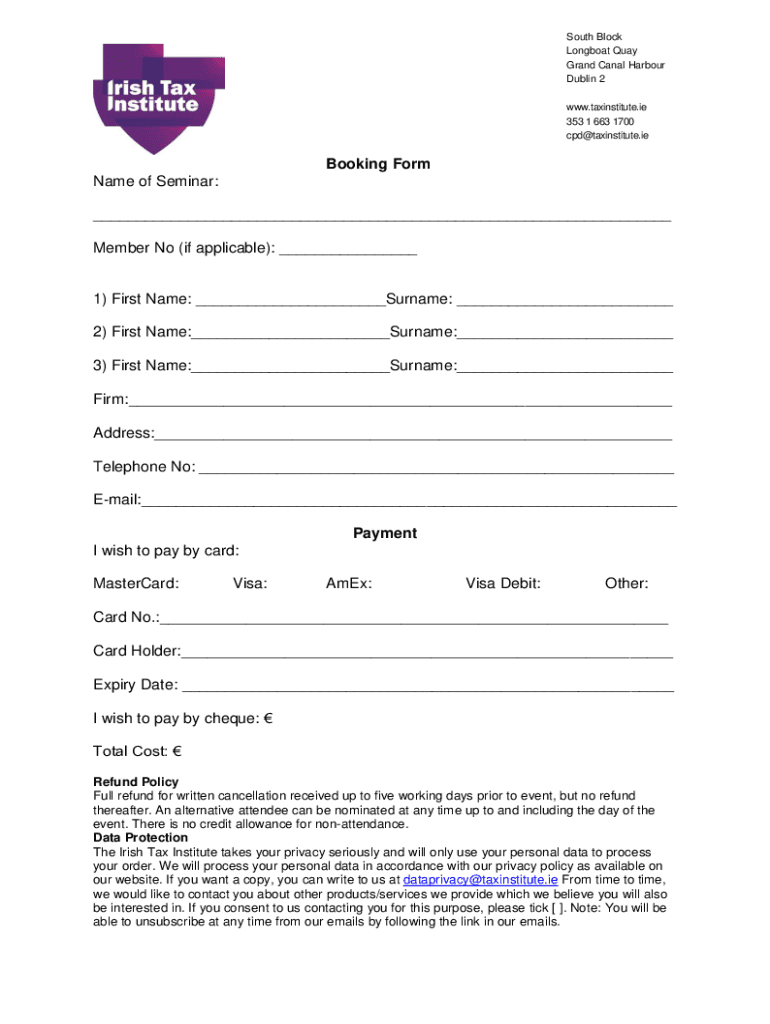

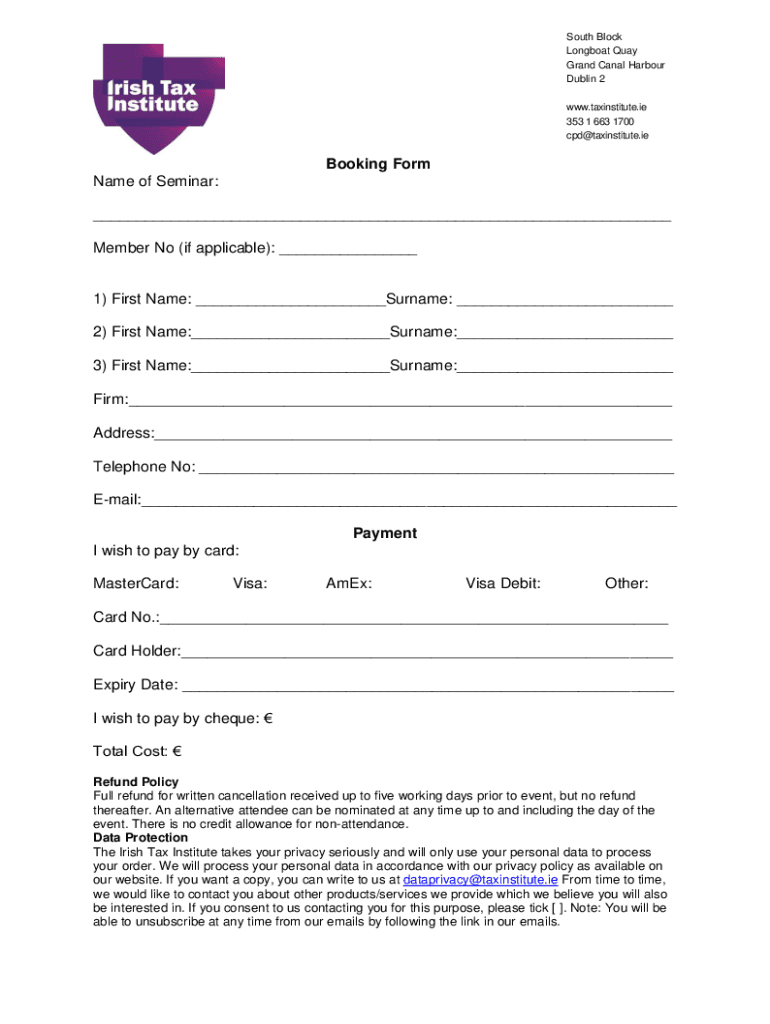

South Block

Longboat Quay

Grand Canal Harbor

Dublin 2

www.taxinstitute.ie

353 1 663 1700

cpd@taxinstitute.ieBooking Form

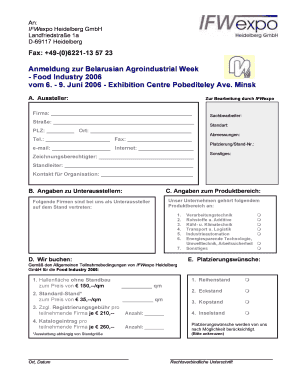

Name of Seminar:

___

Member No (if applicable): ___1) First Name: ___Surname:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irish tax institute

Edit your irish tax institute form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irish tax institute form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irish tax institute online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit irish tax institute. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irish tax institute

How to fill out irish tax institute

01

Obtain the necessary forms for filling out the Irish tax institute from the official website or by contacting the institute directly.

02

Begin by entering your personal information, such as your name, address, and contact details, in the appropriate sections.

03

Provide details about your employment, including your employer's name, address, and tax identification number.

04

Fill out the sections related to your income, such as salary, bonuses, and any additional sources of income.

05

Deduct any allowable expenses or deductions to calculate your taxable income accurately.

06

Declare any tax credits or reliefs you are eligible for to reduce your tax liability.

07

Complete the section on tax payments, including PAYE (Pay As You Earn) withholdings and any other tax payments made throughout the year.

08

Review the completed form for accuracy and make any necessary corrections or additions.

09

Sign and date the form to certify the information provided is true and accurate.

10

Submit the filled-out form to the Irish tax institute either online or by mail, as per their instructions.

Who needs irish tax institute?

01

Individuals working or earning income in Ireland need the Irish tax institute to fulfill their tax obligations and accurately report their income to the tax authorities.

02

Self-employed individuals, including freelancers and business owners, also require the Irish tax institute for managing their tax affairs and ensuring compliance with tax laws.

03

Irish residents who receive income from abroad or hold investments outside of Ireland may benefit from the Irish tax institute's expertise in handling international tax matters.

04

Employers and payroll administrators can also utilize the services of the Irish tax institute to ensure proper withholding and reporting of taxes on behalf of their employees.

05

Anyone seeking professional guidance and advice regarding taxation in Ireland can turn to the Irish tax institute for expert assistance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my irish tax institute directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your irish tax institute and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send irish tax institute to be eSigned by others?

When your irish tax institute is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I sign the irish tax institute electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your irish tax institute in minutes.

What is Irish Tax Institute?

The Irish Tax Institute is a professional body that represents tax practitioners in Ireland. It provides education, training, and resources related to taxation in Ireland.

Who is required to file Irish Tax Institute?

Individuals, businesses, and tax advisors who are engaged in delivering tax services or those who meet specific criteria set by the Revenue Commissioners in Ireland are required to file.

How to fill out Irish Tax Institute?

Filling out the Irish Tax Institute involves completing the relevant forms and documentation as per the guidelines provided by the Institute or the Revenue Commissioners, which can often be done online or via paper submissions.

What is the purpose of Irish Tax Institute?

The purpose of the Irish Tax Institute is to promote tax knowledge and education, uphold professional standards in tax practice, and represent the interests of its members within the tax community.

What information must be reported on Irish Tax Institute?

Information typically required includes personal identification details, income sources, deductions, credits, and any other relevant financial information required for accurate tax assessment.

Fill out your irish tax institute online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irish Tax Institute is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.