Get the free 19 CFR Part 177 -- Administrative Rulings

Show details

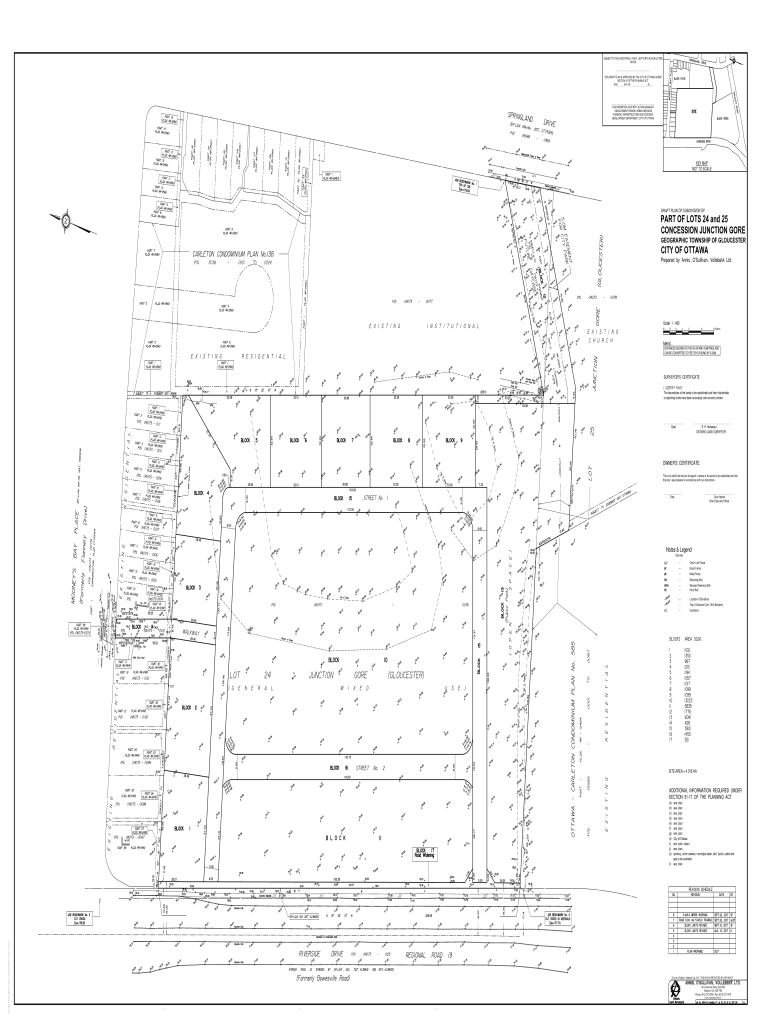

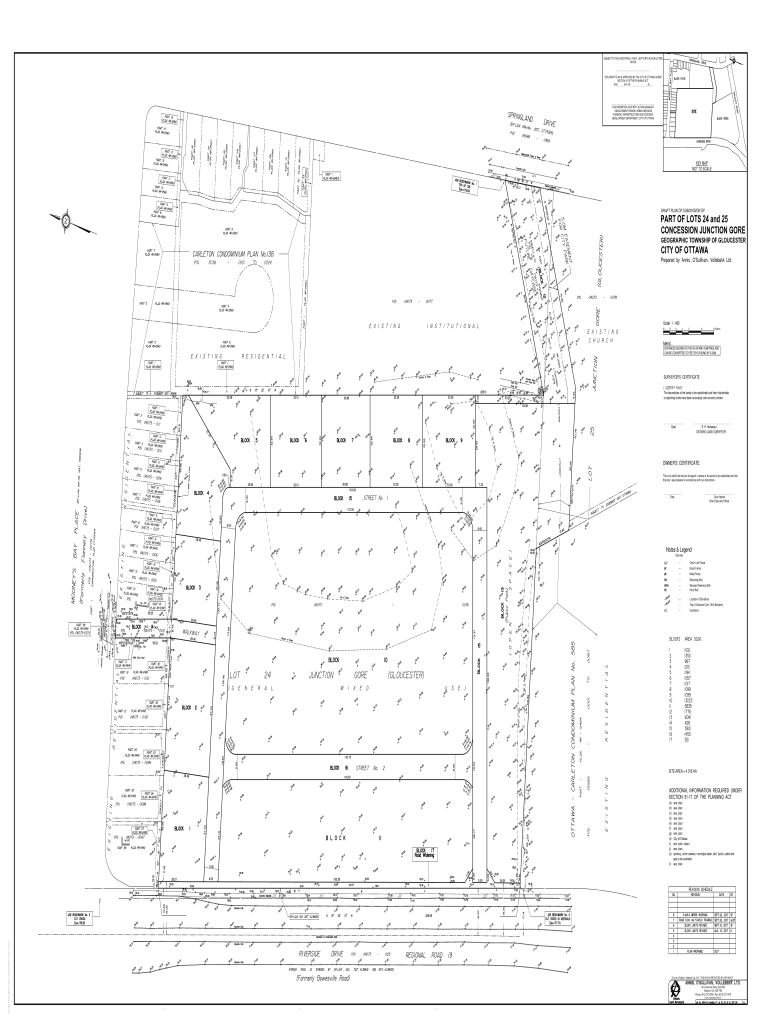

SUBJECT TO THE CONDITIONS, IF ANY, SET FORTH IN OUR LETTER DATED _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _. THIS DRAFT PLAN IS APPROVED BY THE CITY OF OTTAWA UNDER SECTION 51 OF THE PLANNING ACT.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 19 cfr part 177

Edit your 19 cfr part 177 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 19 cfr part 177 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 19 cfr part 177 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 19 cfr part 177. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 19 cfr part 177

How to fill out 19 cfr part 177

01

To fill out 19 CFR Part 177, follow these steps:

02

Begin by reviewing the regulations outlined in 19 CFR Part 177 to understand the requirements and guidelines.

03

Identify the specific product or commodity for which you need to determine its eligibility under the provision of 19 CFR Part 177.

04

Gather all necessary information and documentation related to the product, including its composition, construction, manufacturing process, and any applicable rulings or court decisions.

05

Review any applicable rulings or court decisions that may affect the determination of eligibility under 19 CFR Part 177.

06

Assess the specific characteristics of the product and compare them to the requirements stated in 19 CFR Part 177 to determine if it qualifies for preferential treatment or other provisions.

07

Complete the necessary forms or documents as required by Customs and Border Protection (CBP). Provide accurate and detailed information about the product and its eligibility under 19 CFR Part 177.

08

Submit the filled-out forms and supporting documents to the appropriate CBP office for review and approval.

09

Await the decision or ruling from CBP regarding the eligibility of the product under 19 CFR Part 177.

10

If approved, ensure compliance with any specified conditions or requirements outlined by CBP.

11

Keep a record of the determination, supporting documents, and any subsequent communication with CBP for future reference or audits.

Who needs 19 cfr part 177?

01

Various stakeholders may need to refer to or comply with 19 CFR Part 177, including:

02

- Importers and exporters who deal with goods eligible for preferential treatment under specific provisions outlined in 19 CFR Part 177.

03

- Customs brokers who handle clearance procedures for goods subject to the provisions of 19 CFR Part 177.

04

- Regulatory authorities or government agencies responsible for overseeing and enforcing trade regulations and policies.

05

- Legal professionals or consultants assisting clients in determining the eligibility of their products under 19 CFR Part 177.

06

- Businesses or individuals seeking guidance or clarification on specific provisions or requirements within 19 CFR Part 177.

07

- Any entity involved in international trade activities that may be affected by the regulations and provisions described in 19 CFR Part 177.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 19 cfr part 177 directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your 19 cfr part 177 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I complete 19 cfr part 177 online?

With pdfFiller, you may easily complete and sign 19 cfr part 177 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit 19 cfr part 177 in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing 19 cfr part 177 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is 19 cfr part 177?

19 cfr part 177 refers to the U.S. Customs and Border Protection regulations that govern the importation of goods into the United States.

Who is required to file 19 cfr part 177?

Importers, customs brokers, and other parties involved in the importation process are required to file 19 cfr part 177.

How to fill out 19 cfr part 177?

19 cfr part 177 must be filled out electronically through the Automated Commercial Environment (ACE) portal or through a customs broker.

What is the purpose of 19 cfr part 177?

The purpose of 19 cfr part 177 is to provide information to U.S. Customs and Border Protection about the imported goods, including their value, country of origin, and classification.

What information must be reported on 19 cfr part 177?

Information such as the importer of record, country of origin, value of the goods, and classification of the goods must be reported on 19 cfr part 177.

Fill out your 19 cfr part 177 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

19 Cfr Part 177 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.