Get the free summary of property tax collections for fiscal year ending ...

Show details

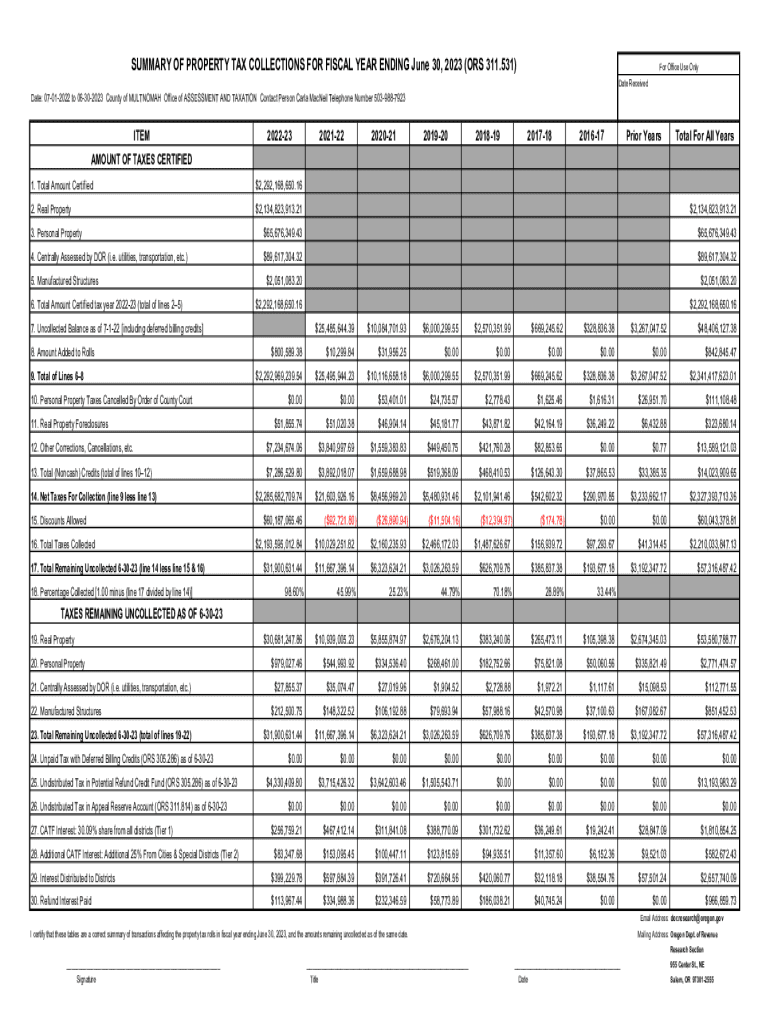

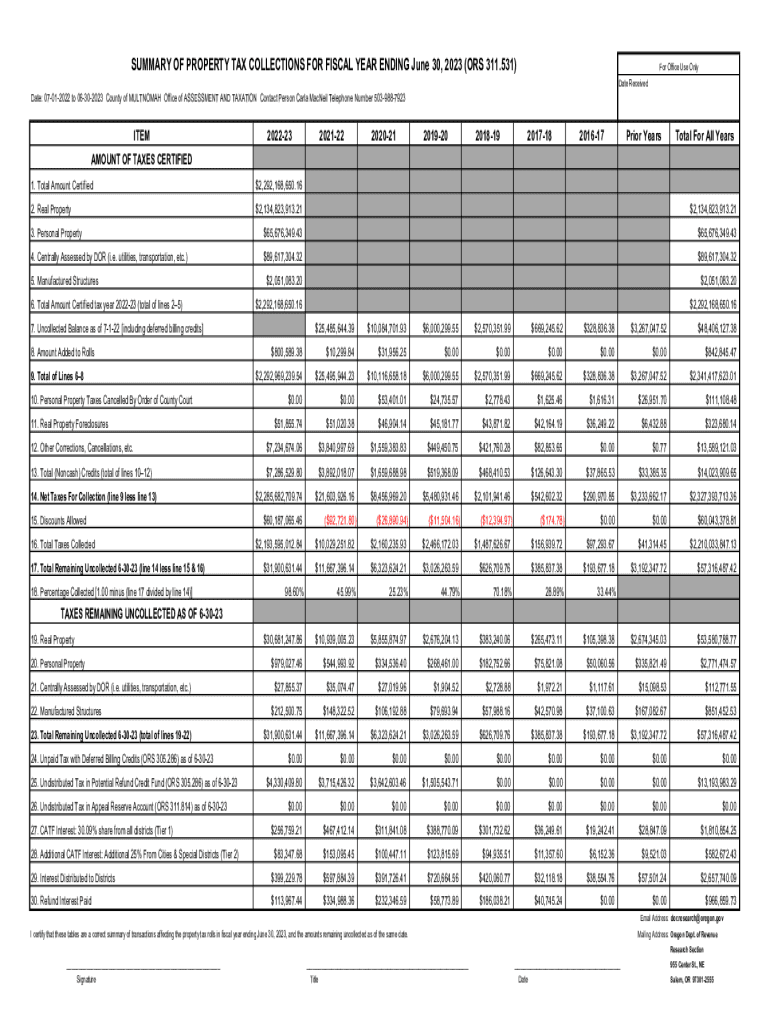

SUMMARY OF PROPERTY TAX COLLECTIONS FOR FISCAL YEAR ENDING June 30, 2023 (ORS 311.531)For Office Use Only Date ReceivedDate: 07012022 to 06302023 County of MULTNOMAH Office of ASSESSMENT AND TAXATION

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign summary of property tax

Edit your summary of property tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your summary of property tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing summary of property tax online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit summary of property tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out summary of property tax

How to fill out summary of property tax

01

Gather all necessary documents such as property ownership details, tax evaluation notices, and any relevant financial statements.

02

Start by providing basic information about the property such as its address and legal description.

03

Include details about the property's assessed value and how it was determined.

04

Mention any exemptions or deductions that apply to the property.

05

Outline the calculation method used to determine the property tax amount.

06

Specify the due dates and methods of payment for the property tax.

07

Include any additional information or explanations that might be necessary.

08

Review the completed summary to ensure accuracy and clarity.

09

Submit the summary of property tax to the appropriate authority.

Who needs summary of property tax?

01

Property owners who are required to pay property tax.

02

Real estate professionals who need to provide information about property taxes to clients.

03

Financial institutions and lenders who require property tax information for loan applications or assessments.

04

Government agencies responsible for assessing and collecting property taxes.

05

Anyone interested in understanding the details and obligations related to property tax.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify summary of property tax without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like summary of property tax, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send summary of property tax to be eSigned by others?

summary of property tax is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How can I edit summary of property tax on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing summary of property tax.

What is summary of property tax?

A summary of property tax is a document that outlines the assessed value of a property, the tax rate, and the total amount owed to local government entities as property tax.

Who is required to file summary of property tax?

Property owners are required to file a summary of property tax for their residential, commercial, or industrial properties.

How to fill out summary of property tax?

To fill out a summary of property tax, property owners must provide details on property characteristics, assessed value, and applicable tax rates as specified by their local tax authority.

What is the purpose of summary of property tax?

The purpose of the summary of property tax is to inform property owners about their tax obligations and to provide a clear record for local governments for tax collection purposes.

What information must be reported on summary of property tax?

The summary must report the property's assessed value, tax rate, total tax liability, property owner's details, and any exemptions or deductions applicable.

Fill out your summary of property tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Summary Of Property Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.