Get the free Douglas County Tax Roll File Layout (PDF)

Show details

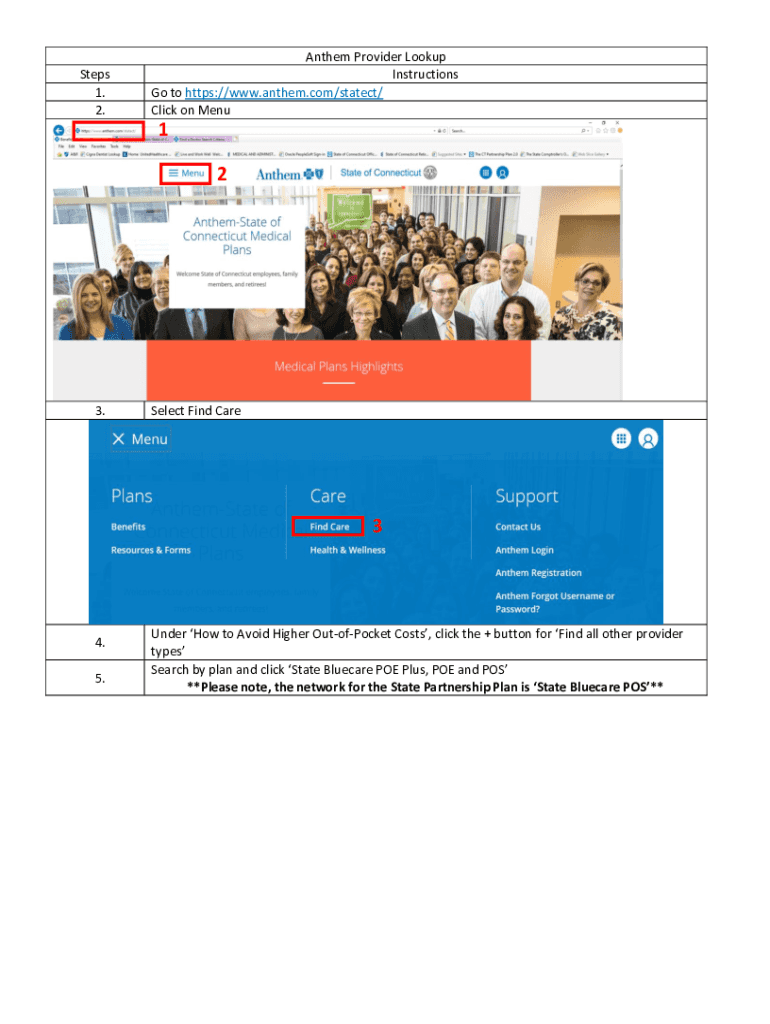

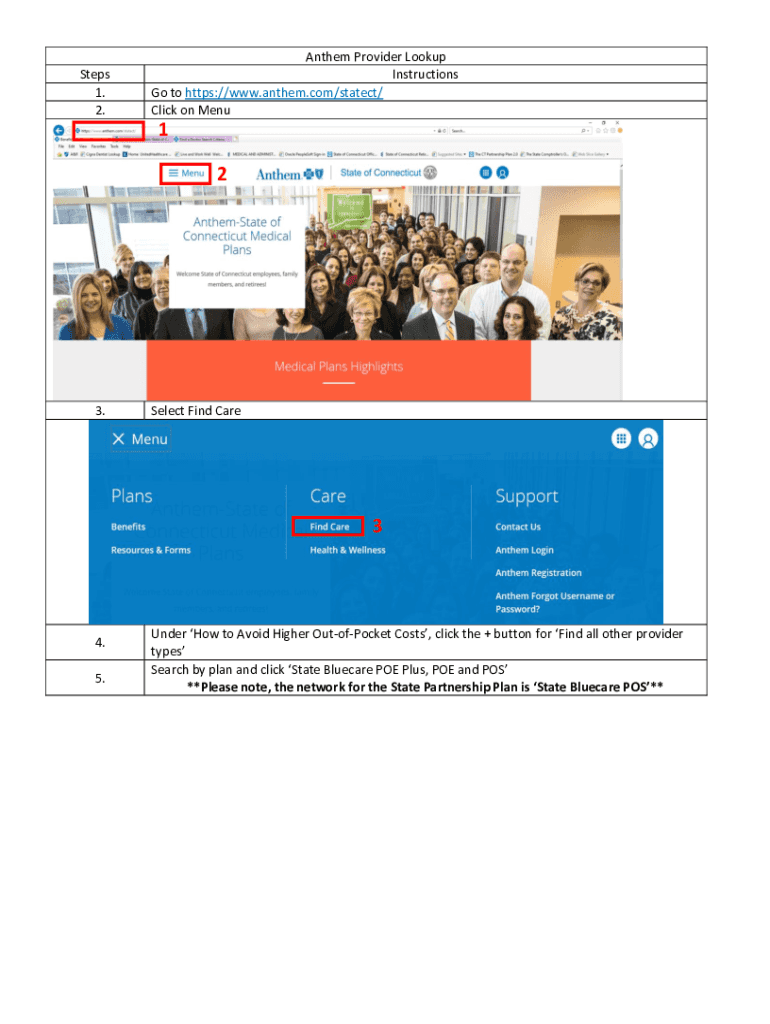

Steps 1. 2.Anthem Provider Lookup Instructions Go to https://www.anthem.com/statect/ Click on Menu1 23.Select Find Care34. 5.Under How to Avoid Higher OutofPocket Costs, click the + button for Find

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign douglas county tax roll

Edit your douglas county tax roll form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your douglas county tax roll form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit douglas county tax roll online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit douglas county tax roll. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out douglas county tax roll

How to fill out douglas county tax roll

01

To fill out the Douglas County tax roll, follow these steps:

02

Obtain the tax roll form from the Douglas County Tax Assessor's Office. You can typically find this form on their website or request a physical copy.

03

Start by entering your personal information, including your name, address, and contact details.

04

Provide details about the property you are filling the tax roll for. This includes the address, legal description, and parcel number.

05

Indicate the property type (residential, commercial, agricultural, etc.)

06

Enter the assessed value of the property. This information can usually be found on your property tax assessment notice or by contacting the assessor's office.

07

Include any exemptions or deductions that apply to the property. This may include homestead exemptions, agricultural exemptions, or other special circumstances.

08

Calculate the total taxable value by subtracting any exemptions or deductions from the assessed value.

09

Provide your signature and date on the form to certify its accuracy.

10

Submit the completed tax roll form to the Douglas County Tax Assessor's Office either in person or by mail.

11

Make sure to meet any deadlines for submitting the tax roll to avoid penalties or late fees.

12

It is recommended to consult the specific guidelines provided by the Douglas County Tax Assessor's Office for accurate and up-to-date instructions on filling out the tax roll form.

Who needs douglas county tax roll?

01

Various individuals and entities may need the Douglas County tax roll, including:

02

- Property owners who are required to report their property for tax assessment purposes.

03

- Real estate agents or brokers who need property information for listing or selling purposes.

04

- Title companies involved in real estate transactions that require accurate tax information.

05

- Appraisers and assessors who assess the value of properties for tax purposes.

06

- Tax professionals and accountants who assist property owners with their tax liabilities.

07

- Government agencies and departments that utilize the tax roll for planning, budgeting, and assessing tax revenues.

08

- Researchers and analysts studying property values, market trends, or economic indicators.

09

The Douglas County tax roll is a vital resource for anyone involved in property-related matters or taxation within the county.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send douglas county tax roll to be eSigned by others?

When you're ready to share your douglas county tax roll, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I sign the douglas county tax roll electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I edit douglas county tax roll on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign douglas county tax roll. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is douglas county tax roll?

The Douglas County tax roll is a record of all taxable properties within Douglas County, including detailed information about property ownership, assessed values, and property tax obligations.

Who is required to file douglas county tax roll?

Property owners in Douglas County are required to file the tax roll to report their taxable property for assessment and taxation.

How to fill out douglas county tax roll?

To fill out the Douglas County tax roll, property owners need to provide details such as property descriptions, ownership information, and any relevant exemptions or deductions. Instructions and forms can usually be obtained from the Douglas County Assessor's office.

What is the purpose of douglas county tax roll?

The purpose of the Douglas County tax roll is to assess property values for taxation, ensuring that property taxes are fairly applied based on each property's value and usage.

What information must be reported on douglas county tax roll?

Information that must be reported on the Douglas County tax roll includes the property owner's name, property address, legal property description, assessed value, and any exemptions claimed.

Fill out your douglas county tax roll online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Douglas County Tax Roll is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.