Get the free VPC Specialty Lending benefits from resilient credit ...

Show details

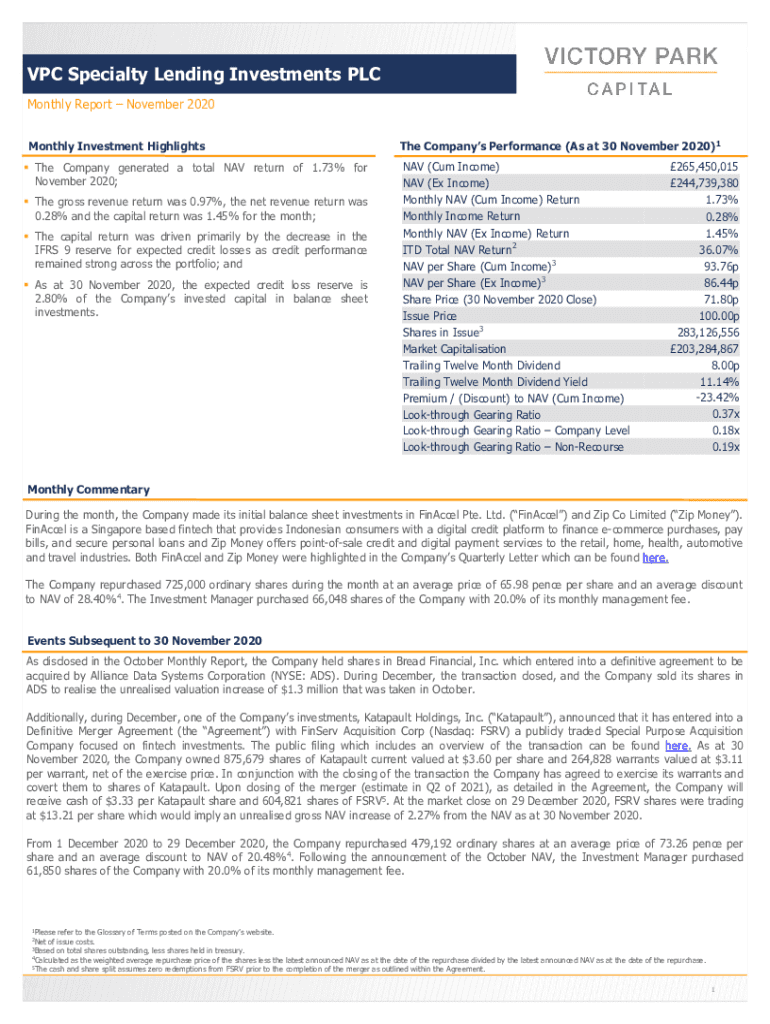

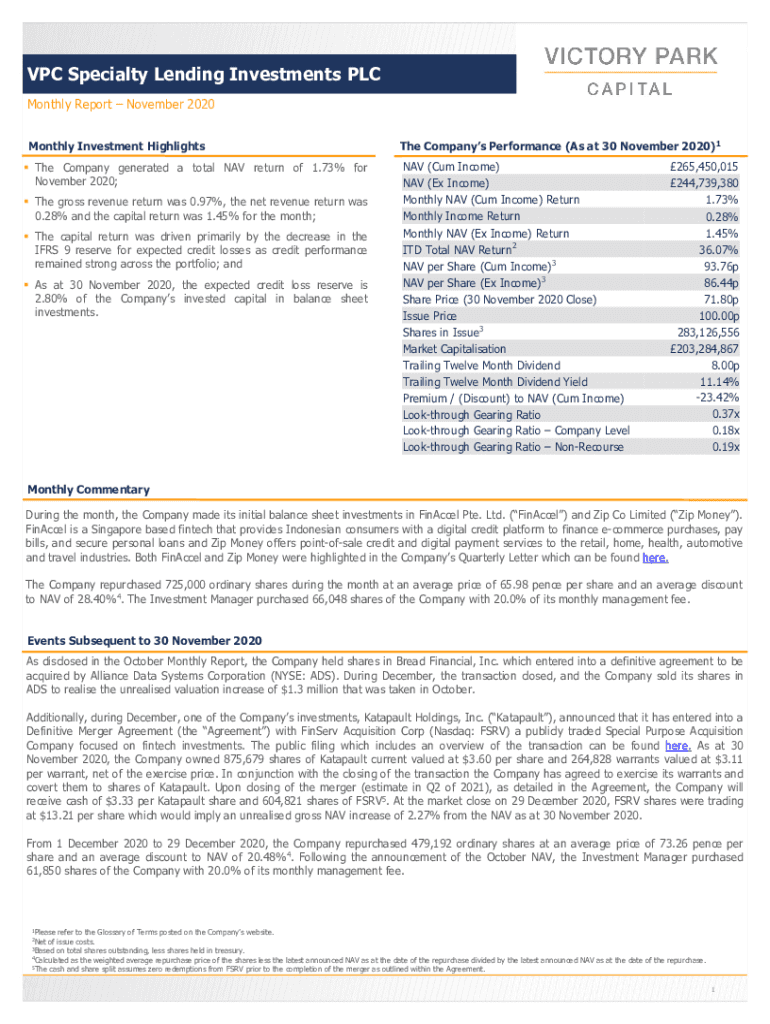

VPC Specialty Lending Investments PLC

Monthly Report November 2020

Monthly Investment Highlights

The Company generated a total NAV return of 1.73% for

November 2020;

The gross revenue return was

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign vpc specialty lending benefits

Edit your vpc specialty lending benefits form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vpc specialty lending benefits form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit vpc specialty lending benefits online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit vpc specialty lending benefits. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out vpc specialty lending benefits

How to fill out vpc specialty lending benefits

01

Start by gathering all the necessary information and documents required to fill out the application for VPC specialty lending benefits.

02

Carefully read through the instructions and guidelines provided by the lending institution to understand the specific requirements and eligibility criteria.

03

Begin filling out the application form by providing accurate and complete information regarding your business, financial statements, revenue, and any relevant background information.

04

Double-check all the details entered in the form to ensure accuracy and correctness. Any incorrect or incomplete information may delay the processing of your application.

05

Attach any supporting documents required by the lending institution, such as business plans, credit histories, and financial projections.

06

Once you have completed the application, review it thoroughly to make sure all sections have been properly filled out and all necessary documents are attached.

07

Submit the filled-out application form and supporting documents to the designated lending institution through the specified submission channel, such as online portals or physical mailing address.

08

Keep track of your application status and follow up with the lending institution if necessary. It is important to stay updated and provide any additional information or clarification requested by the institution.

09

If your application is approved, carefully review the terms and conditions of the VPC specialty lending benefits offered, including interest rates, repayment terms, and any associated fees or charges.

10

Utilize the lending benefits efficiently and responsibly to achieve your business goals and meet your financial needs.

11

Regularly monitor your repayment obligations and ensure timely payments to maintain a positive relationship with the lending institution.

12

Seek professional advice or assistance if you encounter any difficulties or have further questions regarding VPC specialty lending benefits.

Who needs vpc specialty lending benefits?

01

Entrepreneurs and small business owners in need of additional financial support to grow their business.

02

Businesses facing temporary cash flow issues or expansion plans requiring substantial funding.

03

Companies with a positive financial track record and potential for growth.

04

Start-ups looking for flexible and specialized lending solutions tailored to their unique business requirements.

05

Businesses in industries such as technology, healthcare, real estate, and manufacturing that require specialized lending programs.

06

Individuals and organizations seeking competitive interest rates and favorable repayment terms.

07

Entrepreneurs looking to diversify their funding sources and explore alternative lending options.

08

Companies that have been denied traditional bank loans or face challenges securing financing from conventional sources.

09

Businesses that can demonstrate a sound business model and a clear plan for utilizing the funds obtained through VPC specialty lending benefits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send vpc specialty lending benefits for eSignature?

When you're ready to share your vpc specialty lending benefits, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Where do I find vpc specialty lending benefits?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the vpc specialty lending benefits in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit vpc specialty lending benefits on an iOS device?

Use the pdfFiller mobile app to create, edit, and share vpc specialty lending benefits from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is vpc specialty lending benefits?

VPC specialty lending benefits refer to financial advantages and investment opportunities provided to certain borrowers within specific niches in the lending industry, often aimed at tailoring lending to unique business needs or sectors.

Who is required to file vpc specialty lending benefits?

Entities that engage in specialty lending activities under the VPC guidelines and seek to claim associated benefits must file the relevant documentation.

How to fill out vpc specialty lending benefits?

Filling out the VPC specialty lending benefits typically requires completing a prescribed form with details about the lending activities, borrower information, and specific benefits being claimed.

What is the purpose of vpc specialty lending benefits?

The purpose of VPC specialty lending benefits is to incentivize lending to specific sectors or businesses by providing financial support and reducing risks associated with specialty lending.

What information must be reported on vpc specialty lending benefits?

Reports should include details such as borrower identification, loan amounts, use of funds, and how the lending aligns with VPC guidelines.

Fill out your vpc specialty lending benefits online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vpc Specialty Lending Benefits is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.