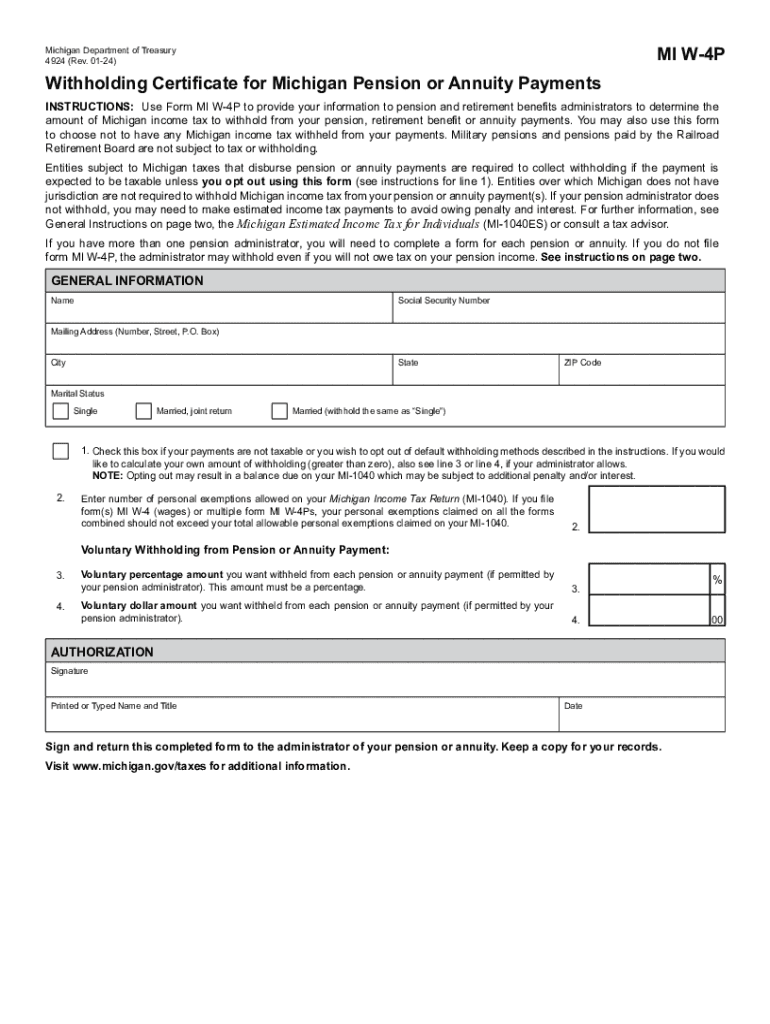

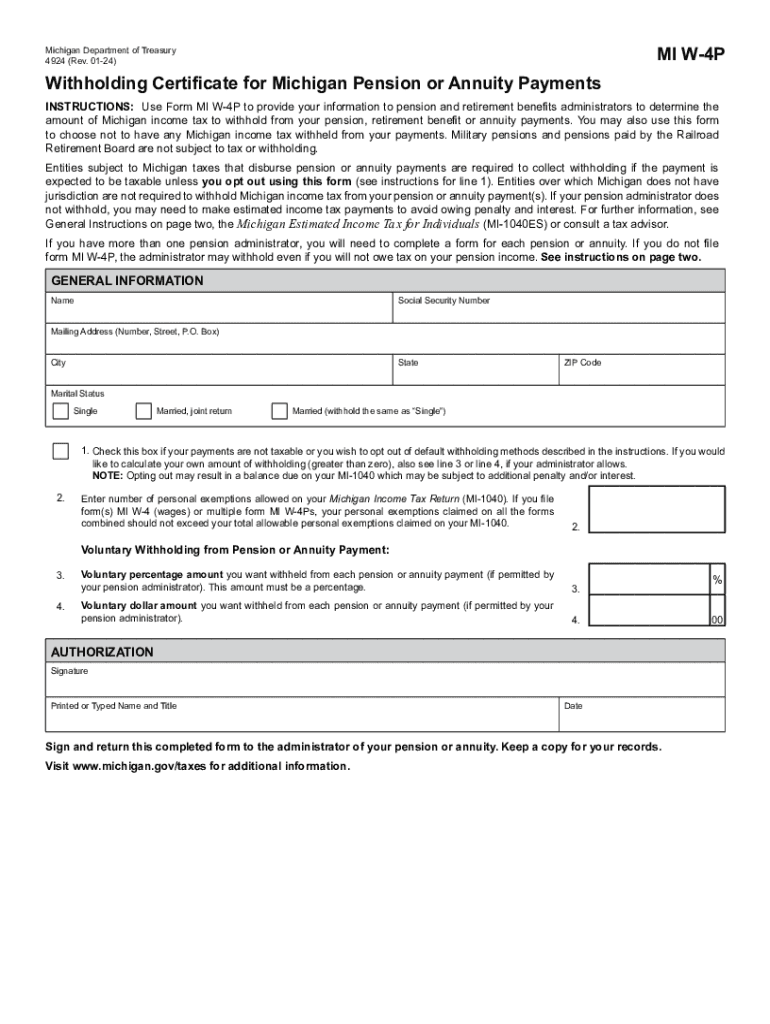

MI W-4P 2024 free printable template

Get, Create, Make and Sign mi w 4p form

Editing michigan w 4p 2024 online

Uncompromising security for your PDF editing and eSignature needs

MI W-4P Form Versions

How to fill out michigan w 4p form

How to fill out MI W-4P

Who needs MI W-4P?

Video instructions and help with filling out and completing mi w4p

Instructions and Help about mi w 4p form

Had snail Carter from first step accounting, and today we're going to do a quick tutorial on how to complete your w-4 form this form is for all my gob holders it lets your payroll department know how many exemptions you're claiming to adjust the taxes withheld from your gross pay basically it lets them calculate how much in taxes that's going to be withheld from your paycheck each week you want to get this number correct so that when you file your taxes next year you won't owe you can get the correct pay each pay period to get the form you can go directly to IRS govt and search for Form w-4 typically it's on the home page because it is a commonly used form once you have the form it only takes a few minutes to complete it, and we're going to go through each line by line hopefully I make it easy for you and you can just print it off and take it directly to your HR department ok line one ask for your name and mailing address you should use the dress you're going to use when you file your tax returns since this will be the address on your form w-2 at the end of the year, and you want those two addresses to match line to ask for your social security number if you don't know about Hart please go check your Social Security card line three is a checkbox where you indicate if you're single married or married but want to be taxed at the single rate single filers do include people who file as head of household as well the only time you should be checking that married box but want to be had the taxes withheld and a higher the higher single rate is if you plan on filing married filing separately line four you check this box if the last name on your form and your Social Security card don't match if they don't match you need to request a new card and the number to do so is listed on the form line five is where all the magic happens if you scroll midway up the form you will see that there is a personal allowances' worksheet, and we're going to go through each one of these line by line as well but here is where you come up with the number of how many exemptions you will want withheld so line a PRE going to put one here if no one else can claim you as a dependent if you live at home with your parents are in college and under the age of 24 you're probably going to put a zero here because your parents will probably claim you on their taxes B you're going to enter one if you're single and only have one job or if you're married and only have one job and your spouse doesn't work or wages from a second job end or from your spouse's job will be $1,500 or less so the final number and B should either be 0 or what C you're going to enter one for your spouse I only recommend doing this if your spouse is not currently working again the final number here should be zero or one D you're going to enter the number of dependents you're claiming on your tax return this includes children stepchildren parents nieces or nephews do not include anyone you will not be filing on your tax...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit michigan withholding certificate online?

How do I edit mi w4p 2024 in Chrome?

Can I create an electronic signature for the MI W-4P in Chrome?

What is MI W-4P?

Who is required to file MI W-4P?

How to fill out MI W-4P?

What is the purpose of MI W-4P?

What information must be reported on MI W-4P?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.