Get the free Flood Insurance - Emergency Management Agency - RI.gov

Show details

LETHAL Mir

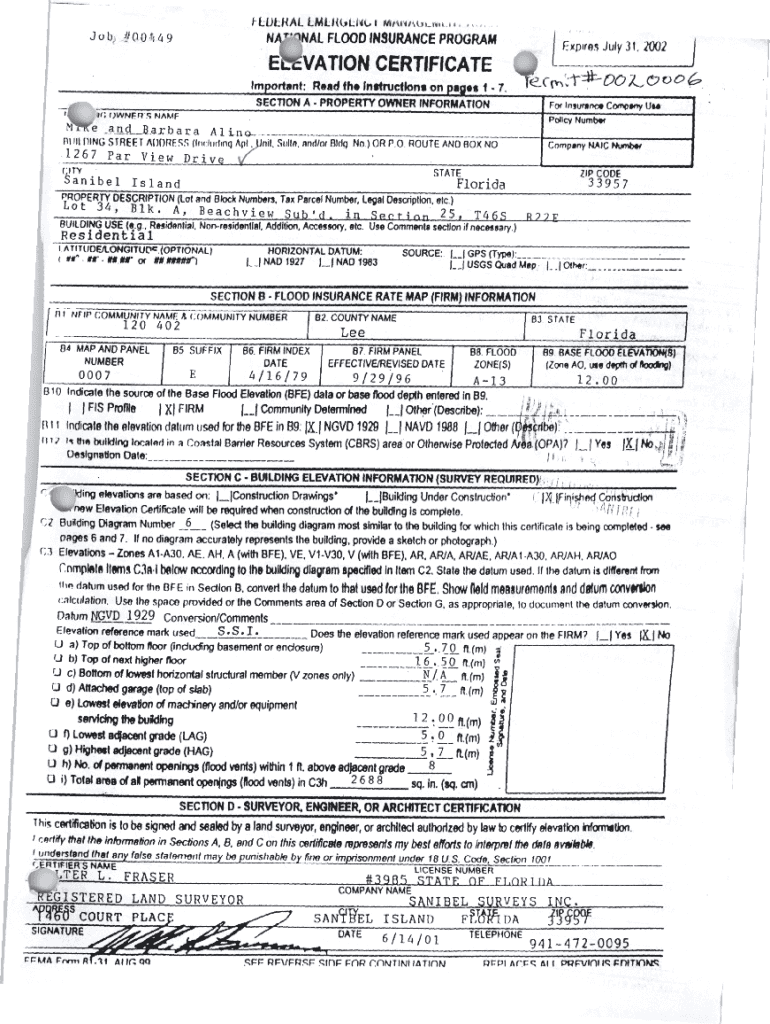

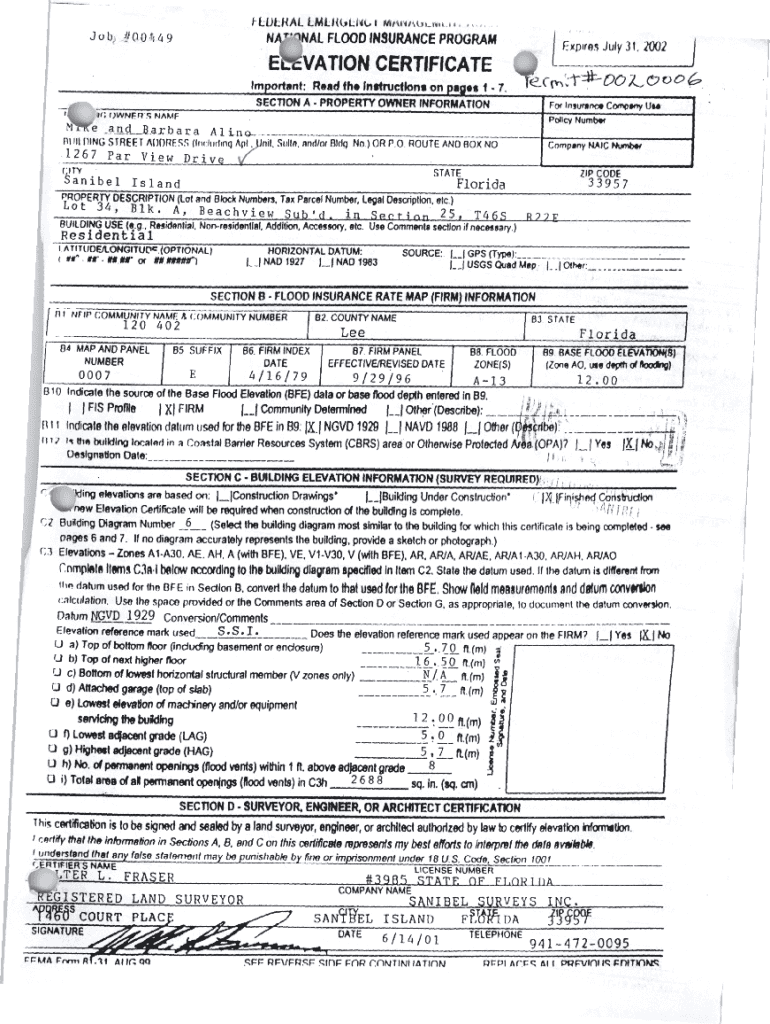

RI III Job) !) 00ttt49hl_i+. MtkrrId,_IR, .i,,1NAL FLOOD INSURANCE PROGRAMIExpiresEicVATION CERTIFICATE

Read the instructions important:

SECTION

Jr;CE _owNETSd__a_nPROPERTYOWNERfiCtY\'t

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign flood insurance - emergency

Edit your flood insurance - emergency form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your flood insurance - emergency form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing flood insurance - emergency online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit flood insurance - emergency. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out flood insurance - emergency

How to fill out flood insurance - emergency

01

Contact your insurance provider: Notify your insurance provider immediately when you experience flooding or need to file a flood insurance claim.

02

Document the damage: Take photos or videos of the affected areas and any damaged items. This will help support your insurance claim.

03

Report the loss: File a claim with your insurance provider as soon as possible. Provide them with detailed information about the flood and the property damage.

04

Mitigate further damage: Take necessary steps to prevent further damage, such as hiring professionals to remove floodwater, drying out the property, or covering damaged areas.

05

Keep records: Keep copies of all communication with your insurance company, receipts for expenses related to cleanup or repairs, and any other relevant documents.

06

Follow claim procedures: Adhere to the instructions provided by your insurance provider to ensure a smooth claim processing.

07

Work with adjusters: Cooperate with the insurance adjusters during the claim process. They will assess the damage and make a determination regarding your insurance coverage.

08

Review your policy: Familiarize yourself with the terms and conditions of your flood insurance policy to understand what is covered and the limits of coverage.

09

Follow up: Stay in contact with your insurance provider throughout the claims process to ensure timely resolution.

10

Seek professional assistance if needed: If you encounter difficulties or are uncertain about certain aspects of filing a flood insurance claim, consider consulting with a public adjuster or an attorney specializing in insurance claims.

Who needs flood insurance - emergency?

01

Anyone living in an area prone to flooding or near bodies of water should consider obtaining flood insurance - emergency.

02

Homeowners, renters, or business owners who want protection against financial loss due to flood damage.

03

Individuals who reside in regions with high rainfall, hurricane risks, or areas with poor drainage systems are particularly susceptible to flood-related emergencies.

04

Homeowners with mortgages from federally regulated or insured lenders may be required to have flood insurance if their property is located in a high-risk flood zone designated by FEMA.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute flood insurance - emergency online?

pdfFiller has made it easy to fill out and sign flood insurance - emergency. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make edits in flood insurance - emergency without leaving Chrome?

flood insurance - emergency can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I fill out flood insurance - emergency on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your flood insurance - emergency, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is flood insurance - emergency?

Flood insurance - emergency is a type of insurance designed to provide financial protection against damages caused by flooding, particularly in areas that are at high risk of flooding.

Who is required to file flood insurance - emergency?

Property owners in flood-prone areas who hold federally backed mortgages are typically required to file for flood insurance - emergency.

How to fill out flood insurance - emergency?

To fill out flood insurance - emergency, you need to complete the National Flood Insurance Program (NFIP) forms, providing necessary information such as property location, flood zone classification, and coverage amounts.

What is the purpose of flood insurance - emergency?

The purpose of flood insurance - emergency is to provide financial assistance to policyholders to cover damage and losses resulting from floods, promoting recovery and rebuilding efforts.

What information must be reported on flood insurance - emergency?

Information that must be reported includes the property address, flood zone designation, coverage limits, and any previous claims related to flooding.

Fill out your flood insurance - emergency online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Flood Insurance - Emergency is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.