Get the free 2011 form - tax utah

Show details

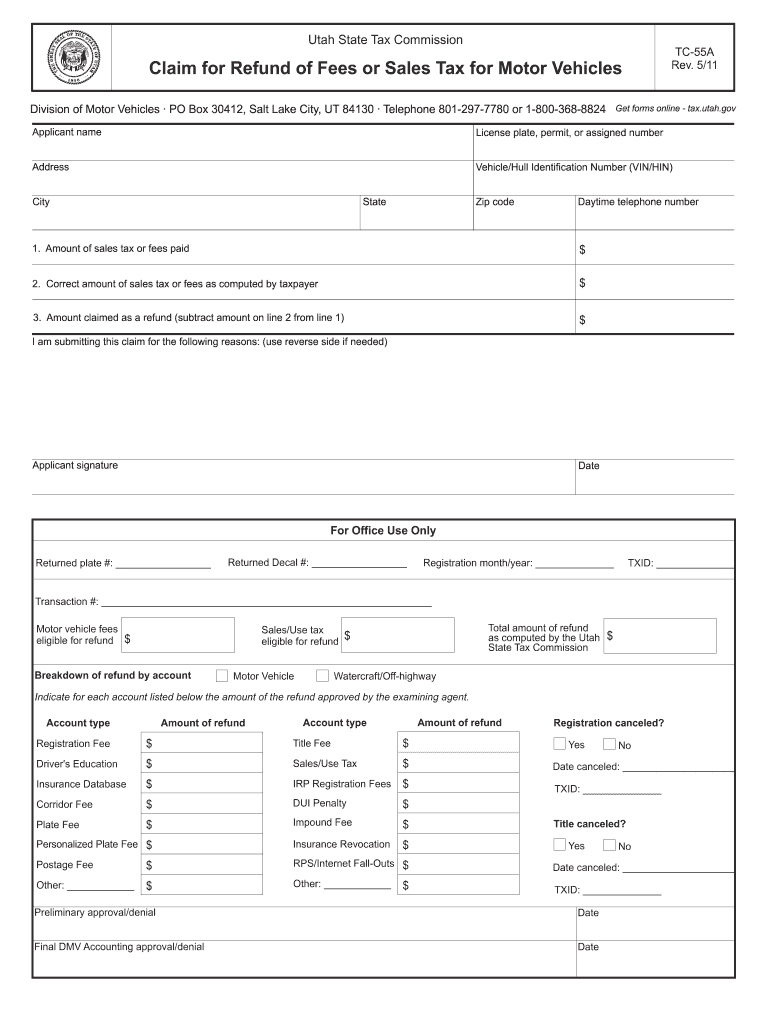

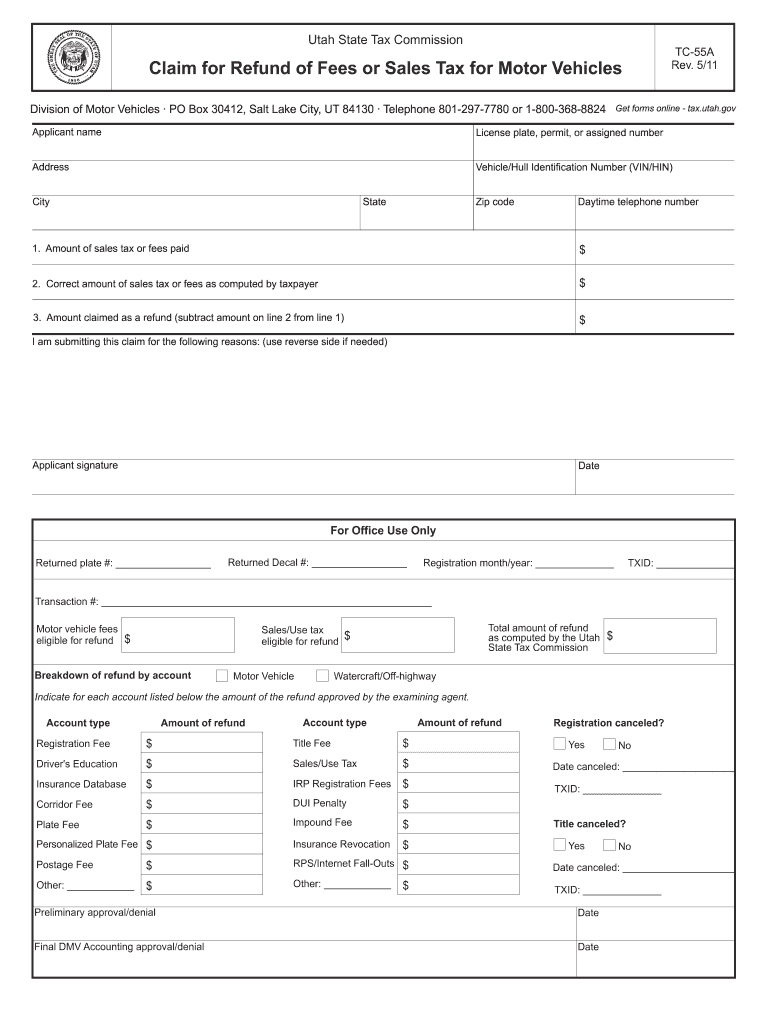

Clear form Utah State Tax Commission Claim for Refund of Fees or Sales Tax for Motor Vehicles Division of Motor Vehicles PO Box 30412 Salt Lake City UT 84130 Telephone 801-297-7780 or 1-800-368-8824 TC-55A Rev. 10/13 Get forms online - tax.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2011 form - tax

Edit your 2011 form - tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011 form - tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2011 form - tax online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2011 form - tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2011 form - tax

How to fill out 2011 form?

01

Gather all necessary information and documents, such as your personal identification details, income statements, and any relevant tax documents.

02

Review the instructions provided with the form to understand its requirements and any specific guidelines.

03

Start by filling out your personal information accurately, including your name, address, and social security number.

04

Proceed to report your income by carefully entering the relevant details from your income statements, such as wages, dividends, or rental income.

05

Deduct any eligible expenses or deductions that you are entitled to claim, ensuring you have proper documentation to support these deductions.

06

Include any additional schedules or forms that may be required based on your specific situation, such as Schedule C for self-employment income or Schedule D for capital gains and losses.

07

Double-check all entries for accuracy and completeness before signing and dating the form.

08

Keep a copy of the completed form and any supporting documents for your records.

Who needs 2011 form?

01

Individuals who earned income or had certain financial transactions in the year 2011 may need to fill out the 2011 form.

02

Taxpayers who were required to file a tax return for that specific year, based on their income, filing status, or age, may need to use the 2011 form.

03

Some individuals who did not meet the income threshold to file a tax return but had taxes withheld from their paychecks or qualify for certain refundable tax credits may also need to complete the 2011 form to claim their refunds or credits.

04

It is important to note that the need for the 2011 form specifically applies to the tax year 2011, and individuals should consult the IRS or a tax professional to determine which form is applicable for the current tax year.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a copy of my K 1?

Where can I find a sample K-1 tax form? You can download a sample copy of Schedule K-1 (Form 1065) from the IRS. But you'll probably receive a copy of Schedule K-1 around tax time from your accountant or whoever is responsible for filing your partnership's Form 1065.

What is the US form 11?

Application For A U.S. Passport (DS-11) You should complete this form if you're applying for the first time, you're applying for your child who is under age 16, or you don't meet our requirements to renew your passport.

How do I get my 2011 tax return?

Complete Form 4506, Request for Copy of Tax Return, and mail it to the IRS address listed on the form for your area. Copies are generally available for the current year as well as the past six years. Please allow 60 days for actual copies of your return.

How do I get past 1099 forms?

People often need copies of their old Forms W-2 or 1099.You can get this transcript in four ways 1. Mail Form 4506-T, Request for Transcript of Tax Return, to the IRS. Order your transcript by phone or online to be delivered by mail. Use IRS Get Transcript. Outsource it all to a tax pro.

Is there a way to get old 1099?

If you are looking for 1099s from earlier years, you can contact the IRS and order a “wage and income transcript”. The transcript should include all of the income that you had as long as it was reported to the IRS. All you need to do is fill out a Form 4506-T and mail or fax it off to the IRS.

How do I find old 1099s in QuickBooks online?

Can I access archived or previously filed forms? Go to QuickBooks Online. Go to Taxes then select 1099 filings. Select View 1099 to view a PDF copy.

What are forms 706 and 709?

What's the difference between Form 706 and Form 709? Form 706 is filed by the executor of an estate on behalf of a deceased person to calculate estate tax owed, while the latter is filed by you to report gifts exceeding the annual exclusion.

What is 2011 IRS form 8948?

Form 8948 is used only by specified tax return preparers (defined below) to explain why a particular return is being filed on paper. A specified tax return preparer may be required by law to electronically file (e-file) certain covered returns (defined below).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out 2011 form - tax using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign 2011 form - tax and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit 2011 form - tax on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share 2011 form - tax from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Can I edit 2011 form - tax on an Android device?

You can edit, sign, and distribute 2011 form - tax on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is form?

Form refers to a standard document or template that is used to collect and record information in a structured manner.

Who is required to file form?

The specific individuals, businesses, or entities required to file a form vary depending on the type of form. It can be individuals, businesses, employers, taxpayers, etc.

How to fill out form?

Filling out a form usually involves providing the requested information in the designated fields or sections. The instructions and guidelines provided with the form should be followed to ensure accurate completion.

What is the purpose of form?

The purpose of a form is to gather specific information for various purposes such as regulatory compliance, record-keeping, data collection, legal documentation, taxation, etc.

What information must be reported on form?

The information that must be reported on a form depends on the nature and purpose of the form. It can include personal details, financial information, employment data, tax-related information, etc.

Fill out your 2011 form - tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2011 Form - Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.