WI GCU Income Tax Preparation Client Information Questionnaire 2023-2026 free printable template

Show details

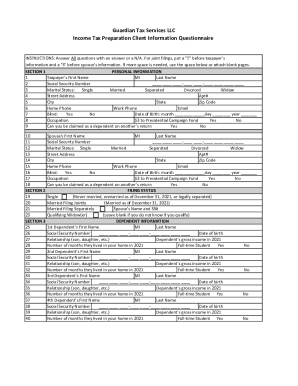

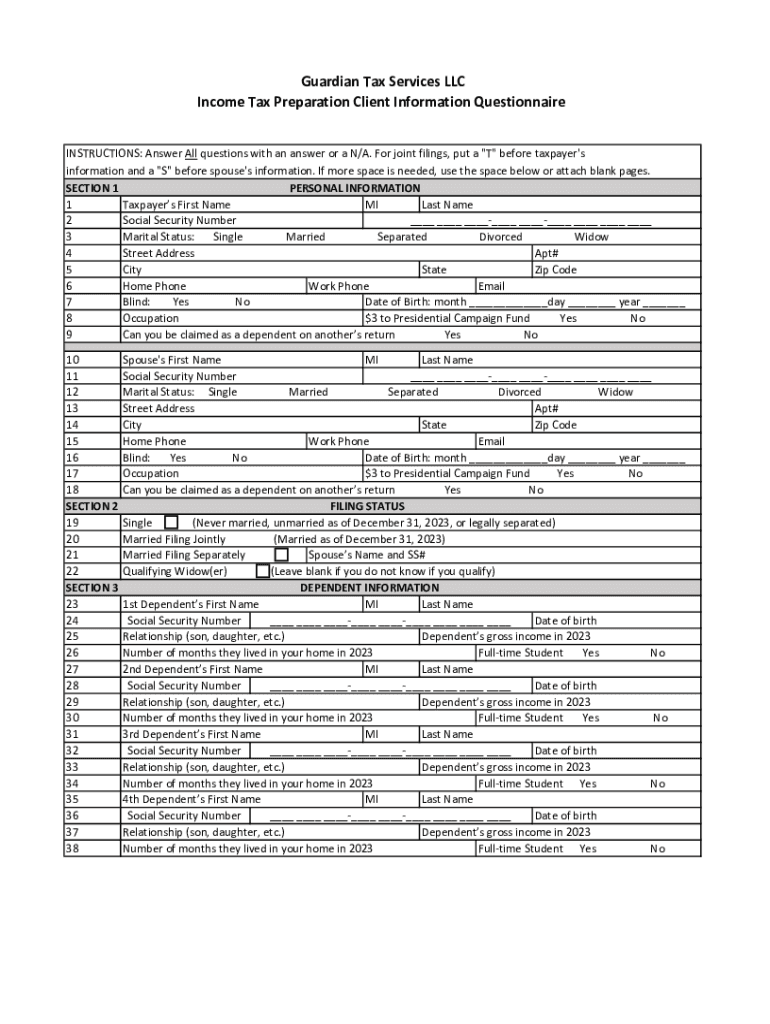

Guardian Tax Services LLC Income Tax Preparation Client Information Questionnaire INSTRUCTIONS: Answer All questions with an answer or a N/A. For joint filings, put a "T" before taxpayer's information

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI GCU Income Tax Preparation Client

Edit your WI GCU Income Tax Preparation Client form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI GCU Income Tax Preparation Client form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WI GCU Income Tax Preparation Client online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit WI GCU Income Tax Preparation Client. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI GCU Income Tax Preparation Client Information Questionnaire Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI GCU Income Tax Preparation Client

How to fill out WI GCU Income Tax Preparation Client Information

01

Gather all necessary documents, such as W-2s, 1099s, and any other income statements.

02

Begin filling out the client information section with your name, address, and Social Security number.

03

Indicate your filing status (e.g., single, married filing jointly, etc.).

04

Provide information on any dependents, including their names and Social Security numbers.

05

List all sources of income and their corresponding amounts.

06

Fill out any deductions or credits that apply to your situation.

07

Review all the information for accuracy before submitting the form.

Who needs WI GCU Income Tax Preparation Client Information?

01

Individuals who are preparing their income taxes in Wisconsin.

02

Clients utilizing tax preparation services that require client information forms.

03

Anyone seeking to ensure compliance with state tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

What are some good tax questions to ask?

7 Most Common Tax Questions Answered by a CPA How can I reduce my tax bill? What kind of deductions do I qualify for? What is the difference between marginal and effective tax rates? Which is better: a tax credit or a tax deduction? Can I deduct medical expenses? Should I itemize or claim the standard deduction?

What questions should a tax preparer ask?

8 Questions to Ask Your Tax Advisor What Does Your Tax Preparation Process Look Like? How Can You Help Me With My Tax Goals? What Information Will You Need From Me to File My Taxes? What Can I Do Differently to Improve My Tax Situation? Based on My Situation, What Other Things Should I Try and Do This Year?

What steps do you think a client will take in choosing a tax preparer?

10 Tips for Choosing a Tax Preparer Check the preparer's qualifications. Check on the preparer's history. Ask about their service fees. Ask if they offer electronic filing. Make sure the tax preparer is accessible. Provide all records and receipts needed to prepare your return. Never sign a blank return.

When providing written tax advice to a client the practitioner must do which of the following?

Written Tax Advice. In providing written advice concerning any Federal tax matter, you must (i) base your advice on reasonable assumptions, (ii) reasonably consider all relevant facts that you know or should know, and (iii) use reasonable efforts to identify and ascertain the relevant facts.

What are 3 key questions you should ask to determine whether a client is required to file an income tax return?

In most cases, income, filing status and age determine if a taxpayer must file a tax return.

How do I prepare for a tax preparer interview?

Are You Making the Most Out of Your Tax Prep Interviews? Smile and welcome your client. Gather personal information. Ask for last year's return. Ask for all possible sources of income, not just W2s. Be sure to ask about all possible adjustments to income. Determine if your client qualifies for any tax credits. Payments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete WI GCU Income Tax Preparation Client online?

pdfFiller has made it simple to fill out and eSign WI GCU Income Tax Preparation Client. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How can I edit WI GCU Income Tax Preparation Client on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing WI GCU Income Tax Preparation Client.

How do I edit WI GCU Income Tax Preparation Client on an Android device?

You can make any changes to PDF files, such as WI GCU Income Tax Preparation Client, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is WI GCU Income Tax Preparation Client Information?

WI GCU Income Tax Preparation Client Information is a form utilized by clients in Wisconsin to provide necessary financial details and personal information required for the preparation of their income tax returns.

Who is required to file WI GCU Income Tax Preparation Client Information?

Individuals and businesses who are seeking income tax preparation services in Wisconsin must file the WI GCU Income Tax Preparation Client Information. This typically includes residents, non-residents, and anyone earning income in Wisconsin.

How to fill out WI GCU Income Tax Preparation Client Information?

To fill out the WI GCU Income Tax Preparation Client Information, individuals should provide their personal details such as name, address, Social Security number, and relevant income details, along with deductibles, exemptions, and any relevant tax credits.

What is the purpose of WI GCU Income Tax Preparation Client Information?

The purpose of the WI GCU Income Tax Preparation Client Information is to gather essential information that tax preparers need to accurately prepare and file income tax returns for individuals and businesses in Wisconsin.

What information must be reported on WI GCU Income Tax Preparation Client Information?

The information that must be reported on WI GCU Income Tax Preparation Client Information includes personal identifying information, income sources, deductions, tax credits, and any other financial information pertinent to the tax preparation process.

Fill out your WI GCU Income Tax Preparation Client online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI GCU Income Tax Preparation Client is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.