IA 6251B 2023-2025 free printable template

Show details

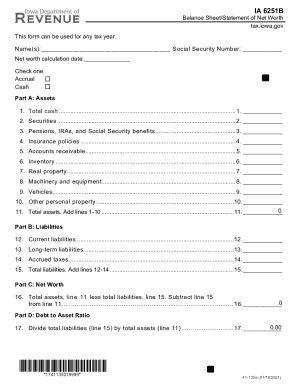

IA 6251BBalance Sheet/Statement of Net Worth

tax.iowa.gov

This form can be used for any tax year.

Name(s): ___ Social Security Number: ___

Net worth calculation date: ___

Check one:

Accrual

CashPart

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign total tax line 42iowa

Edit your total tax line 42iowa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your total tax line 42iowa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit total tax line 42iowa online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit total tax line 42iowa. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IA 6251B Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out total tax line 42iowa

How to fill out IA 6251B

01

Start by downloading a copy of Form IA 6251B from the official tax website.

02

Enter your personal information at the top of the form, including your name, address, and Social Security Number.

03

Carefully read the instructions provided with the form to understand the requirements.

04

Fill out Part I by entering your income details and calculating your total income.

05

Move to Part II to report any deductible expenses and calculate your taxable income.

06

Complete Part III, where you need to enter any tax credits you are eligible for.

07

Review all sections to ensure accuracy, correcting any errors or missing information.

08

Sign and date the form before submitting it, either online or via mail, as per the given instructions.

Who needs IA 6251B?

01

Individuals who have received certain types of income subject to specific tax rules need to fill out IA 6251B.

02

Taxpayers claiming special deductions or credits related to income must also complete this form.

03

Those who are filing an amended return may require IA 6251B to accurately report their income.

Fill

form

: Try Risk Free

People Also Ask about

What is the net worth document?

A net worth statement is a financial tool that shows your financial position at a given point in time. It is like a “financial snapshot” that shows the dollar value of what you own (assets) and what you owe (liabilities or debts). This formula for calculating net worth is Assets – Liabilities = Net Worth.

Where do I find net worth on a balance sheet?

On a company's balance sheet, net worth is demonstrated through the owners' equity section.

Where do I find my net worth?

Your net worth is your assets minus your liabilities. It's what you have left over after you pay all your liabilities. Net worth is a better measure of someone's financial stability than income alone. A person's income could be disrupted by job loss or reduction in work hours.

Where can I find the net worth of a company?

How do you find the net worth of a business? To check the net worth of a business, one can look at the company's balance sheet and subtract net liabilities from net assets. If the result is positive, the company has a positive net worth and is financially healthy.

How do I find net worth on balance sheet?

As noted earlier, the difference between your assets and your liabilities is your net worth. The formula looks like this: (Sum of the current value of all assets) - (Sum of the current total of all outstanding liabilities) = Net worth.

What is the difference between balance sheet and net worth statement?

The balance sheet is also known as a net worth statement. The value of a company's equity equals the difference between the value of total assets and total liabilities. Note that the values on a company's balance sheet highlight historical costs or book values, not current market values.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit total tax line 42iowa online?

With pdfFiller, the editing process is straightforward. Open your total tax line 42iowa in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for the total tax line 42iowa in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your total tax line 42iowa.

How can I fill out total tax line 42iowa on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your total tax line 42iowa, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is IA 6251B?

IA 6251B is an Iowa state tax form used to report and calculate additional tax owed due to certain adjustments made to income or credits.

Who is required to file IA 6251B?

Individuals who have certain adjustments to their Iowa taxable income or who need to recalculate tax credits may be required to file IA 6251B.

How to fill out IA 6251B?

To fill out IA 6251B, taxpayers should provide accurate income figures, document any applicable adjustments, and complete the required calculations as per the instructions provided on the form.

What is the purpose of IA 6251B?

The purpose of IA 6251B is to ensure that any additional taxes owed due to income adjustments or credits are properly reported and paid to the state of Iowa.

What information must be reported on IA 6251B?

IA 6251B requires taxpayers to report their Iowa taxable income, any adjustments, tax calculations, and any credits that affect their tax liability.

Fill out your total tax line 42iowa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Total Tax Line 42iowa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.