Get the free Accounts Payable - Roles & Responsibilities

Show details

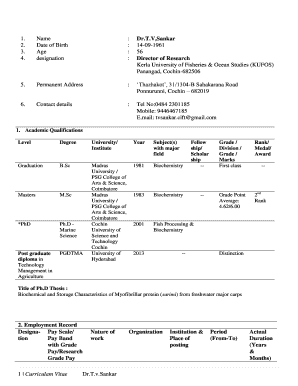

POSITION TITLE:Accounts Payable Officer [fixed term]GROUP:Corporate ServicesSECTION:FinanceREPORTS TO:Finance LeadRESPONSIBLE FOR:n/aFAMILY:OS6GRADE:10DATE REVIEWED:March 2023JOB NUMBER:HBRC STRATEGY

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accounts payable - roles

Edit your accounts payable - roles form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accounts payable - roles form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing accounts payable - roles online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit accounts payable - roles. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accounts payable - roles

How to fill out accounts payable - roles

01

To fill out accounts payable roles, follow these steps:

02

Identify the responsibilities and tasks associated with the accounts payable role.

03

Create a job description outlining the necessary skills and qualifications.

04

Determine the reporting structure and hierarchy for the accounts payable team.

05

Define the roles and responsibilities for each position within accounts payable, such as accounts payable clerk, accounts payable supervisor, or accounts payable manager.

06

Clearly communicate the expectations and requirements of each role to potential candidates or current employees.

07

Conduct interviews or evaluations to assess the suitability of candidates for the accounts payable roles.

08

Select candidates who possess the necessary skills, knowledge, and experience required for the accounts payable positions.

09

Train the selected candidates on the specific duties and processes involved in the accounts payable role.

10

Provide ongoing support, guidance, and resources to the accounts payable team members to ensure they can effectively perform their roles.

11

Regularly review and evaluate the performance of the accounts payable team members to identify areas for improvement and provide constructive feedback.

12

Continuously update and adapt the roles and responsibilities of the accounts payable positions to meet the changing needs of the organization and industry.

13

Foster a collaborative and communicative environment within the accounts payable team to promote efficiency and productivity.

14

By following these steps, you can successfully fill out accounts payable roles.

Who needs accounts payable - roles?

01

Accounts payable roles are needed by any organization or business that deals with financial transactions and has a need to manage and process invoices, bills, and payments effectively.

02

Some specific entities that require accounts payable roles include:

03

- Corporations

04

- Small businesses

05

- Non-profit organizations

06

- Government agencies

07

- Educational institutions

08

By having designated accounts payable roles, these entities can ensure timely and accurate payment processing, optimize cash flow management, and maintain strong vendor relationships.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify accounts payable - roles without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including accounts payable - roles. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send accounts payable - roles for eSignature?

accounts payable - roles is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I sign the accounts payable - roles electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your accounts payable - roles.

What is accounts payable - roles?

Accounts payable refers to the accounting department or ledger that processes and manages the amounts a company owes to its suppliers or creditors for goods and services received. The roles involved include maintaining accurate records, processing invoices, and ensuring timely payments.

Who is required to file accounts payable - roles?

Typically, businesses of all sizes, including sole proprietorships, partnerships, corporations, and non-profits, are required to track and file accounts payable. It is essential for maintaining healthy cash flow and credit relationships.

How to fill out accounts payable - roles?

To fill out accounts payable, one must gather all relevant invoices, verify their accuracy, enter specified details such as vendor information, invoice amounts, and due dates into the accounting software or ledger, and ensure proper authorizations for payments are in place.

What is the purpose of accounts payable - roles?

The purpose of accounts payable is to keep track of outstanding debts that a business owes to its creditors, manage cash flow effectively, maintain supplier relationships, and comply with financial reporting standards.

What information must be reported on accounts payable - roles?

Information that must be reported on accounts payable includes vendor names, invoice numbers, payment due dates, amounts owed, transaction descriptions, and any associated terms or discounts receiveable.

Fill out your accounts payable - roles online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accounts Payable - Roles is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.