Get the free Land Available for Taxes

Show details

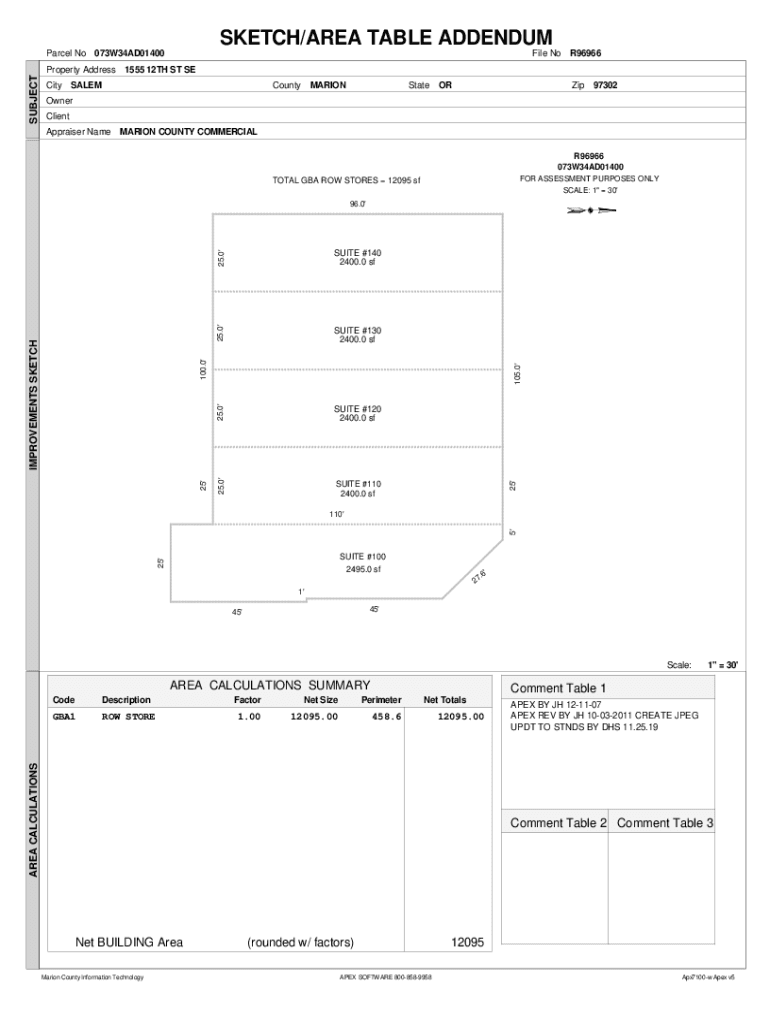

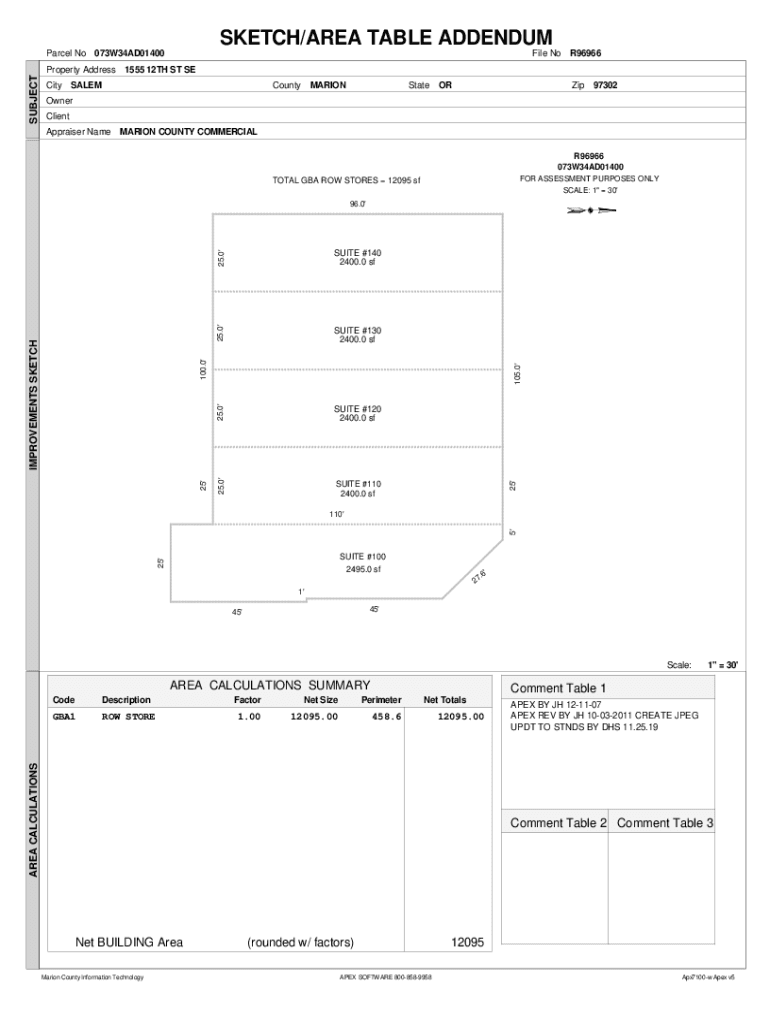

SKETCH/AREA TABLE ADDENDUM

Parcel No 073W34AD01400SUBJECTProperty Addressable No R969661555 12TH ST City Daly County Marionette Trip 97302Owner

Client

Appraiser Name MARION COUNTY COMMERCIAL

R96966

073W34AD01400

FOR

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign land available for taxes

Edit your land available for taxes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your land available for taxes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit land available for taxes online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit land available for taxes. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out land available for taxes

How to fill out land available for taxes

01

Gather all necessary documentation and information about the land available for taxes, such as property deeds, tax assessment records, and any relevant legal documents.

02

Contact the local tax assessor's office or the designated government agency responsible for handling land taxes. Inquire about the specific requirements and forms needed to fill out.

03

Obtain the required forms and carefully read through the instructions provided. Fill out each section accurately and completely.

04

Provide the requested information about the land, including its location, boundaries, size, and any improvements or structures on the property.

05

Include details about any previous tax payments or outstanding obligations related to the land.

06

Double-check all the information provided before submitting the filled-out forms.

07

Depending on the specified procedures, submit the completed forms either online, by mail, or in person to the appropriate tax authorities.

08

Pay any applicable fees or taxes associated with the filing process.

09

Keep copies of all submitted documents and receipts for future reference.

10

Follow up with the tax assessor's office or government agency to ensure the land available for taxes has been correctly processed and any outstanding tax liabilities are resolved.

Who needs land available for taxes?

01

Individuals or organizations who want to acquire or develop land for various purposes, such as building homes, commercial projects, agricultural activities, or other investment ventures.

02

Investors looking for potential real estate opportunities or tax liens to purchase and profit from.

03

Government entities responsible for managing and allocating land resources.

04

Real estate developers, builders, or contractors in need of available land for development projects.

05

Farmers or agricultural businesses seeking additional land for cultivation or expansion.

06

Land speculators interested in purchasing land available for taxes at a discounted price for future resale or development.

07

Non-profit organizations or land conservancies aiming to acquire land for conservation or preservation purposes.

08

Financial institutions that may require information about land available for taxes as part of loan or mortgage evaluations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my land available for taxes in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your land available for taxes and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I sign the land available for taxes electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your land available for taxes in minutes.

How do I edit land available for taxes on an Android device?

You can make any changes to PDF files, like land available for taxes, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is land available for taxes?

Land available for taxes refers to properties that are subject to tax sale due to unpaid taxes and are available for tax lien or tax deed sale.

Who is required to file land available for taxes?

Typically, local governments or tax authorities are required to file information regarding land available for taxes, which includes identifying properties that have delinquent taxes.

How to fill out land available for taxes?

To fill out land available for taxes, property owners must complete the appropriate forms provided by their local tax authority and include relevant details like property identification, tax amounts owed, and owner information.

What is the purpose of land available for taxes?

The purpose of land available for taxes is to facilitate the sale of properties that have delinquent taxes, allowing local governments to recover owed taxes and generate revenue.

What information must be reported on land available for taxes?

Information that must be reported includes the property description, owner details, amount of taxes owed, and any applicable liens or encumbrances.

Fill out your land available for taxes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Land Available For Taxes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.