Get the free 2000 Tax Allocation Revenue Bonds, Series A

Show details

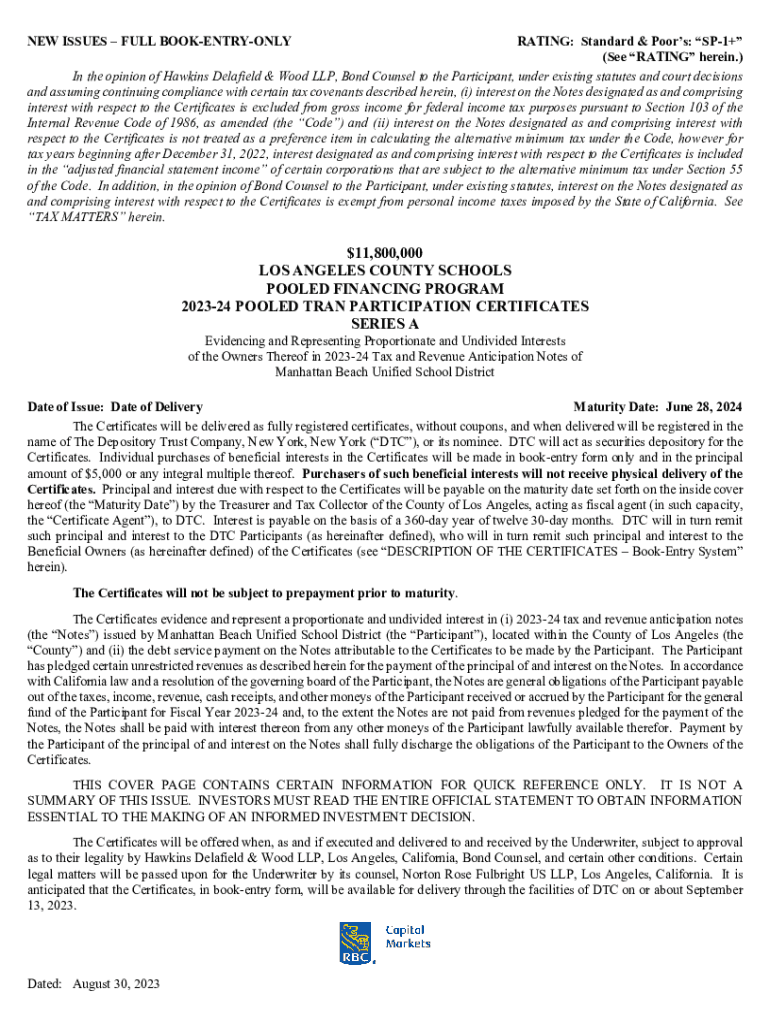

NEW ISSUES FULL BOOKENTRYONLYRATING: Standard & Poors: SP1+ (See RATING herein.) In the opinion of Hawkins Delafield & Wood LLP, Bond Counsel to the Participant, under existing statutes and court

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2000 tax allocation revenue

Edit your 2000 tax allocation revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2000 tax allocation revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2000 tax allocation revenue online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2000 tax allocation revenue. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2000 tax allocation revenue

How to fill out 2000 tax allocation revenue

01

Gather all necessary documents like W-2 forms, 1099 forms, and any other income statements.

02

Use tax software or hire a tax professional to assist you in filling out the tax forms accurately.

03

Start by entering your personal information, including your name, Social Security number, and address.

04

Fill out the appropriate sections for your income, deductions, and credits.

05

Carefully calculate your tax liability and make sure all numbers are accurate.

06

Double-check all the filled information for any errors or omissions.

07

Sign and date the forms before submitting them to the appropriate tax agency.

08

Keep copies of all the filled forms and supporting documents for your records.

Who needs 2000 tax allocation revenue?

01

Individuals who earned income and meet the eligibility criteria for the 2000 tax allocation revenue program are the ones who need it.

02

This program is designed to provide financial assistance to individuals who are struggling with their taxes and need help paying them.

03

It aims to lessen the burden of tax payment for those who have lower incomes or face other financial hardships.

04

Eligibility criteria may vary, so it is important to check with the relevant tax authorities to determine if you qualify for this program.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get 2000 tax allocation revenue?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific 2000 tax allocation revenue and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make changes in 2000 tax allocation revenue?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your 2000 tax allocation revenue and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I sign the 2000 tax allocation revenue electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your 2000 tax allocation revenue and you'll be done in minutes.

What is tax allocation revenue bonds?

Tax allocation revenue bonds are municipal bonds that are issued by a city or county to finance redevelopment projects. The repayment of these bonds is secured by the increased tax revenue generated from the property within a designated redevelopment area.

Who is required to file tax allocation revenue bonds?

Entities such as local government agencies or redevelopment agencies that issue tax allocation revenue bonds for financing redevelopment projects are required to file them.

How to fill out tax allocation revenue bonds?

To fill out tax allocation revenue bonds, the issuing agency must provide detailed information on the project, its financing structure, estimated tax revenues, and adhere to state regulations. This typically involves completing a form supplied by the relevant authority.

What is the purpose of tax allocation revenue bonds?

The purpose of tax allocation revenue bonds is to fund public infrastructure improvements and redevelopment projects to stimulate economic growth and enhance property values in designated areas.

What information must be reported on tax allocation revenue bonds?

Information that must be reported includes the intended use of proceeds, project costs, estimated tax increment revenue, and compliance with regulatory requirements.

Fill out your 2000 tax allocation revenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2000 Tax Allocation Revenue is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.