Get the free Bank Secrecy Act/Anti-Money Laundering: Joint Statement ...

Show details

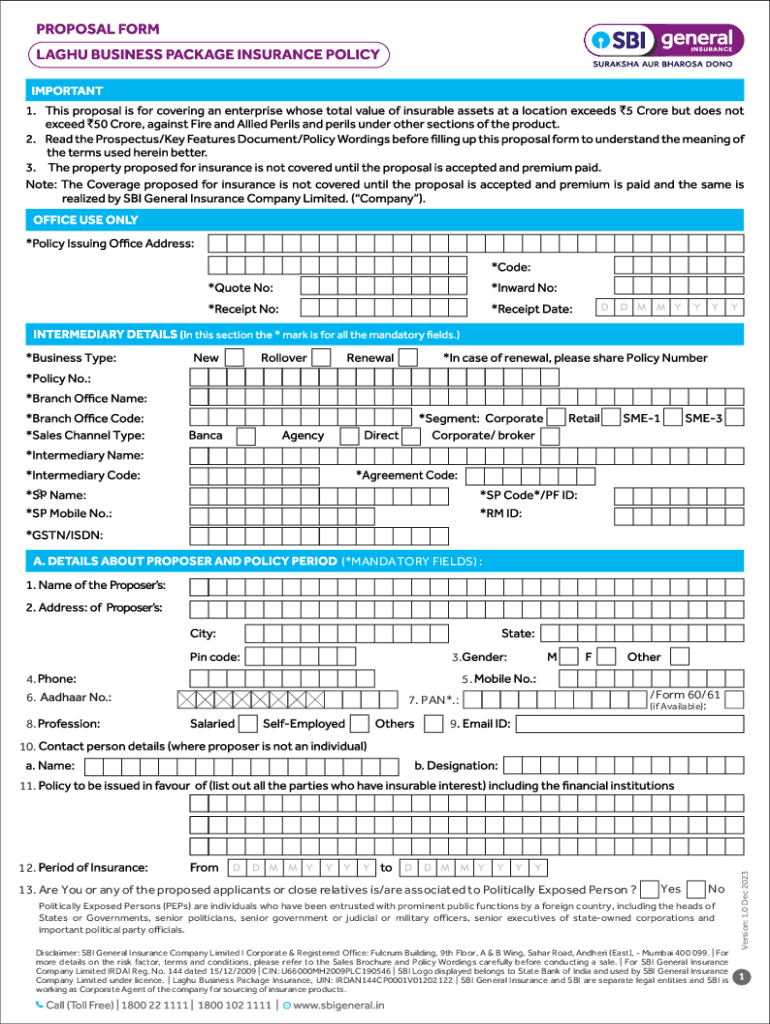

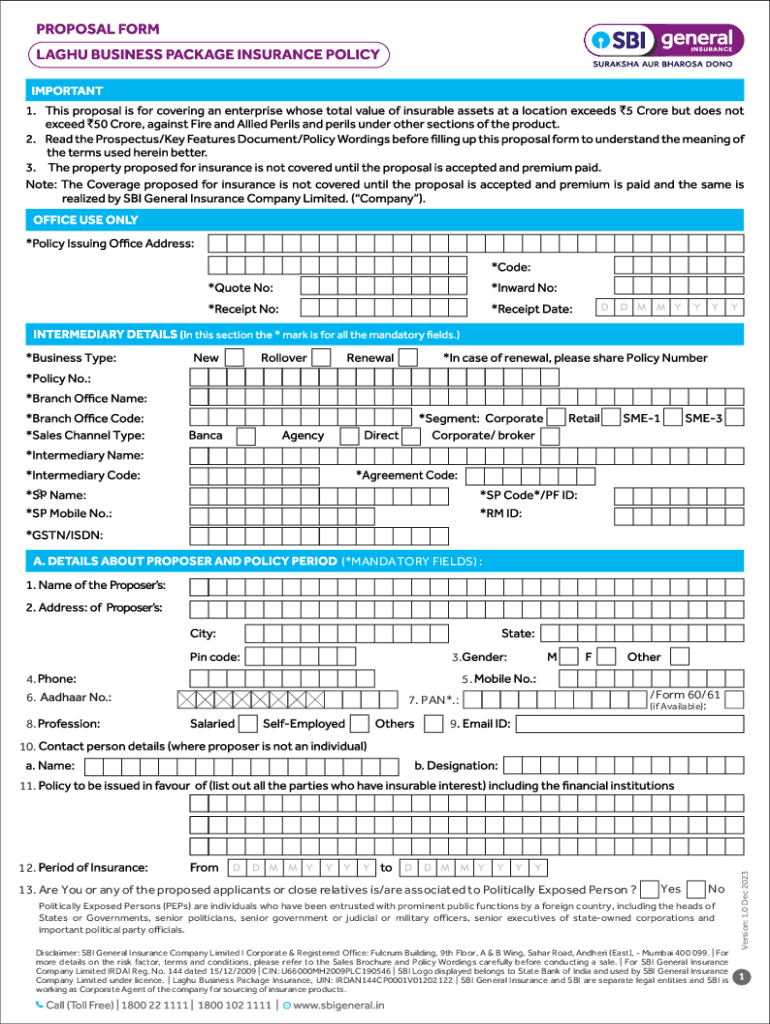

2.(*MANDATORY FIELDS) :3.

4.5.6.7. PAN×.:8.9./Form 60/61

(if Available):10.12.

13. Are You or any of the proposed applicants or close relatives is/are associated to Politically Exposed Person ? YesNoPolitically

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bank secrecy actanti-money laundering

Edit your bank secrecy actanti-money laundering form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bank secrecy actanti-money laundering form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bank secrecy actanti-money laundering online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit bank secrecy actanti-money laundering. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bank secrecy actanti-money laundering

How to fill out bank secrecy actanti-money laundering

01

Step 1: Understand the requirements of the Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) regulations.

02

Step 2: Designate a BSA/AML compliance officer within your organization.

03

Step 3: Develop and implement a comprehensive BSA/AML compliance program, including policies, procedures, and internal controls.

04

Step 4: Conduct ongoing employee training on BSA/AML compliance.

05

Step 5: Establish customer due diligence processes to verify the identity of customers and assess the risks associated with their accounts.

06

Step 6: Monitor customer transactions for suspicious activity and file Suspicious Activity Reports (SARs) when needed.

07

Step 7: Maintain proper recordkeeping of all BSA/AML compliance activities and reports.

08

Step 8: Periodically review and update the BSA/AML compliance program to ensure it remains effective and up to date with regulatory requirements.

Who needs bank secrecy actanti-money laundering?

01

Financial institutions such as banks, credit unions, and money service businesses are required to comply with the Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) regulations.

02

Additionally, businesses involved in activities that are highly vulnerable to money laundering and terrorist financing, such as casinos, pawnbrokers, and dealers in precious metals or stones, may also be subject to BSA/AML compliance requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my bank secrecy actanti-money laundering directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign bank secrecy actanti-money laundering and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I get bank secrecy actanti-money laundering?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific bank secrecy actanti-money laundering and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I edit bank secrecy actanti-money laundering on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign bank secrecy actanti-money laundering right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is bank secrecy act anti-money laundering?

The Bank Secrecy Act (BSA) is a U.S. law designed to combat money laundering and financial crimes. It requires financial institutions to assist government agencies in detecting and preventing money laundering by reporting certain transactions and maintaining records.

Who is required to file bank secrecy act anti-money laundering?

Financial institutions, including banks, credit unions, and other entities that accept deposits or engage in financial transactions are required to file reports under the Bank Secrecy Act.

How to fill out bank secrecy act anti-money laundering?

To fill out BSA reports, institutions must gather and verify the required data on the transactions, complete the appropriate forms such as the Currency Transaction Report (CTR) or Suspicious Activity Report (SAR), and submit them electronically through the Financial Crimes Enforcement Network (FinCEN) portal.

What is the purpose of bank secrecy act anti-money laundering?

The purpose of the BSA and its anti-money laundering provisions is to detect and prevent money laundering, terrorist financing, and other financial crimes by ensuring transparency in financial transactions.

What information must be reported on bank secrecy act anti-money laundering?

Institutions must report information such as the amount of currency involved in transactions, the identity of the individuals involved, the nature and purpose of the transaction, and any suspicious behaviors that may indicate illegal activities.

Fill out your bank secrecy actanti-money laundering online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bank Secrecy Actanti-Money Laundering is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.