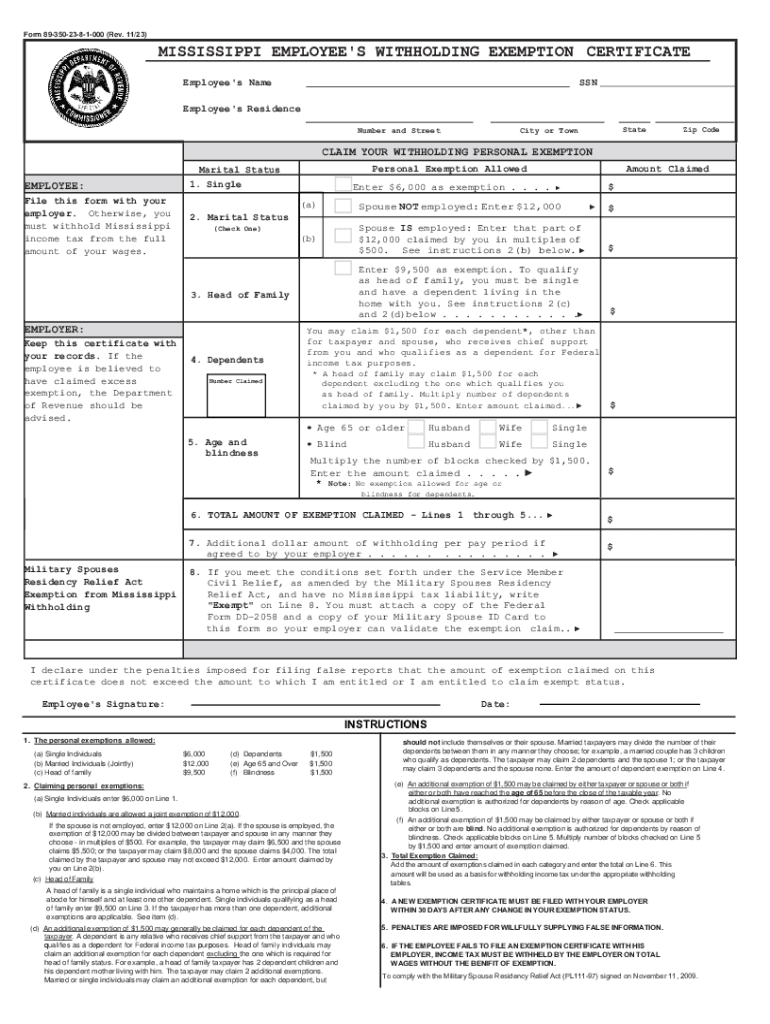

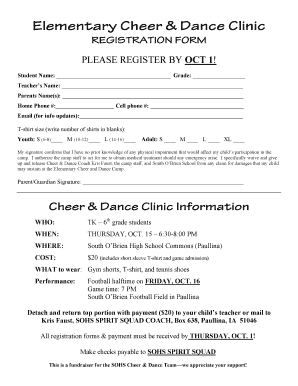

MS DoR 89-350 2023 free printable template

Get, Create, Make and Sign ms state tax withholding form

How to edit tax state mississippi online

Uncompromising security for your PDF editing and eSignature needs

MS DoR 89-350 Form Versions

How to fill out mississippi forms state

How to fill out MS DoR 89-350

Who needs MS DoR 89-350?

Video instructions and help with filling out and completing state withholding forms mississippi

Instructions and Help about mississippi form 89 350

I guess we're live at your boy Jay Beret here coming to you once again in 2014 actually for the first time in 2014 but uh I had a great friend of mine here Mr. Eric Smith out of Tulsa, and I'm in Atlanta currently we're here to talk about w-4 withholding form and what it can do for you and benefit you and your family basically it's your right from day one, and it's very it's a very misunderstood document within your tax code or whatever but anyway without further ado I think we should get right into it and start breaking it down for you, so it can help you and your fan Mr. Eric Smith would you want to step in for me preview please what's up J Beret sir it's good to be here with you yes sir definitely man I tell you what this is one of my most exciting financial topics to talk about, although it's one of the most basic and easiest thing to talk about it's one of the most important, and you know actually Jason as I've talked to people in the interviewed folks that you know we're in tax season this particular document is where most people's financial either their financial blessings happen because this document is filled out correctly or their financial distress and their families on a monthly basis happen because this document is filled out incorrectly it's an important document as a matter of fact when you pull it up when we get into it, we're going to point out the IRS tells people fill this document out every year or at least whenever your financial situation changes so that's so important so yeah man you want to we want to talk about first well let's just let's just start I guess with the first page okay go on into that and break it down for folks because like I said I was always taught you claim zero or one you know some people claim exempt for half the year, and then they go back — 1 or 0 um you know I never got any education on it when I went into HR and filled it out you know I didn't get any help there so I just you know you really didn't know didn't really even look at it to be honest with you so well let me say something let me just say something real quick the purpose remember the purpose of the w-4 because we do live in the United States of America everyone in this country has a responsibility to contribute to capitalism in this country and the way we do that is through the technology paid the only way the IRS and your job is going to be comfortable and making sure that they have the dollars that they need from them from the citizens of this country is if you have a job they need, they feel like they need to get their money first so your w-4 form is the form that you fill out that gives them the permission and then the authorization to take money out of your paycheck each pay period and give it send it in to the IRS a lot of people misunderstand that they think the withholding mean how many people they claim on their taxes I mean they confuse those they don't necessarily match them up and that's not necessarily correct when you file...

People Also Ask about mississippi state forms

Does Mississippi tax retirement income?

Does Mississippi have state withholding tax?

What is a form 80-105?

Does Mississippi have a state tax form?

Does MS have a state tax form?

Who must file a Mississippi state tax return?

What is a form 80 108?

Do you have to file a state tax return in Mississippi?

Does Mississippi have a state income tax form?

What is IRS form 80 107?

What income is taxable in Mississippi?

Who has to file a Mississippi tax return?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my state ms taxes directly from Gmail?

How do I make edits in ms withholding form without leaving Chrome?

Can I create an eSignature for the form 89 350 15 8 1 000 in Gmail?

What is MS DoR 89-350?

Who is required to file MS DoR 89-350?

How to fill out MS DoR 89-350?

What is the purpose of MS DoR 89-350?

What information must be reported on MS DoR 89-350?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.