MD SDAT 1 Instructions 2024-2025 free printable template

Fill out, sign, and share forms from a single PDF platform

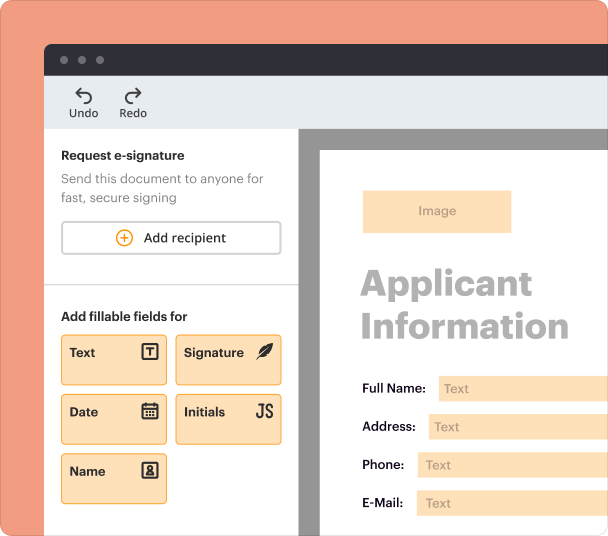

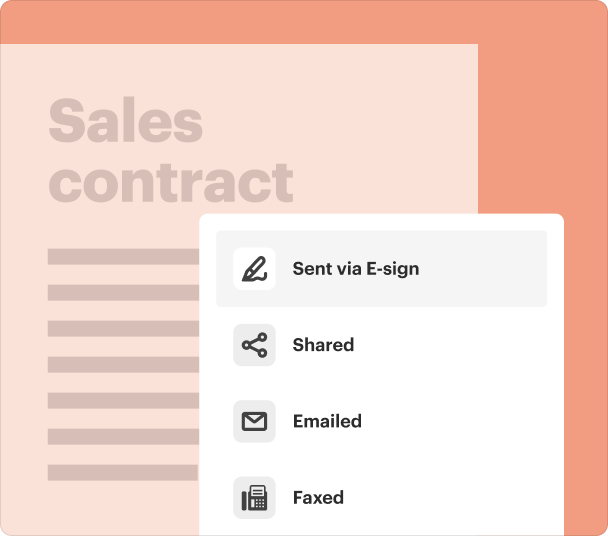

Edit and sign in one place

Create professional forms

Simplify data collection

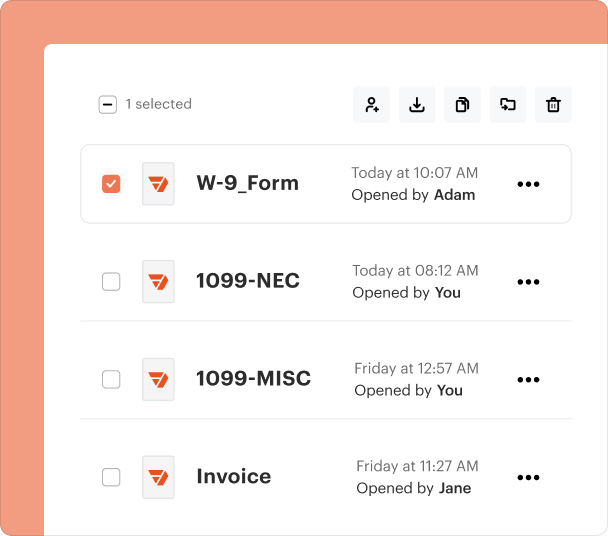

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

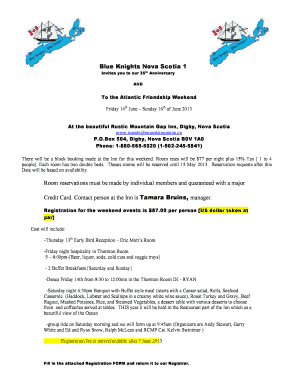

Comprehensive Guide to Maryland Business Entity Annual Report

Filing the Maryland Business Entity Annual Report is crucial for maintaining compliance and good standing with state regulations. This guide covers the md sdat 1 instructions form form to help you navigate the filing process efficiently.

Understanding the business entity annual report

The Business Entity Annual Report is a mandatory document that businesses in Maryland must file annually. It serves as a record of compliance with state regulations and an overview of the business's status. Failure to comply can result in penalties, including fines and loss of good standing.

-

This report keeps your business in compliance and allows you to maintain good standing with the state.

-

Each Maryland business must file its annual report, detailing its current status and structure.

-

Late or missing filings can result in fines and potential legal implications for your business.

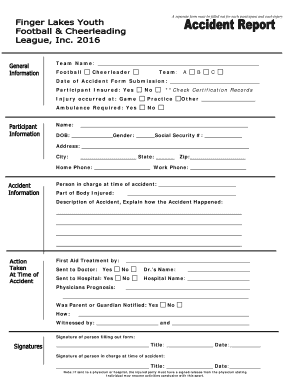

Required information for completing the report

Completing the Maryland Business Entity Annual Report requires specific information about your business. Knowing what to include is essential for a smooth filing process.

-

Identify your business structure; this affects the forms and fees you will need.

-

Different entity types have different fees. Ensure you check these before filing.

-

The SDAT ID is unique to your business, while the FEIN is used for tax purposes.

-

Do not include social security numbers within the report.

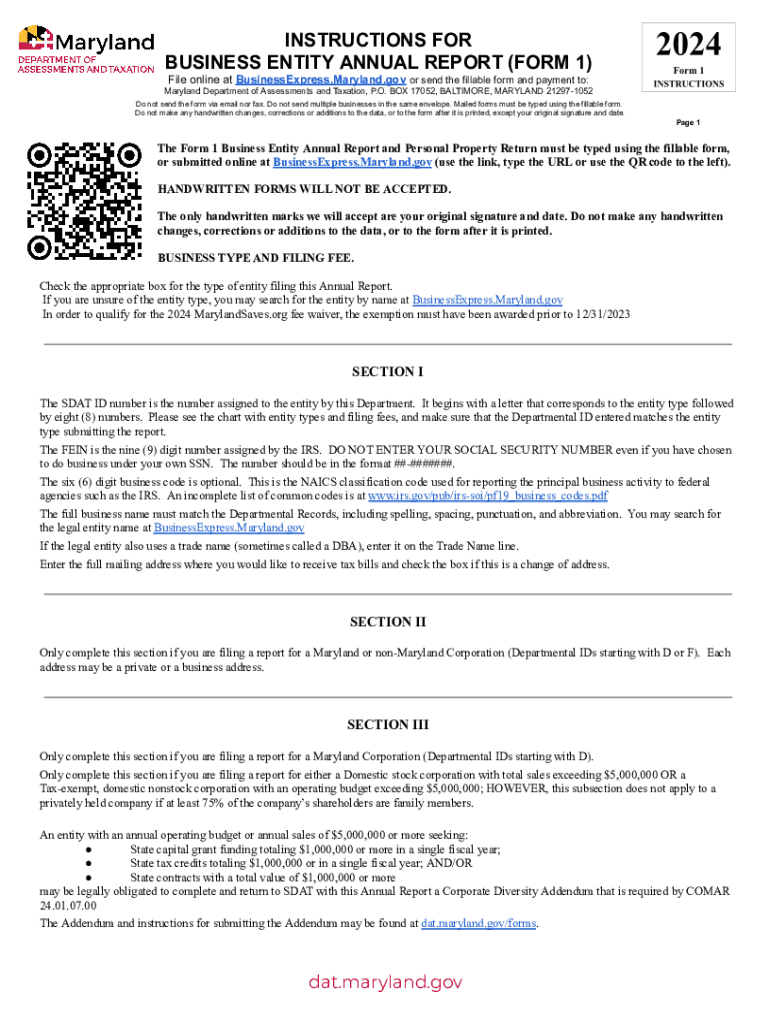

How do you file online?

Filing online is the most efficient way to submit your Business Entity Annual Report. Utilizing the BusinessExpress Maryland website simplifies the process considerably.

-

Navigate to the BusinessExpress Maryland site to begin your filing.

-

Follow the simple prompts to complete and submit your report.

-

Tools on pdfFiller can assist with filling and managing the form easily.

What are the procedures for filing by mail?

If you prefer filing by mail, ensure you are aware of the detailed procedures to follow. This will help your submission get processed correctly.

-

Always confirm you have the correct address for the Maryland Department of Assessments and Taxation.

-

Use fillable PDFs to minimize errors in your submission.

-

These are often not accepted, leading to rejected filings.

What common mistakes should you avoid while filing?

Mistakes during the filing process can lead to rejections and unnecessary penalties. Awareness is key to avoiding these common pitfalls.

-

These can lead to errors and may result in the rejection of your report.

-

Make sure you correctly identify your business type to avoid filing the wrong forms.

-

All required signatures and dates must be included to ensure proper processing.

Insights into Maryland's business filing fees

Understanding the fee structure for your business entity is vital for budgeting and ensuring timely filing.

-

Fees vary based on the type of entity and must be factored into your annual report preparation.

-

Some businesses may qualify for fee waivers through MarylandSaves.org, which requires documentation.

-

Know which payment methods are allowed when filing the annual report.

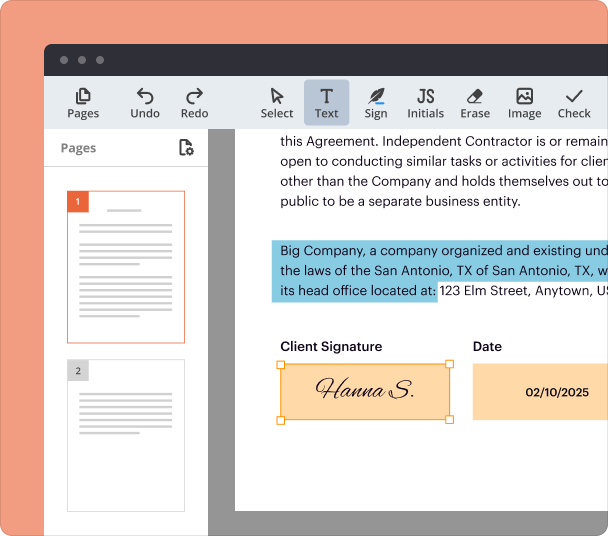

Leveraging pdfFiller for efficient document management

pdfFiller offers powerful tools for managing your document filing process, enhancing your efficiency.

-

Edit PDFs and streamline your preparation before submission using pdfFiller.

-

Utilize eSign features for timely filing, ensuring compliance with deadlines.

-

Teams can benefit from collaborative tools in pdfFiller when managing multiple reports.

Frequently Asked Questions about maryland personal property tax extension online form

What if my business is inactive? Do I still file?

Yes, even if your business is inactive, you still need to file an annual report. This keeps your business on record with the state, maintaining its good standing.

How do I correct errors after submission?

If you discover an error after your report has been submitted, you can file a correction report. Ensure you act swiftly to avoid further penalties.

What are the deadlines for filing the annual report?

The deadlines vary based on your business's formation date. Generally, reports are due by April 15th of each year for most entity types.

How do I pay my filing fees?

Filing fees can be paid online via the BusinessExpress site or sent via mail with your paper submission. Check for the accepted payment methods before submission.

Is there a fee for filing the report online?

While filing online is typically quicker, fees may still apply. Verify the fee structure on the BusinessExpress site before proceeding.

pdfFiller scores top ratings on review platforms