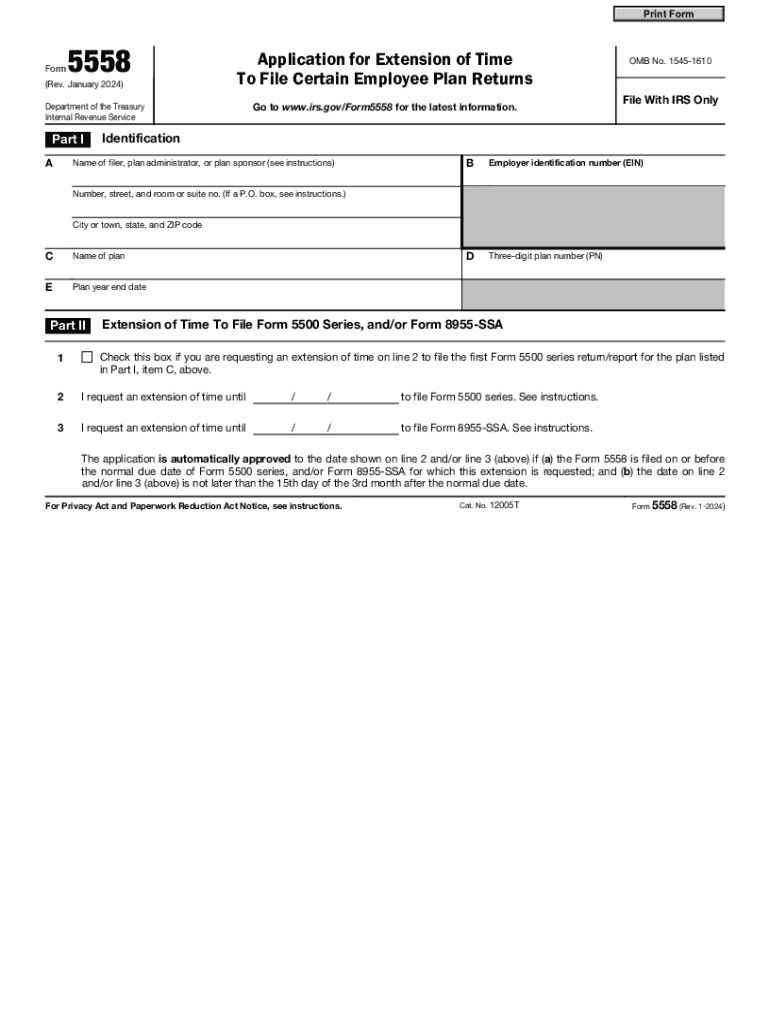

IRS 5558 2024 free printable template

Instructions and Help about IRS 5558

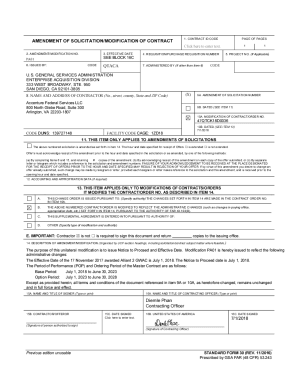

How to edit IRS 5558

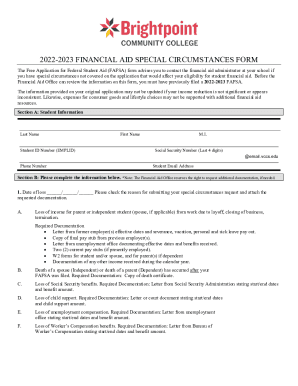

How to fill out IRS 5558

About IRS 5 previous version

What is IRS 5558?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 5558

How can I correct a mistake on my IRS 5558 after submission?

To correct mistakes on your IRS 5558, you must file an amended return. This involves completing the new form with the correct information and marking it as 'amended' to indicate that it replaces the previous submission. Keep in mind that you should also retain a copy of both the original and amended forms for your records.

What should I do if my e-filed IRS 5558 gets rejected?

If your e-filed IRS 5558 is rejected, check the rejection codes provided in the notification to understand the issue. Common reasons include incorrect information or missing signatures. You can fix these errors and resubmit the form electronically, ensuring all details are accurate to avoid further rejections.

Are e-signatures acceptable when submitting IRS 5558?

Yes, e-signatures are acceptable for IRS 5558, provided that the software used for e-filing adheres to IRS standards for digital signatures. Make sure to follow the guidelines set by the IRS regarding e-signatures to ensure your submission is valid.

What should I do if I receive a notice related to my IRS 5558?

If you receive a notice regarding your IRS 5558, carefully review the document to understand the issue raised. It is important to respond promptly and provide the required documentation or clarification as indicated in the notice to resolve the matter effectively.

How might the e-filing process for IRS 5558 differ based on the software used?

The e-filing process for IRS 5558 can vary by software due to differences in user interfaces, features, and technical requirements. Ensure that any software you choose is IRS-approved and meets the technical specifications for e-filing to streamline your submission experience.