NY Form IT-204-LL-I 2023 free printable template

Show details

Department of Taxation and FinanceIT204LLInstructions for Form IT204LLPartnership, Limited Liability Company, and Limited Liability Partnership Filling Fee Payment Form General information Who must

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ny instructions 204 ll form

Edit your NY Form IT-204-LL-I form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY Form IT-204-LL-I form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY Form IT-204-LL-I online

To use the professional PDF editor, follow these steps below:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NY Form IT-204-LL-I. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY Form IT-204-LL-I Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY Form IT-204-LL-I

How to fill out NY Form IT-204-LL-I

01

Obtain NY Form IT-204-LL-I from the New York State Department of Taxation and Finance website or your local tax office.

02

Fill in the entity's name as it appears on the tax records.

03

Enter the Employer Identification Number (EIN) or Social Security Number (SSN).

04

Provide the primary business address.

05

Indicate the date of formation or incorporation.

06

Specify the type of entity (LLC, partnership, etc.).

07

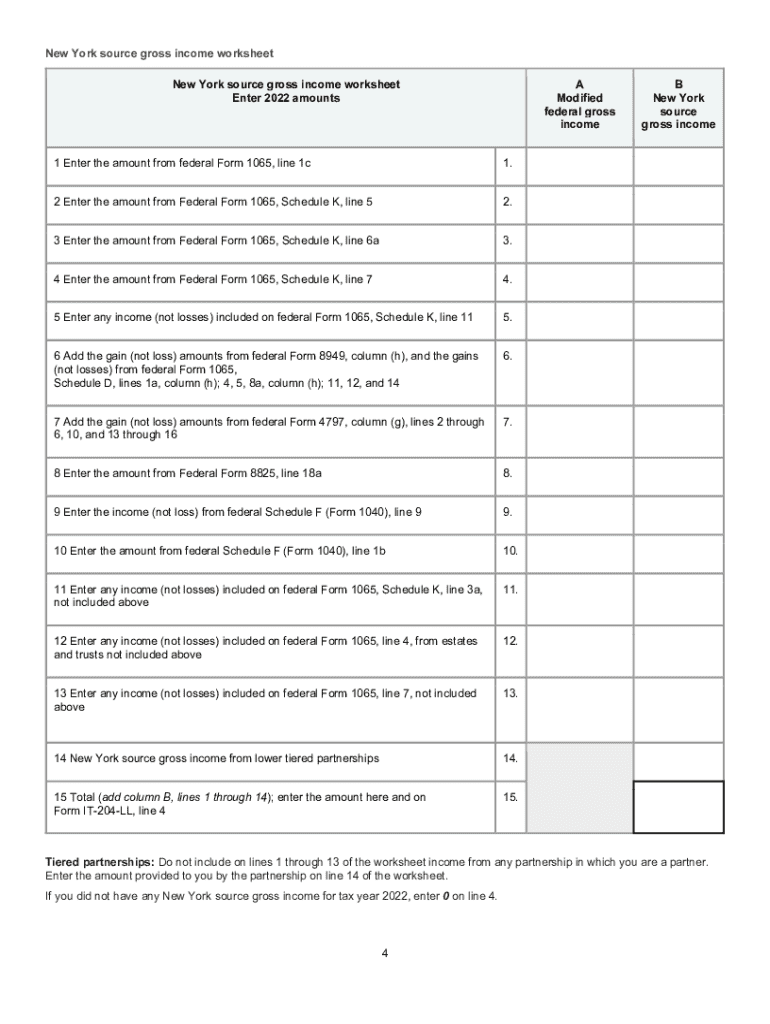

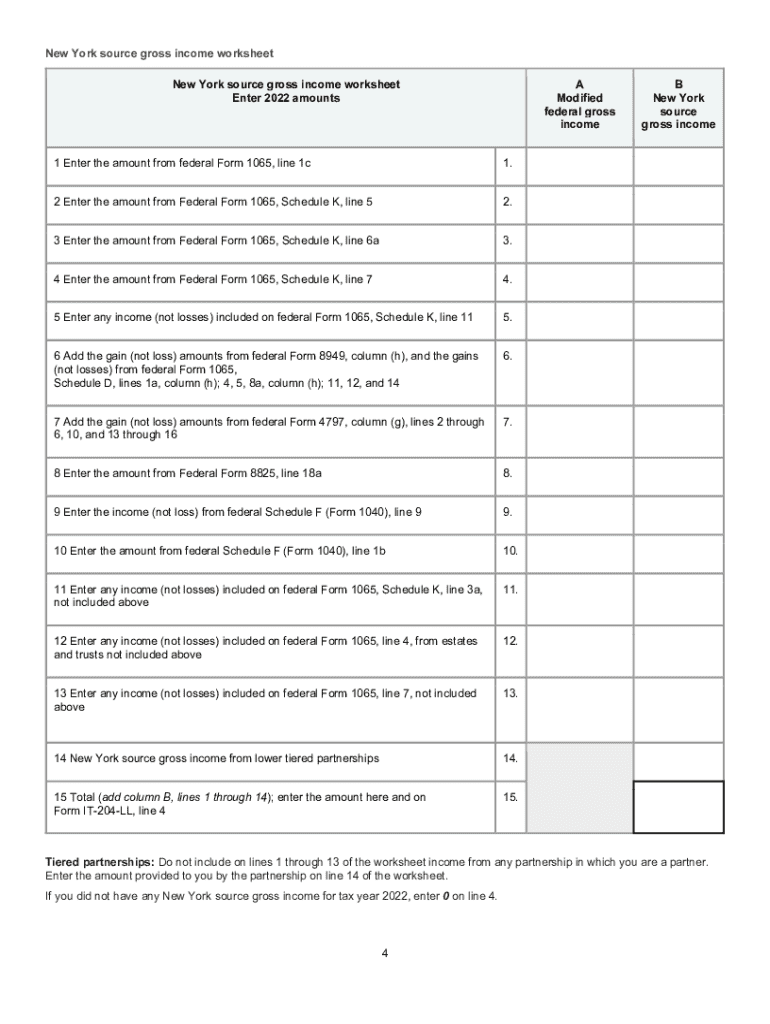

Complete the income and tax calculation sections as applicable.

08

Review the instructions for any additional schedules or documents required.

09

Sign and date the form before submitting it.

10

Keep a copy of the submitted form and any attachments for your records.

Who needs NY Form IT-204-LL-I?

01

New York businesses that are classified as LLCs or partnerships and are required to file a tax return.

02

Any entity that has a gross income exceeding the specified threshold as outlined by the New York State tax regulations.

03

Those looking to report and pay the LLC fee as mandated by New York State law.

Fill

form

: Try Risk Free

People Also Ask about

Who Must File NYC 4S?

S CORPORATIONS An S Corporation is subject to the General Corporation Tax and must file either Form NYC- 4S, NYC-4S-EZ or NYC-3L, whichever is appli- cable. Under certain limited circumstances, an S Corporation may be permitted or required to file a combined return (Form NYC-3A).

What is ny form IT-204-LL?

Form IT-204-LL, Partnership, Limited Liability Company, and Limited Liability Partnership Filing Fee Payment Form.

Who must file a NY nonresident return?

If you had any income during your resident period or if you had New York source income during your nonresident period, you are required to file a New York State return. You will file Form IT-203, Nonresident and Part-Year Resident Income Tax Return.

What is form IT 204 IP?

The Form IT-204-IP provided to you by your partnership lists your distributive share of any credits, credit components, credit factors, recapture of credits, and any other information reported by the partnership during the tax year. You need this information when completing your individual income tax return.

What type of partners does New York require pass-through entity withholding?

The pass-through entity tax must be paid by a partnership or New York S corporation to another jurisdiction on income derived from that jurisdiction and subject to tax under Article 22. This includes any taxes paid by an LLC treated as a partnership or S corporation for New York tax purposes.

Who Must File Form NYC 204?

Any partnership that carries on or liquidates any trade, business, profession or occupation wholly or partly within New York City and has a total gross income from all business regardless of where carried on of more than $25,000 (prior to any deduction for cost of goods sold or services performed) must file an

Who has to file a NY partnership return?

Income tax responsibilities must file Form IT-204, Partnership Return if it has either (1) at least one partner who is an individual, estate, or trust that is a resident of New York State, or (2) any income, gain, loss, or deduction from New York sources (see instructions).

What is ny form it-204?

What's new for 2021? For a detailed list of what's new, including a summary of tax law changes, visit our website (see Need help?) and search 2021. Use Form IT-204 to report income, deductions, gains, losses, and credits from the operation of a partnership for calendar year 2021, or other tax year beginning in 2021.

Does NY accept federal extension for partnerships?

New York does not recognize a federal extension. If you cannot meet the filing deadline for a NY business return, you should request a six-month extension of time by filing Form CT-5, Request for Six-Month Extension to File (For Franchise/Business Taxes, MTA Surcharge, or Both), on or before the due date of the return.

Who Must File NYC Partnership Return?

Income tax responsibilities must file Form IT-204, Partnership Return if it has either (1) at least one partner who is an individual, estate, or trust that is a resident of New York State, or (2) any income, gain, loss, or deduction from New York sources (see instructions).

Do general partnerships need to be registered in NY?

You do not need to register a general partnership in New York. However, you will need to file a Certificate of Assumed Name for any additional business names. You will also need to register for state and federal taxes and meet all licensing, permitting, and clearance requirements.

What is an Article 22 partner New York?

Line F1, Article 22: A partner that is an individual, partnership or LLC treated as partnership for federal purposes, a trust, or estate.

Can you efile NY it-204-LL?

E-file options Electronically file your Form IT-204-LL using New York State-approved software. For more information, see E-file Approved Software Developers for Partnership.

Do I need to file a NYC 204?

Any partnership that carries on or liquidates any trade, business, profession or occupation wholly or partly within New York City and has a total gross income from all business regardless of where carried on of more than $25,000 (prior to any deduction for cost of goods sold or services performed) must file an

What is NYC unincorporated business tax?

A 4% tax rate is charged for taxable income allocated to New York City. Who is Exempt from this Tax? Performing services as an employee is not subject to UBT. An owner, lessee, or fiduciary who is engaged in holding, leasing, or managing real property for their own account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the NY Form IT-204-LL-I in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your NY Form IT-204-LL-I and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out the NY Form IT-204-LL-I form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign NY Form IT-204-LL-I and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How can I fill out NY Form IT-204-LL-I on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your NY Form IT-204-LL-I from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is NY Form IT-204-LL-I?

NY Form IT-204-LL-I is the New York State Partnership Return of Income and Loss form that is used to report the income, deductions, gains, losses, etc., of a partnership for tax purposes.

Who is required to file NY Form IT-204-LL-I?

Partnerships doing business in New York State are required to file NY Form IT-204-LL-I, including Limited Liability Companies (LLCs) classified as partnerships for tax purposes.

How to fill out NY Form IT-204-LL-I?

To fill out NY Form IT-204-LL-I, partnership members must gather financial records, report income, deductions, and other relevant items on the form, and ensure it is filed by the due date.

What is the purpose of NY Form IT-204-LL-I?

The purpose of NY Form IT-204-LL-I is to provide New York State with a summary of a partnership's income and losses, ensuring proper taxation of the partnership's earnings.

What information must be reported on NY Form IT-204-LL-I?

Information that must be reported on NY Form IT-204-LL-I includes the partnership's name, address, EIN, the income, deductions, tax credits, and partners’ details.

Fill out your NY Form IT-204-LL-I online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY Form IT-204-LL-I is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.