Get the free FAT H E R 'S DAY TEA TIME

Show details

First Tee Celebrity Charity Classic Kickoff Event for the 2020 Travelers Championship Sunday, June 14, 2020, TPC River Highlands 1:30 PM Shotgun You won\'t want to miss this opportunity to play the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fat h e r

Edit your fat h e r form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fat h e r form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fat h e r online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fat h e r. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fat h e r

How to fill out fat h e r

01

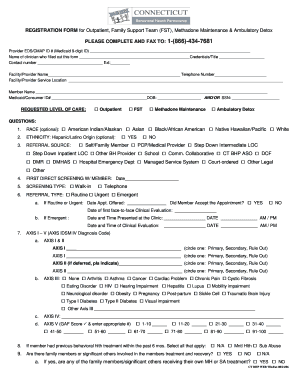

To fill out a FAT H.E.R form, follow these steps:

02

Start by downloading the FAT H.E.R form from the official website or obtain a physical copy from the relevant authority.

03

Read the instructions carefully to understand the purpose and requirements of the form.

04

Begin by providing your personal information, such as name, address, contact details, and any other requested details.

05

Fill in the specific sections of the form that pertain to your situation or the purpose of your submission. This may include financial information, employment details, or any other relevant information as instructed.

06

Double-check the form for accuracy, making sure all the required fields are completed and any supporting documents are attached if necessary.

07

Sign and date the form at the designated space to acknowledge the accuracy and truthfulness of the information provided.

08

Keep a copy of the completed form for your records before submitting it to the appropriate authority as instructed.

09

If submitting the form electronically, follow the given instructions on how to securely transmit the document. If submitting a physical copy, ensure it is mailed or delivered to the correct address.

10

After submission, follow up with the relevant authority to ensure that your form has been received and processed accordingly.

11

Always refer to the official instructions and guidelines for filling out the FAT H.E.R form to ensure compliance and accuracy.

Who needs fat h e r?

01

Various individuals and entities may need to fill out a FAT H.E.R form, including:

02

- Individuals who are required to report their financial information for tax purposes or to comply with regulatory requirements.

03

- Businesses and corporations that need to disclose their financial transactions and assets.

04

- Financial institutions and banks that must provide information on their customers' accounts and transactions.

05

- Government agencies that collect financial data to monitor and regulate economic activities.

06

- Professionals or individuals conducting transactions with high-value assets or involved in activities susceptible to money laundering or terrorist financing.

07

- Any individual or entity that falls under the jurisdiction or regulation requiring the completion of a FAT H.E.R form.

08

It is essential to consult the specific regulations and guidelines in your jurisdiction to determine if and when you need to fill out a FAT H.E.R form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send fat h e r for eSignature?

When you're ready to share your fat h e r, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I execute fat h e r online?

With pdfFiller, you may easily complete and sign fat h e r online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How can I edit fat h e r on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit fat h e r.

What is FATCA?

FATCA stands for the Foreign Account Tax Compliance Act, a U.S. tax law aimed at preventing tax evasion by U.S. taxpayers holding accounts and other financial assets offshore.

Who is required to file FATCA?

U.S. taxpayers, including individuals and entities, who have foreign financial assets that exceed certain thresholds are required to file FATCA.

How to fill out FATCA?

To fill out FATCA, taxpayers must complete IRS Form 8938, reporting their foreign financial assets, and submit it along with their annual tax return.

What is the purpose of FATCA?

The purpose of FATCA is to improve tax compliance by U.S. taxpayers with foreign financial accounts and to combat tax evasion.

What information must be reported on FATCA?

Taxpayers must report information such as the type of foreign financial assets, the account numbers, the value of the assets, and any income generated from these assets.

Fill out your fat h e r online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fat H E R is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.