Get the free Advance child tax credit payments letter ...

Show details

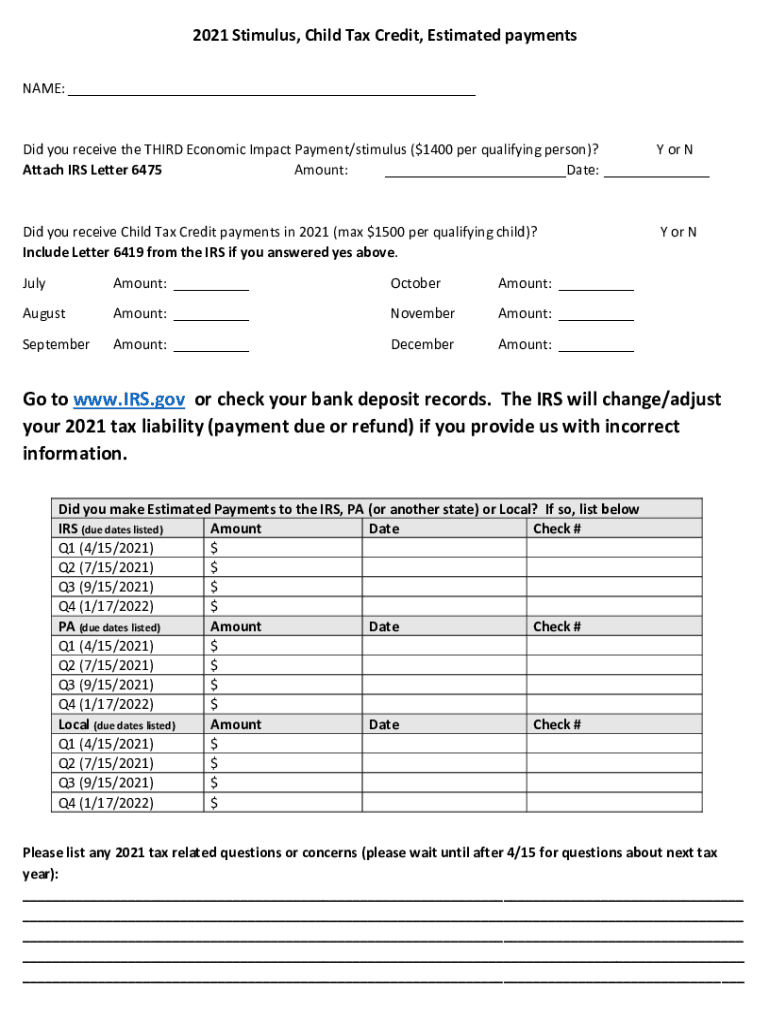

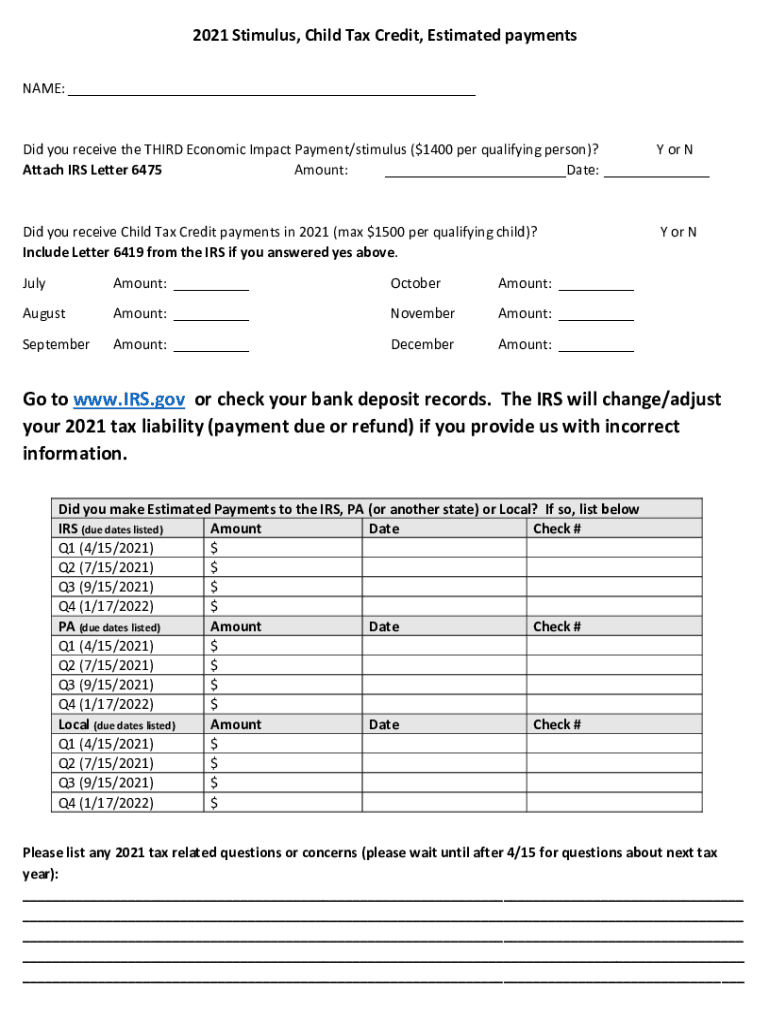

2021 Stimulus, Child Tax Credit, Estimated payments NAME: ___Did you receive the THIRD Economic Impact Payment/stimulus ($1400 per qualifying person)? Y or N Attach IRS Letter 6475 Amount: ___Date:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign advance child tax credit

Edit your advance child tax credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your advance child tax credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit advance child tax credit online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit advance child tax credit. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out advance child tax credit

How to fill out advance child tax credit

01

To fill out the advance child tax credit, follow these steps:

02

Determine if you qualify: Check if you have a dependent child who is under the age of 17 at the end of the year.

03

Calculate your income: Make sure your modified adjusted gross income (MAGI) falls within the income limits. For example, for the tax year 2021, the phase-out begins at $75,000 for single filers, $112,500 for head of household, and $150,000 for married filing jointly.

04

Check eligibility for the child: Ensure that the child has a valid Social Security Number (SSN) and meets the residency requirements.

05

Fill out Form 1040 or Form 1040-SR: Use either of these forms to report your income and claim the advance child tax credit. The credit will be calculated automatically using the information provided.

06

Provide accurate information: Make sure all the required information is correctly filled out, including the child's details and income information.

07

Submit the form: Once you have completed the form, submit it to the IRS according to their instructions and deadlines.

08

Keep track of updates: Stay informed about any changes or updates from the IRS regarding the advance child tax credit.

Who needs advance child tax credit?

01

The advance child tax credit is designed to support families with dependent children. Generally, individuals who have qualifying children under the age of 17 may be eligible for this credit. However, eligibility is also based on income and residency requirements. Therefore, individuals and families who have dependent children, meet the income limits, and satisfy the necessary requirements can benefit from the advance child tax credit.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit advance child tax credit from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including advance child tax credit, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I edit advance child tax credit online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your advance child tax credit to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I sign the advance child tax credit electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your advance child tax credit in minutes.

What is advance child tax credit?

The advance child tax credit is a temporary expansion of the Child Tax Credit that allows eligible families to receive periodic payments based on their expected tax credit for the year, providing financial assistance to help cover child-related expenses.

Who is required to file advance child tax credit?

Taxpayers who qualify for the Child Tax Credit and wish to receive the advance payments must file a tax return, either for the year prior or for the current year, depending on the specific requirements set by the IRS.

How to fill out advance child tax credit?

To fill out the advance child tax credit, taxpayers need to use the IRS Form 1040 or 1040-SR and include information about qualifying children. They may also need to provide specific data on their income and residency status to determine eligibility.

What is the purpose of advance child tax credit?

The purpose of the advance child tax credit is to provide immediate financial relief to families with children, ensuring they have the resources to meet daily expenses and support child development while also increasing the overall economic security of families.

What information must be reported on advance child tax credit?

Taxpayers must report information including the number of qualifying children, their ages, taxpayer identification numbers, income level, and filing status to determine eligibility for the advance child tax credit.

Fill out your advance child tax credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Advance Child Tax Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.