Get the free Changing Accounting Methods Using Form 3115 - Federal

Show details

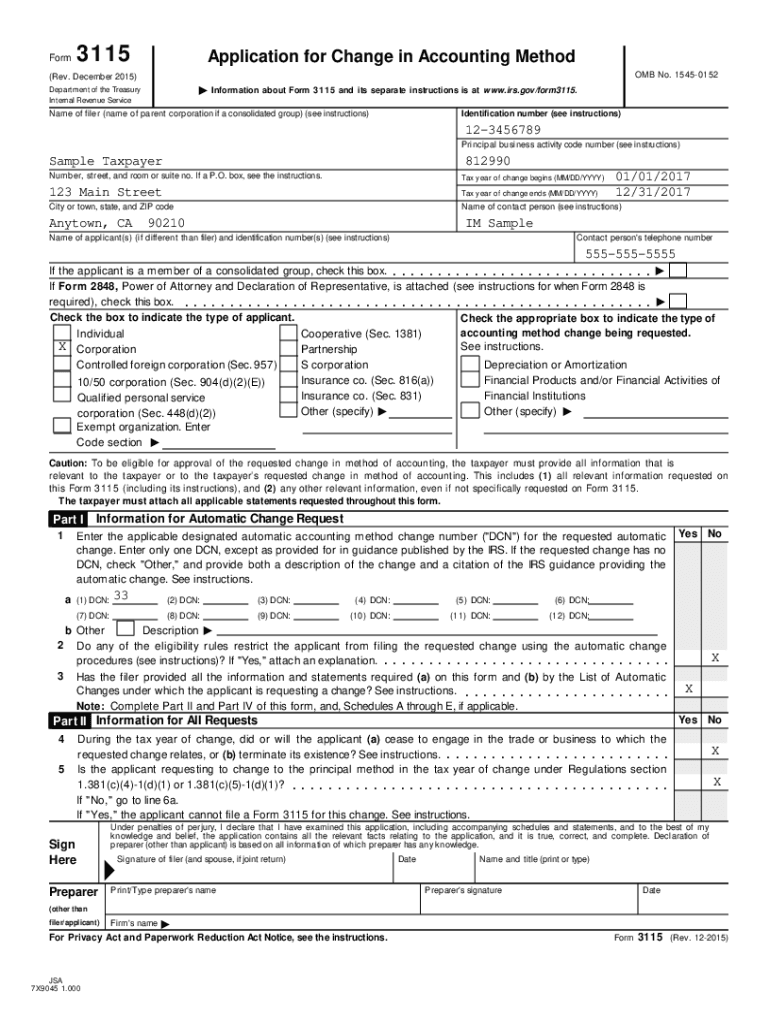

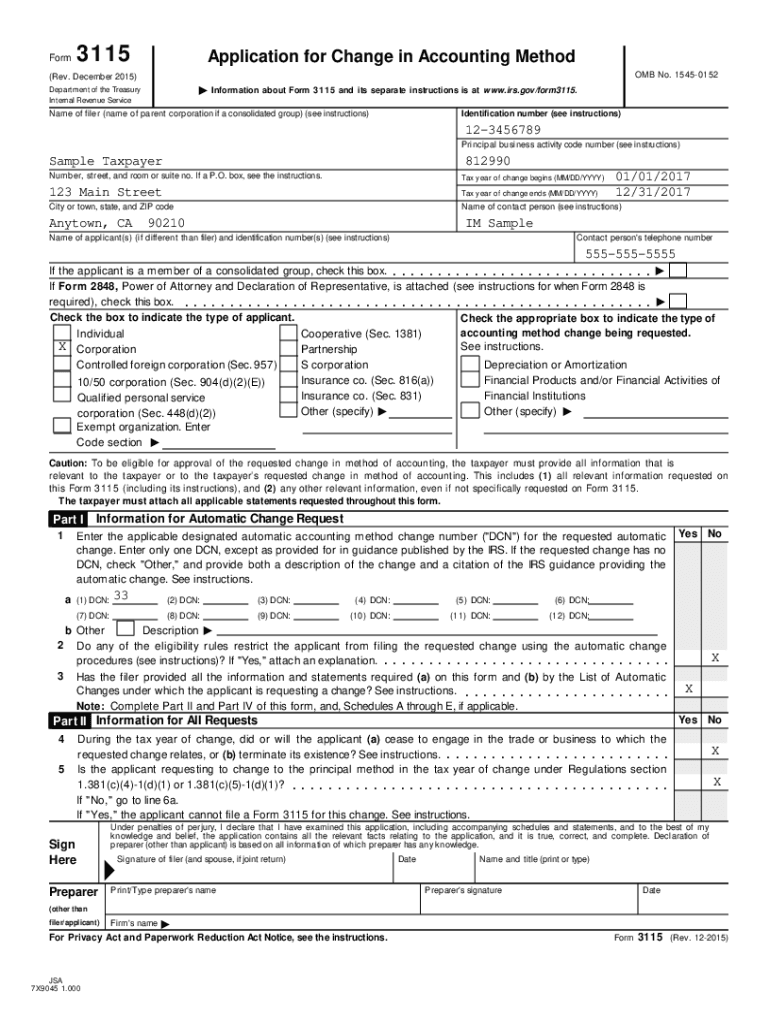

Form3115Application for Change in Accounting Method(Rev. December 2015)IDepartment of the Treasury Internal Revenue ServiceOMB No. 15450152 Information about Form 3115 and its separate instructions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign changing accounting methods using

Edit your changing accounting methods using form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your changing accounting methods using form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing changing accounting methods using online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit changing accounting methods using. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out changing accounting methods using

How to fill out changing accounting methods using

01

To fill out changing accounting methods, follow these steps:

02

Identify the need for changing accounting methods. This could be due to a change in business operations, regulatory changes, or better accounting practices.

03

Review the current accounting methods that are being used. Understand the impact of the proposed changes and the effect it will have on financial statements.

04

Consult with accounting professionals or experts to ensure compliance with accounting standards and regulations.

05

Prepare a detailed plan for implementing the changes. This may include creating new accounts, adjusting financial statements, and updating accounting software.

06

Communicate the proposed changes to stakeholders such as shareholders, employees, and regulators. Provide them with the necessary information and reasoning behind the changes.

07

Implement the changes in a systematic manner. Ensure that all necessary adjustments are made, and that financial statements accurately reflect the new accounting methods.

08

Monitor and review the effectiveness of the new accounting methods. Make any necessary adjustments to optimize financial reporting and compliance.

09

Document the changes made and maintain proper records for auditing purposes.

10

Continuously educate and train accounting staff on the new accounting methods to ensure proper understanding and adherence.

11

Seek professional guidance if needed and stay updated on any changes in accounting standards or regulations that may impact the chosen methods.

Who needs changing accounting methods using?

01

Changing accounting methods may be necessary for various entities:

02

- Businesses undergoing significant operational changes or expansions.

03

- Entities adapting to new regulatory requirements.

04

- Companies looking to improve their accounting practices and financial reporting.

05

- Organizations transitioning to new accounting software or systems.

06

- Entities facing mergers, acquisitions, or changes in ownership.

07

- Businesses seeking better alignment with industry standards and best practices.

08

- Entities aiming to enhance transparency and accuracy in financial reporting.

09

- Companies in need of better tax planning strategies.

10

- Organizations needing to comply with changes in national or international accounting standards.

11

- Entities aiming to mitigate accounting risks and errors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send changing accounting methods using for eSignature?

To distribute your changing accounting methods using, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I complete changing accounting methods using online?

Filling out and eSigning changing accounting methods using is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out the changing accounting methods using form on my smartphone?

Use the pdfFiller mobile app to complete and sign changing accounting methods using on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is changing accounting methods using?

Changing accounting methods refers to the process of altering the way a business recognizes and reports its financial transactions, such as switching from cash accounting to accrual accounting.

Who is required to file changing accounting methods using?

Taxpayers who choose to change their accounting method, including businesses and individuals with complex accounting needs, are typically required to file for a change in accounting method.

How to fill out changing accounting methods using?

To fill out the changing accounting methods, taxpayers must complete the appropriate IRS form, usually Form 3115, and provide details about the current and new accounting methods, along with any required disclosures.

What is the purpose of changing accounting methods using?

The purpose of changing accounting methods is to align financial reporting with the business's operational realities, provide clarity to financial statements, and comply with tax regulations.

What information must be reported on changing accounting methods using?

Information that must be reported includes the current accounting method, the new accounting method being adopted, the reasons for the change, and any adjustments to income or expenses as a result of the change.

Fill out your changing accounting methods using online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Changing Accounting Methods Using is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.