Get the free Long Form for Senior Property Taxes

Show details

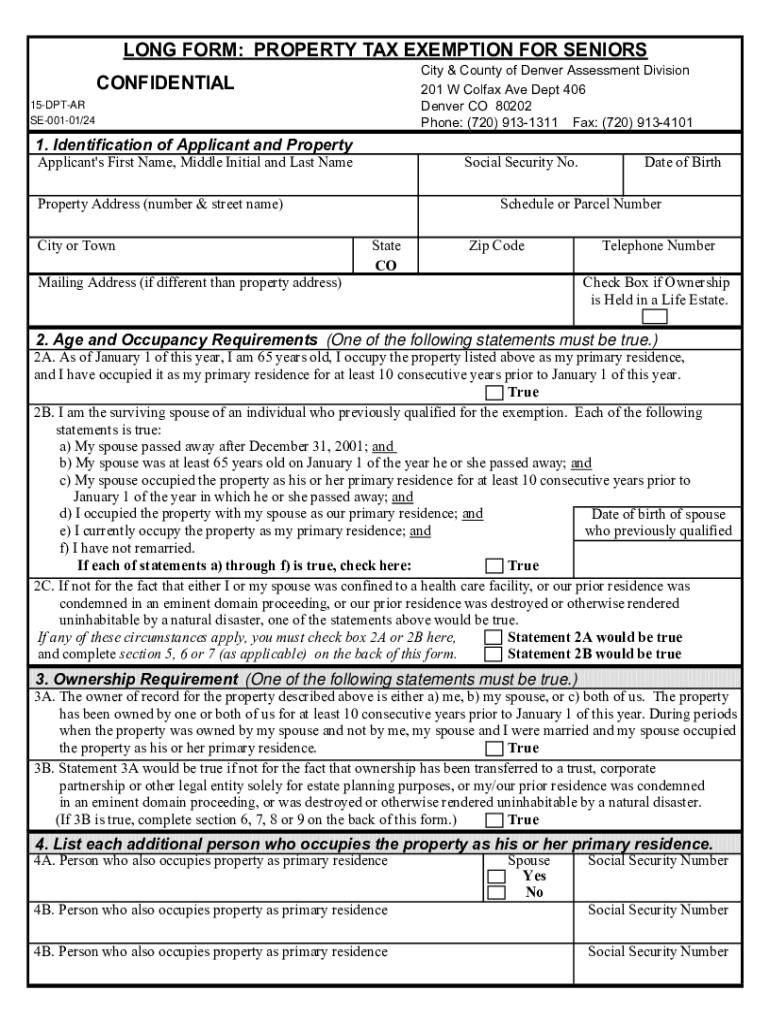

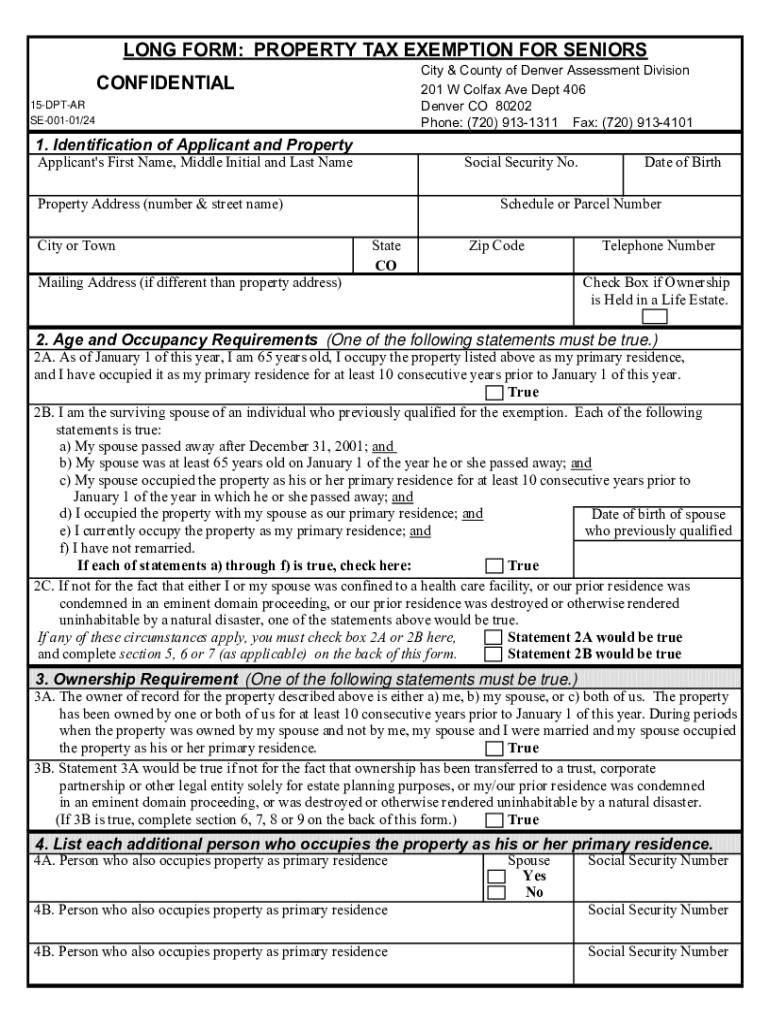

LONG FORM: PROPERTY TAX EXEMPTION FOR Seniority & County of Denver Assessment Division

201 W Colfax Ave Dept 406

Denver CO 80202

Phone: (720) 9131311 Fax: (720) 9134101CONFIDENTIAL

15DPTAR

SE00101/241.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign long form for senior

Edit your long form for senior form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your long form for senior form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing long form for senior online

To use the professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit long form for senior. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out long form for senior

How to fill out long form for senior

01

Start by gathering all the necessary information and documentation, such as the senior's personal details (name, date of birth, address), identification documents (ID card, passport), and any supporting documents required for the form.

02

Read the instructions carefully to understand the specific requirements of the long form for seniors.

03

Begin filling out the form by providing accurate and complete information in each section. Take your time and double-check the entered details for accuracy.

04

Pay attention to any special instructions or additional forms that may need to be submitted along with the long form for seniors.

05

If you are unsure about any question or section, seek assistance from relevant authorities or consult the provided helpline.

06

Review the completed form thoroughly before submitting it, ensuring that all information is accurate and the necessary documents are attached.

07

Follow the prescribed submission process, whether it is submitting the form online, mailing it, or visiting a designated office.

08

Keep a copy of the filled-out form and the supporting documents for your records.

09

Follow up on the status of your application if necessary, and take note of any additional steps or documents requested by the authorities.

10

If the form requires a fee, ensure that it is paid promptly and retain proof of payment.

Who needs long form for senior?

01

The long form for seniors is typically needed by individuals who are aged 65 and above and require certain benefits, assistance, or services targeted towards senior citizens.

02

This form is commonly used to apply for senior citizen discounts, social security benefits, healthcare programs, retirement plans, and various other senior-oriented programs or services.

03

It is important for seniors to fill out this form accurately and completely in order to avail the benefits and privileges they are entitled to.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send long form for senior for eSignature?

When you're ready to share your long form for senior, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit long form for senior in Chrome?

long form for senior can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for signing my long form for senior in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your long form for senior and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is long form for senior?

The long form for senior typically refers to the IRS Form 1040-SR, which is designed for seniors aged 65 or older, offering simpler reporting options and larger font.

Who is required to file long form for senior?

Seniors aged 65 or older who have income over a certain threshold, including wages, pensions, or other income sources, are required to file the long form for seniors if they need to report their income to the IRS.

How to fill out long form for senior?

To fill out the long form for senior, you need to gather all income statements (W-2s, 1099s), complete the personal information section, report your income, adjustments, and calculate your tax liability following the IRS instructions.

What is the purpose of long form for senior?

The purpose of the long form for senior is to allow older taxpayers to report their income and claim deductions, credits, and other tax benefits in a straightforward manner tailored for their needs.

What information must be reported on long form for senior?

The information that must be reported includes your filing status, income sources, adjustments to income, tax deductions, credits, and any other relevant tax information.

Fill out your long form for senior online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Long Form For Senior is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.