VALIC VL 8725 2013 free printable template

Get, Create, Make and Sign VALIC VL 8725

How to edit VALIC VL 8725 online

Uncompromising security for your PDF editing and eSignature needs

VALIC VL 8725 Form Versions

How to fill out VALIC VL 8725

How to fill out VALIC VL 8725

Who needs VALIC VL 8725?

Instructions and Help about VALIC VL 8725

Lean the tax returns season but for anyone expecting a refund well those folks usually don't waste any time filing yeah the average tax refund is nearly three thousand dollars so what should you do with the money Terry O'Grady with the VALID financial it's here with us and Terry I would have to imagine the first thing that you should do or the thing you should try and concentrate on is paying down debt well you definitely want to get out of debt but first with that tax refund you probably don't even want to get that tax refund we can talk about that as we go, but you're really giving Uncle Sam an interest-free loan all year it's your money that you could have had in your pocket all throughout the year paying off debt due you're saying don't get that refund you're saying be a little smarter maybe in what the w-4 yeah go to HR I adjust the w-4 get more accurate withholding that way you have more on your paycheck throughout the year that you can either put toward debt or put into your 401 K or some other kinds of savings so yeah so when we're talking about paying down debt though what should we start with because you know a lot of people carry like house payment they carry you know student loans I carry other things credit card debt what should they look at and how should they pay them down well most people think if you pay off the highest interest rate loan first if you do the math that's the black and white math that's going to be the way to go, so you pay the highest interest rate credit card or the highest interest rate loan first, but that's that's the black and white math, and we've found it's not really about the math it's about behavior, so we're looking for some wins under your belt so the easiest way to do that is to list your debts from lowest to highest from smallest to largest pay the minimum payments on all the debts except the smallest one that one you're going to gang up on so in this example where you have the three thousand dollar tax refund well you can sock away that right under the smallest debt you may knock that out than whatever you're doing on the smallest debt you add it to the next smallest and so on and so on, and it's snowballing now you get some wins under your belt you get some momentum going just like in sports Djokovic at the Australian Open you get some momentum, and then you're unbeatable then you can knock this stuff out I kind of look at it like when you're doing something around the house when you have all these jobs to do around the house do the things that you can get out of the way right away that way when you start the big thing you've accomplished so much already then now you can tackle a bit kicking that's madam John mojo baby get that momentum go you sound really positive about saving money, and it is a great thing especially when you do have money in the bank how much money should people have saved away in case you know you lose a job or something in question good question you definitely have to have an...

People Also Ask about

What is VALIC retirement?

Are VALIC annuities safe?

What does VALIC offer?

How do I withdraw money from VALIC?

What is a cash distribution request?

What kind of retirement plan is VALIC?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in VALIC VL 8725?

How do I edit VALIC VL 8725 straight from my smartphone?

How do I complete VALIC VL 8725 on an iOS device?

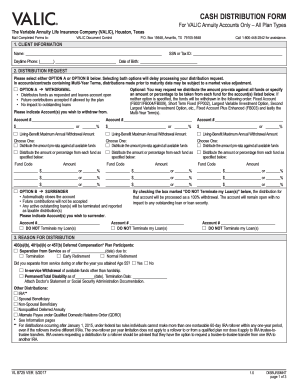

What is VALIC VL 8725?

Who is required to file VALIC VL 8725?

How to fill out VALIC VL 8725?

What is the purpose of VALIC VL 8725?

What information must be reported on VALIC VL 8725?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.