Get the free How to make TRS GST claims when travelling from Australia

Show details

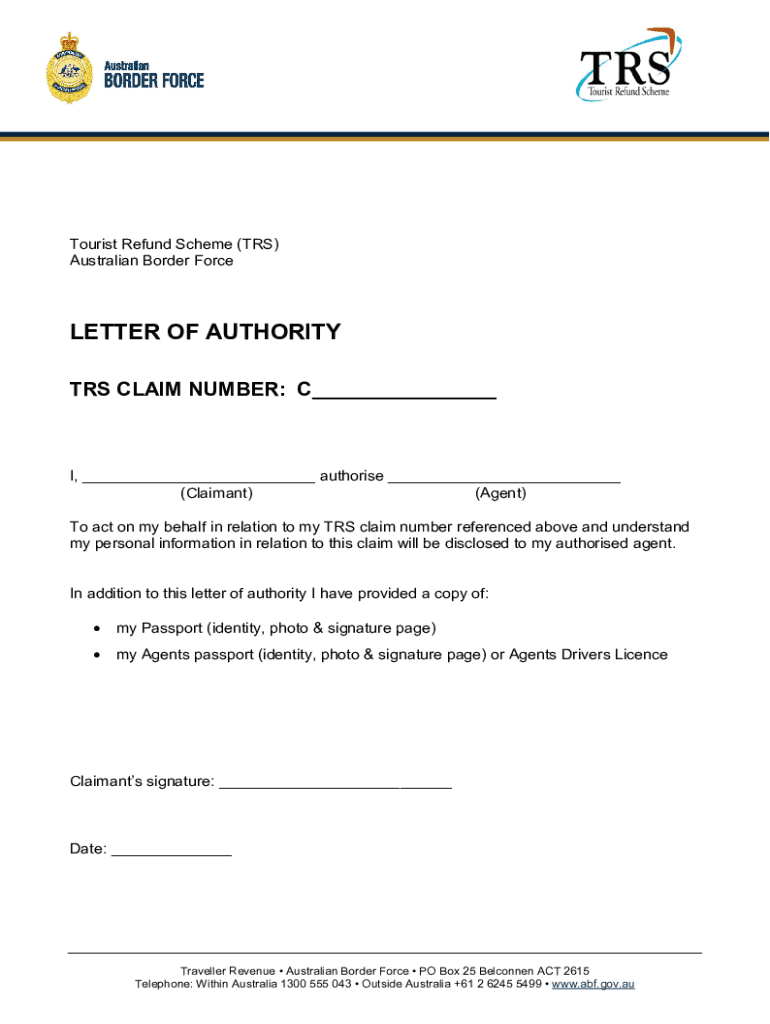

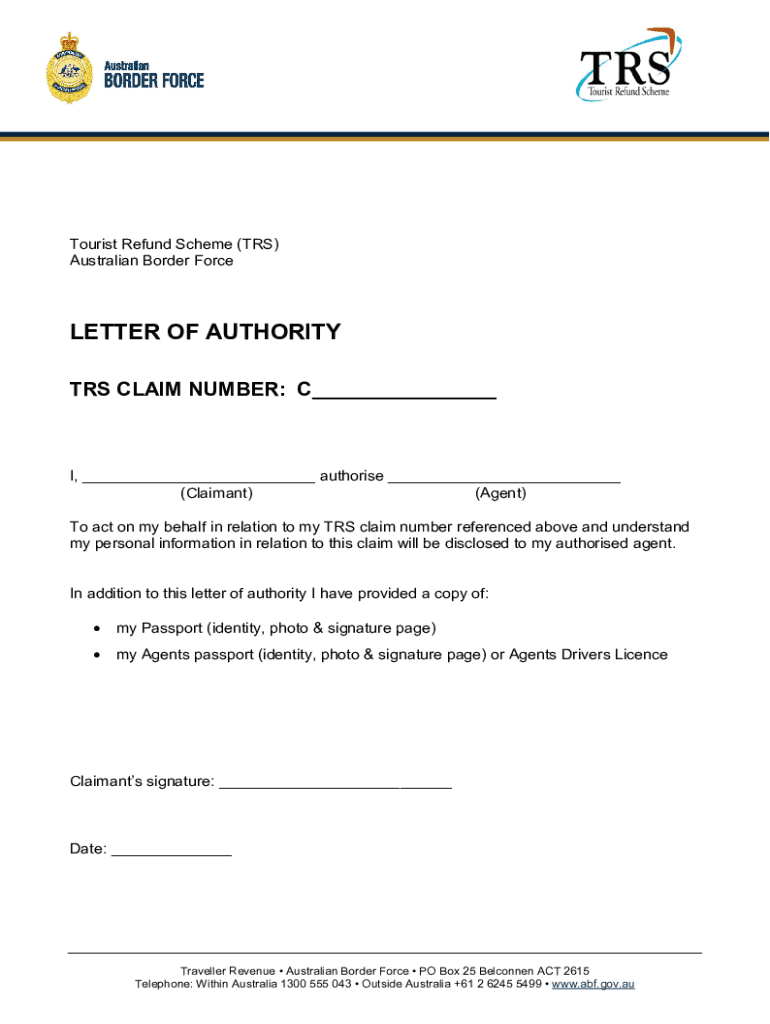

Tourist Refund Scheme (TRS)

Australian Border ForceLETTER OF AUTHORITY

TRS CLAIM NUMBER: C___I, ___ authorize ___

(Claimant)

(Agent)

To act on my behalf in relation to my TRS claim number referenced

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign how to make trs

Edit your how to make trs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how to make trs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing how to make trs online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit how to make trs. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out how to make trs

How to fill out how to make trs

01

Gather the necessary ingredients for making trs, including flour, yeast, salt, water, and any additional flavorings or add-ins you desire.

02

In a large mixing bowl, combine the flour, yeast, and salt.

03

Gradually add water to the flour mixture while stirring with a wooden spoon, until a dough forms.

04

Knead the dough on a floured surface for about 5-10 minutes, or until it becomes smooth and elastic.

05

Place the dough in a greased bowl and cover it with a damp cloth. Let it rise in a warm place for about 1-2 hours, or until it doubles in size.

06

After the dough has risen, punch it down to release any air bubbles. Divide it into smaller portions and shape them into desired trs shapes.

07

Preheat your oven to the specified temperature for baking trs.

08

Transfer the shaped trs onto a baking sheet lined with parchment paper. Let them rest for about 15-20 minutes.

09

Bake the trs in the preheated oven for the recommended time, or until they turn golden brown and sound hollow when tapped on the bottom.

10

Remove the trs from the oven and let them cool on a wire rack before serving.

Who needs how to make trs?

01

Anyone who enjoys baking and wants to try making their own homemade trs.

02

People who want to experiment with different flavors or variations of trs.

03

Individuals who prefer freshly baked bread over store-bought options.

04

Bakers who want to impress their friends and family with their baking skills.

05

Those who find the process of making trs therapeutic and enjoyable.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit how to make trs from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like how to make trs, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I create an electronic signature for signing my how to make trs in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your how to make trs directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit how to make trs on an Android device?

The pdfFiller app for Android allows you to edit PDF files like how to make trs. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is how to make trs?

TRS refers to a Tax Reporting Statement, which provides information on various financial transactions for tax purposes.

Who is required to file how to make trs?

Individuals and entities that engage in specific financial transactions that are subject to reporting requirements must file a TRS.

How to fill out how to make trs?

To fill out a TRS, gather relevant financial information, complete the required fields accurately and provide supporting documentation as necessary.

What is the purpose of how to make trs?

The purpose of a TRS is to ensure transparency and compliance with tax regulations by reporting financial activities.

What information must be reported on how to make trs?

Information such as transaction amounts, dates, parties involved, and applicable tax-related details must be reported on a TRS.

Fill out your how to make trs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How To Make Trs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.