Get the free About Schedule D (Form 1040), Capital Gains and Losses

Show details

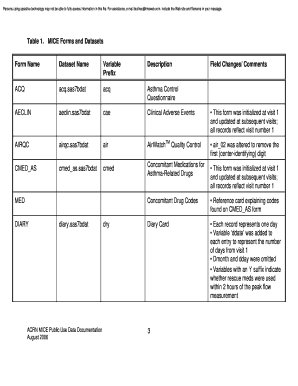

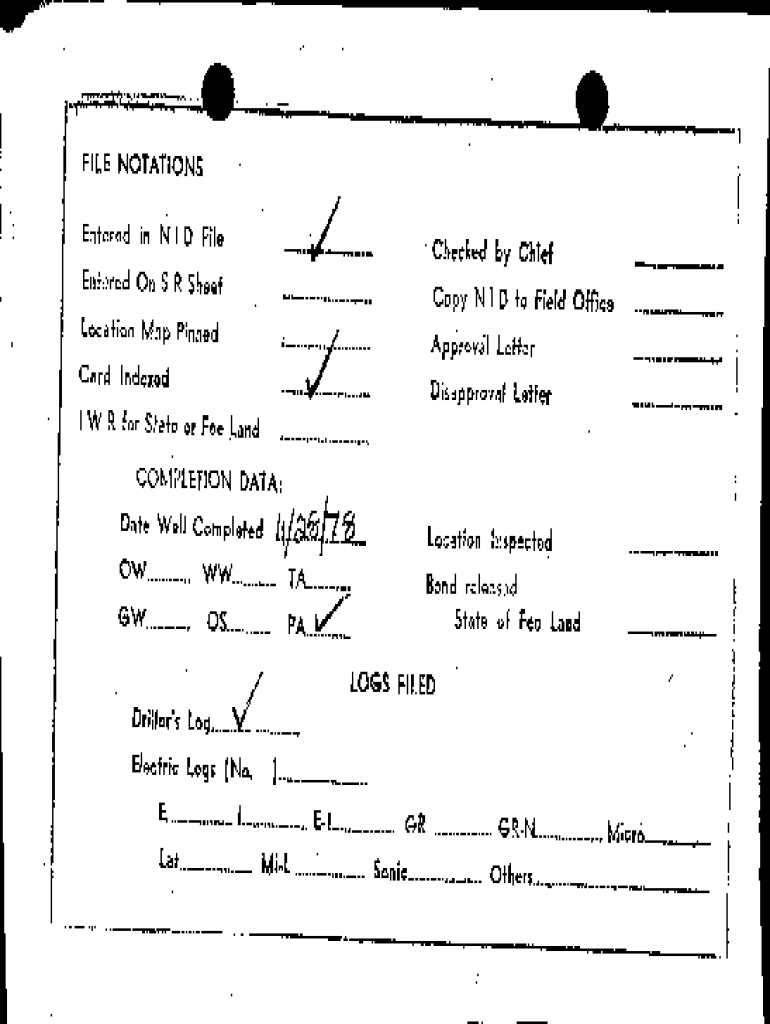

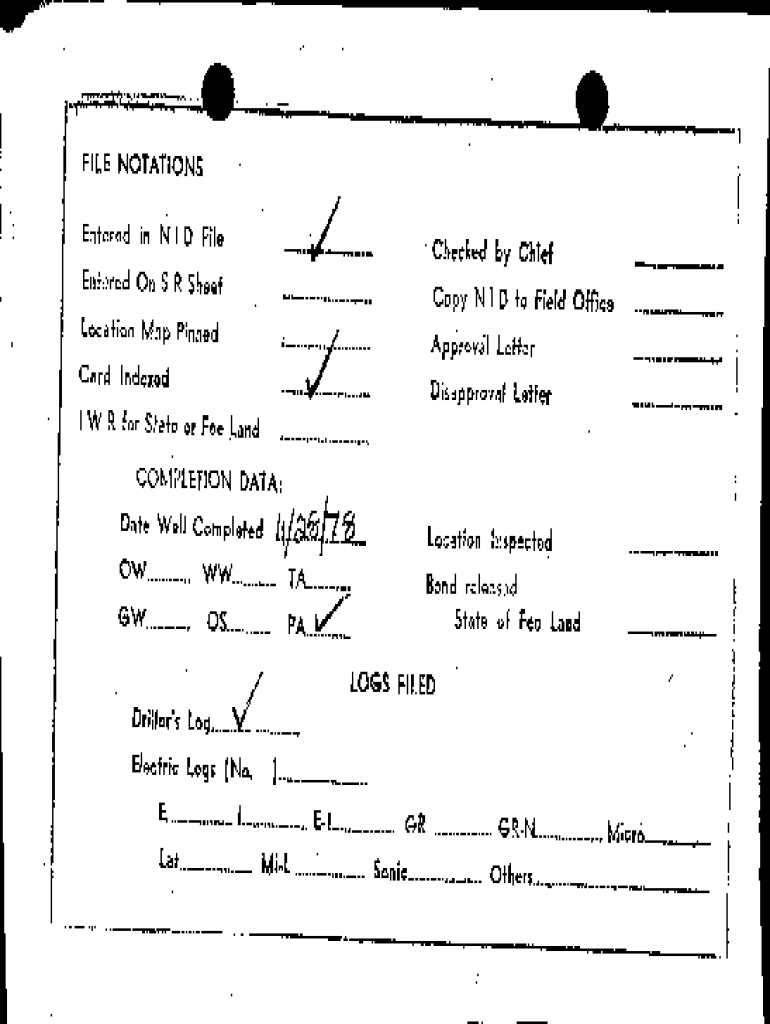

FILE NOTATIONS Entered in N I D File. Entered On SR Spellchecked by Chief...... Copy N I D to Field Office................. Location Map Pinned.......... Approval Letter......... Card IndexedDisapproval

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign about schedule d form

Edit your about schedule d form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your about schedule d form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit about schedule d form online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit about schedule d form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out about schedule d form

How to fill out Schedule D form:

01

Gather necessary information: Before starting to fill out the Schedule D form, make sure you have all the relevant information ready. This includes details about your investments, such as the purchase and sale dates, cost basis, and sale proceeds.

02

Report your capital gains and losses: The main purpose of Schedule D is to report any capital gains or losses from the sale of investments. Begin by completing Part I of the form, where you'll calculate your short-term gains or losses. This includes investments held for one year or less.

03

Fill out Part II: In Part II of Schedule D, you'll report long-term capital gains or losses. These are investments that you have held for more than one year. Make sure to accurately enter the necessary information for each transaction, including the date of purchase, date of sale, and the difference between the sale proceeds and cost basis.

04

Net your gains and losses: Once you have completed both Part I and Part II, you'll need to calculate the net gain or loss. This is done in Part III of the Schedule D form. If you have more gains than losses, you'll have a net capital gain. If you have more losses than gains, you'll have a net capital loss.

05

Complete the tax worksheet: After calculating the net gain or loss, you'll need to fill out the tax worksheet included in the Schedule D instructions. This will help determine the actual amount of tax you owe or the refund you'll receive based on your capital gains or losses.

Who needs to fill out Schedule D form:

01

Individuals who have sold investments: If you have sold investments such as stocks, bonds, mutual funds, or real estate, you will likely need to fill out Schedule D. This form is used to report capital gains and losses from these transactions.

02

Taxpayers with capital gains: Even if you haven't sold any assets, you may still need to fill out Schedule D if you've received capital gains. This could be from receiving a distribution from a mutual fund or the sale of a partnership interest.

03

Individuals who have received capital loss carryovers: If you had capital losses in previous years that exceeded your gains and you carried forward those losses, you will need to fill out Schedule D to report any gains or losses in the current tax year.

Remember that tax laws can be complex, and it is always advisable to consult with a tax professional or refer to the IRS's guidelines to ensure accuracy when filling out Schedule D and other tax forms.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit about schedule d form from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your about schedule d form into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I make changes in about schedule d form?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your about schedule d form to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I sign the about schedule d form electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your about schedule d form in seconds.

What is about schedule d form?

Schedule D form is used to report capital gains and losses from the sale of assets such as stocks, bonds, and real estate.

Who is required to file about schedule d form?

Individuals who have capital gains or losses from the sale of assets are required to file Schedule D form with their tax return.

How to fill out about schedule d form?

To fill out Schedule D form, individuals need to report the details of each asset sold during the year, including the purchase price, sale price, and any capital gains or losses.

What is the purpose of about schedule d form?

The purpose of Schedule D form is to report capital gains and losses to the IRS for tax purposes.

What information must be reported on about schedule d form?

On Schedule D form, individuals must report details of each asset sold, including the purchase price, sale price, and any capital gains or losses.

Fill out your about schedule d form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

About Schedule D Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.