Get the free Development Expense Credit - tax ri

Show details

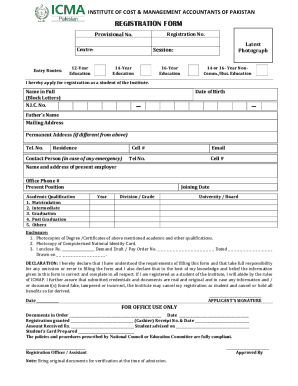

RI-7695E State of Rhode Island and Providence Plantations DEPARTMENT OF REVENUE Division of Taxation Research & Development Expense Credit RIG 44-32-3 2014 NAME OF ELIGIBLE COMPANY ADDRESS CITY STATE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign development expense credit

Edit your development expense credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your development expense credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing development expense credit online

To use our professional PDF editor, follow these steps:

1

Log into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit development expense credit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out development expense credit

How to fill out development expense credit:

01

Gather all necessary documentation: Before starting the process of filling out the development expense credit, make sure you have all the required documents, such as receipts, invoices, and any supporting documentation related to the development expenses incurred.

02

Research the criteria and eligibility requirements: Familiarize yourself with the criteria and eligibility requirements for claiming the development expense credit. This information can usually be found on the official website or guidelines provided by the relevant tax authority.

03

Determine the qualifying expenses: Identify which expenses qualify for the development expense credit. These expenses may include research and development costs, prototype development, software development, and other similar expenditures. Be sure to review the specific guidelines to ensure your expenses meet the qualifying criteria.

04

Complete the appropriate forms: Obtain the necessary forms for claiming the development expense credit. These forms may vary depending on the country or jurisdiction. Fill out the forms accurately and provide all required information. Remember to double-check the forms for any errors or missing information before submitting.

05

Calculate the credit amount: Follow the instructions provided on the forms to calculate the development expense credit amount. This calculation may involve determining the percentage or a fixed amount that can be claimed based on the qualifying expenses.

06

Attach supporting documents: Attach all relevant supporting documents to your application. This may include receipts, invoices, contracts, and any additional documentation required to support your claimed expenses. Ensure that all documents are legible and properly organized.

07

Submit the application: Once you have completed all the necessary forms and attached the supporting documents, submit your application for the development expense credit. Make sure to meet any specified deadlines and follow the submission instructions provided by the tax authority.

Who needs development expense credit?

01

Startups and Small Businesses: Development expense credits are often targeted towards startups and small businesses that engage in research and development activities. These credits can provide financial incentives for companies to invest in innovation and technology advancements.

02

Technology and Software Companies: Companies operating in the technology and software industry frequently incur significant development expenses. These businesses often rely on development expense credits to offset some of the costs associated with research, prototype development, and software creation.

03

Manufacturers and Manufacturers: Manufacturing companies involved in product development, design, and engineering can also benefit from development expense credits. These credits can help offset expenses related to product improvements, process enhancements, and technological innovations.

04

Biotech and Pharmaceutical Companies: Biotechnology and pharmaceutical companies engaged in research and development of new drugs, treatments, and medical devices may be eligible for development expense credits. These credits can support the high costs associated with pioneering medical advancements.

05

Research Organizations and Institutions: Research organizations, universities, and other academic institutions that conduct research activities may also be eligible for development expense credits. These credits can provide financial support for academic research, promoting innovation and advancements in various fields.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is development expense credit?

Development expense credit is a tax credit available to businesses that incur expenses related to research, experimentation, or development of new products or processes.

Who is required to file development expense credit?

Businesses that have incurred eligible expenses related to research, experimentation, or development are required to file for development expense credit.

How to fill out development expense credit?

To fill out development expense credit, businesses must provide detailed information about the eligible expenses incurred during the tax year.

What is the purpose of development expense credit?

The purpose of development expense credit is to incentivize businesses to invest in research, experimentation, and development activities.

What information must be reported on development expense credit?

Businesses must report details of the eligible expenses incurred, including the nature of the expenses and how they relate to research, experimentation, or development.

How can I manage my development expense credit directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your development expense credit and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I send development expense credit for eSignature?

Once you are ready to share your development expense credit, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I edit development expense credit on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing development expense credit.

Fill out your development expense credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Development Expense Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.