Get the free adopting budget, imposing mill levy and appropriating funds

Show details

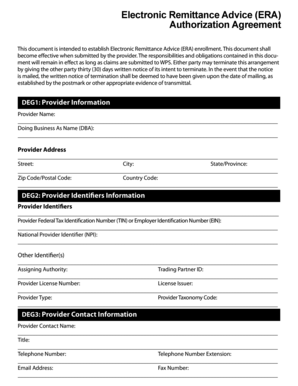

RESOLUTION ADOPTING BUDGET, IMPOSING MILL LEVY AND APPROPRIATING FUNDS (2020)The Board of Directors of Willow Springs Ranch Metropolitan District (the Board), El Paso County, Colorado (the District)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign adopting budget imposing mill

Edit your adopting budget imposing mill form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your adopting budget imposing mill form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing adopting budget imposing mill online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit adopting budget imposing mill. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out adopting budget imposing mill

How to fill out adopting budget imposing mill

01

Start by gathering all the necessary financial information such as the estimated revenue and expenditure for the specified budget period.

02

Determine the millage rate, which is the amount of tax imposed per $1,000 of taxable property value.

03

Calculate the total assessed property value for the jurisdiction by obtaining valuations from the appropriate authority.

04

Multiply the millage rate by the total assessed property value to determine the total revenue to be generated from the millage tax.

05

Take into consideration any exemptions or limitations on the millage rate that may apply.

06

Assess the expected expenses and prioritize them based on their importance and urgency.

07

Allocate the available revenue to different budget categories and departments according to their needs and requirements.

08

Review and revise the proposed budget to ensure it is balanced and meets the financial goals of the jurisdiction.

09

Seek input and approval from relevant stakeholders such as the governing body, community members, or department heads.

10

Finalize the budget by documenting all the details and submit it for implementation and monitoring.

Who needs adopting budget imposing mill?

01

Adopting budget imposing mill is necessary for any jurisdiction, such as a city, county, or municipality, that relies on property taxes as a significant source of revenue.

02

It is particularly important for local government entities responsible for providing essential services and amenities to their residents.

03

By adopting a budget and imposing a millage tax, these jurisdictions can ensure a stable and predictable income stream to fund public infrastructure projects, public safety, education, healthcare, and other community-oriented programs.

04

Additionally, adopting a budget helps ensure transparency and accountability in financial management, allowing citizens to understand how their tax dollars are being utilized.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send adopting budget imposing mill to be eSigned by others?

When you're ready to share your adopting budget imposing mill, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I edit adopting budget imposing mill on an iOS device?

Use the pdfFiller mobile app to create, edit, and share adopting budget imposing mill from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I complete adopting budget imposing mill on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your adopting budget imposing mill. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is adopting budget imposing mill?

Adopting a budget imposing mill refers to the process by which a governing body sets a tax rate (millage rate) to fund the adopted budget for the upcoming fiscal year.

Who is required to file adopting budget imposing mill?

Local government entities, such as municipalities and school districts, are required to file adopting budget imposing mill as part of their budgeting process.

How to fill out adopting budget imposing mill?

To fill out the adopting budget imposing mill, complete the designated form by entering relevant financial information, including proposed mill rates, budget estimates, and any public comment or feedback received during the budget process.

What is the purpose of adopting budget imposing mill?

The purpose of adopting budget imposing mill is to ensure that sufficient revenue is generated through property taxes to fund essential government services and programs within the community.

What information must be reported on adopting budget imposing mill?

Information that must be reported includes the proposed mill rate, estimated tax revenue, budget summary, and any public hearings held regarding the budget.

Fill out your adopting budget imposing mill online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Adopting Budget Imposing Mill is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.