Get the free Planned Gift TypesAdvancement Services

Show details

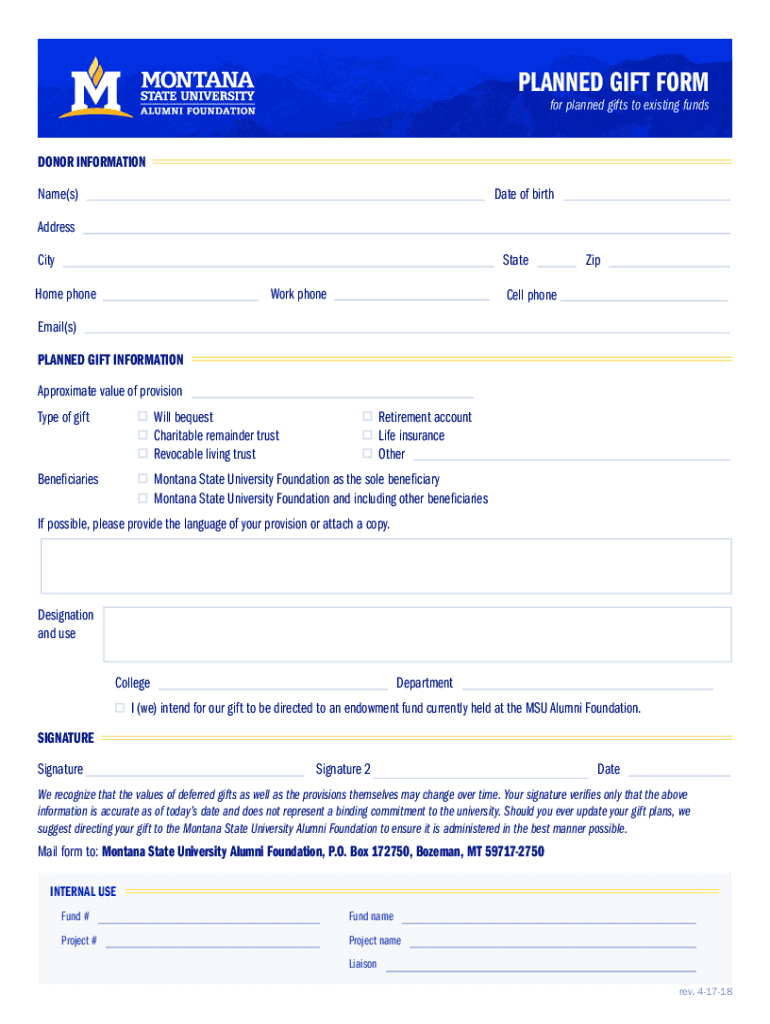

PLANNED GIFT FORM for planned gifts to existing fundsDONOR INFORMATION Name(s)Date of birthAddress CityStateHome phoneWork phoneZipCell phoneEmail(s) PLANNED GIFT INFORMATION Approximate value of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign planned gift typesadvancement services

Edit your planned gift typesadvancement services form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your planned gift typesadvancement services form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit planned gift typesadvancement services online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit planned gift typesadvancement services. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out planned gift typesadvancement services

How to fill out planned gift typesadvancement services

01

To fill out planned gift types, follow these steps:

02

Research and understand the different types of planned gifts available, such as bequests, charitable gift annuities, or life insurance policies.

03

Determine which type of planned gift aligns with your philanthropic goals and financial situation.

04

Consult with a financial advisor or estate planning attorney to ensure you understand the legal and tax implications of your planned gift.

05

Contact the organization or institution that you wish to make the planned gift to and inquire about their specific process and requirements.

06

Gather all necessary documentation, such as beneficiary information or legal forms, to complete the planned gift paperwork.

07

Follow the provided instructions and provide accurate information.

08

Submit the completed paperwork to the organization or institution and retain copies for your records.

09

Review and update your planned gift periodically to ensure it still aligns with your intentions and goals.

Who needs planned gift typesadvancement services?

01

Planned gift typesadvancement services are typically needed by:

02

- Individuals who wish to make a charitable contribution as part of their estate planning.

03

- Donors who want to leave a lasting legacy or support a cause they are passionate about.

04

- Non-profit organizations or institutions that rely on planned gifts to sustain their operations and fund future projects.

05

- Estate planning attorneys or financial advisors who assist clients in creating comprehensive financial plans.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit planned gift typesadvancement services on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing planned gift typesadvancement services, you can start right away.

How do I fill out the planned gift typesadvancement services form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign planned gift typesadvancement services and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete planned gift typesadvancement services on an Android device?

Use the pdfFiller Android app to finish your planned gift typesadvancement services and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is planned gift types advancement services?

Planned gift types advancement services refer to the various methods of donating assets to a nonprofit organization, which may include bequests, charitable gift annuities, and charitable remainder trusts. These services help organizations manage and acknowledge these types of gifts.

Who is required to file planned gift types advancement services?

Organizations that receive planned gifts are typically required to file planned gift types advancement services to document and report the contributions for tax compliance and record-keeping purposes.

How to fill out planned gift types advancement services?

To fill out planned gift types advancement services forms, organizations should provide detailed information about the donor, the type of gift, its value, and any relevant documentation that supports the transaction.

What is the purpose of planned gift types advancement services?

The purpose of planned gift types advancement services is to facilitate the management and reporting of planned gifts, ensuring that they are handled in accordance with legal and tax regulations while maximizing benefits for both the donor and the organization.

What information must be reported on planned gift types advancement services?

Key information that must be reported includes the donor's personal details, the type of planned gift, the date of the gift, its estimated value, and any specific terms or conditions associated with the gift.

Fill out your planned gift typesadvancement services online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Planned Gift Typesadvancement Services is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.