Get the free tuition refunds/lost revenue

Show details

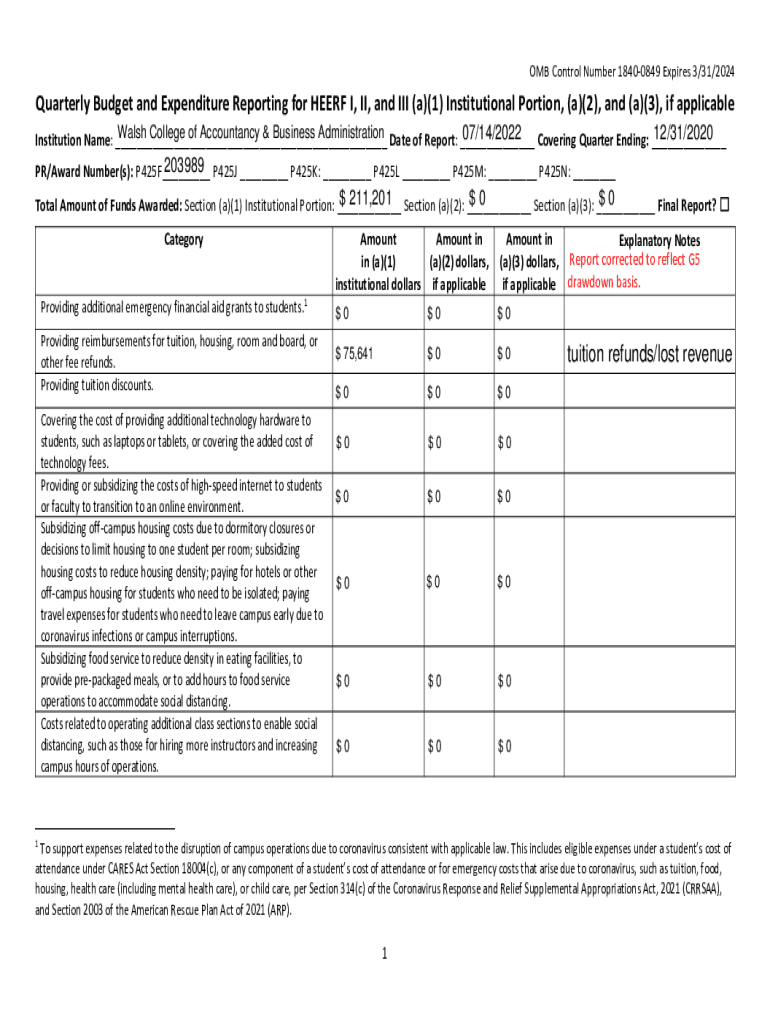

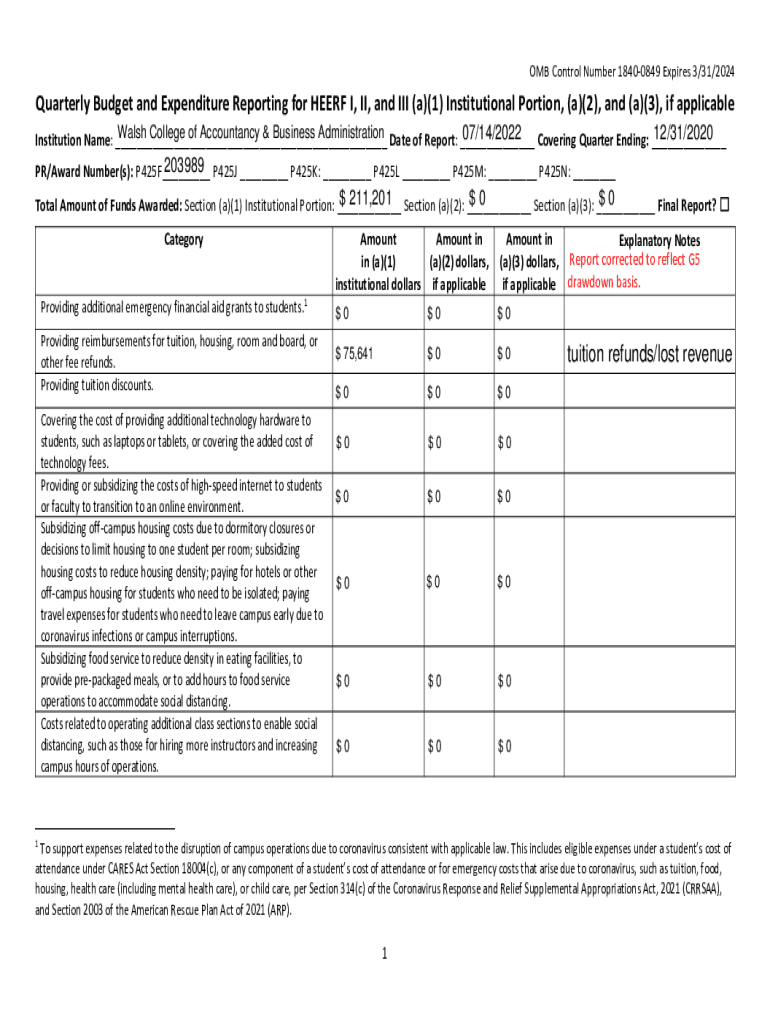

OMBControlNumber18400849Expires3/31/2024QuarterlyBudgetandExpenditureReportingforHEERFI,II,andIII(a)(1)InstitutionalPortion,(a)(2),and(a)(3),ifapplicable Walsh College of Accountancy & Business Administration

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tuition refundslost revenue

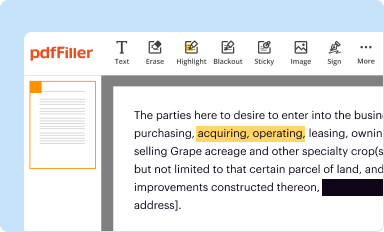

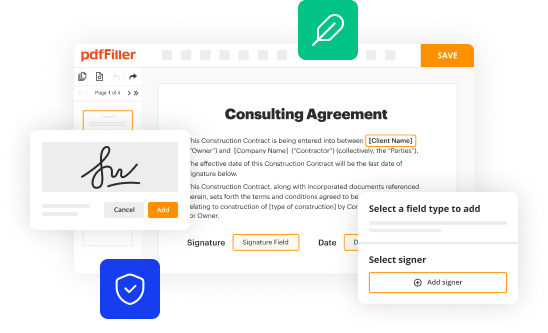

Edit your tuition refundslost revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tuition refundslost revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tuition refundslost revenue online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tuition refundslost revenue. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tuition refundslost revenue

How to fill out tuition refundslost revenue

01

Gather all necessary documentation related to the tuition refundslost revenue, such as receipts, financial records, and any other relevant paperwork.

02

Determine the specific reason for the refund or lost revenue, whether it is due to a cancelation, withdrawal, or other circumstances.

03

Contact the appropriate department or person responsible for handling tuition refundslost revenue, such as the finance or accounting department.

04

Submit a formal request or application for the refund or lost revenue, providing all necessary information and documentation.

05

Follow up on the status of the request, and provide any additional information or clarification if needed.

06

Once approved, ensure that the refund or lost revenue is properly processed and credited back to the appropriate account or individual.

07

Keep records of the refund or lost revenue transaction for future reference or audit purposes.

Who needs tuition refundslost revenue?

01

Students who have paid tuition but are no longer attending the educational institution due to various reasons, such as transfer, drop out, or cancellation of enrollment.

02

Educational institutions or organizations that have experienced a loss of revenue due to factors like cancelation of courses, events, or programs, or decrease in student enrollment.

03

Parents or guardians who have made tuition payments on behalf of their children or dependents but are now eligible for a refund due to unforeseen circumstances or change in enrollment status.

04

Non-profit or for-profit educational institutions that provide refunds to students or clients as part of their consumer protection policies or contractual agreements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tuition refundslost revenue in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your tuition refundslost revenue and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I get tuition refundslost revenue?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific tuition refundslost revenue and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I complete tuition refundslost revenue on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your tuition refundslost revenue, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is tuition refundslost revenue?

Tuition refunds or lost revenue refer to the money that educational institutions must return to students when they withdraw from classes or for other reasons, resulting in a financial loss for the institution.

Who is required to file tuition refundslost revenue?

Educational institutions that experience a loss of tuition revenue due to student withdrawals or refund requests are required to file tuition refundslost revenue.

How to fill out tuition refundslost revenue?

To fill out tuition refunds lost revenue, institutions typically need to provide detailed information about the total tuition collected, the amount refunded, and specific student withdrawal instances, according to the guidelines provided by the relevant authority.

What is the purpose of tuition refundslost revenue?

The purpose of reporting tuition refunds lost revenue is to maintain financial transparency and accountability within educational institutions and to track financial impacts resulting from student withdrawals.

What information must be reported on tuition refundslost revenue?

The report must include total tuition fees collected, total refunds processed, specific cases of student withdrawals, and any applicable financial data related to the lost revenue.

Fill out your tuition refundslost revenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tuition Refundslost Revenue is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.