Get the free Sale of Rental Property but Cost Basis Unknown

Show details

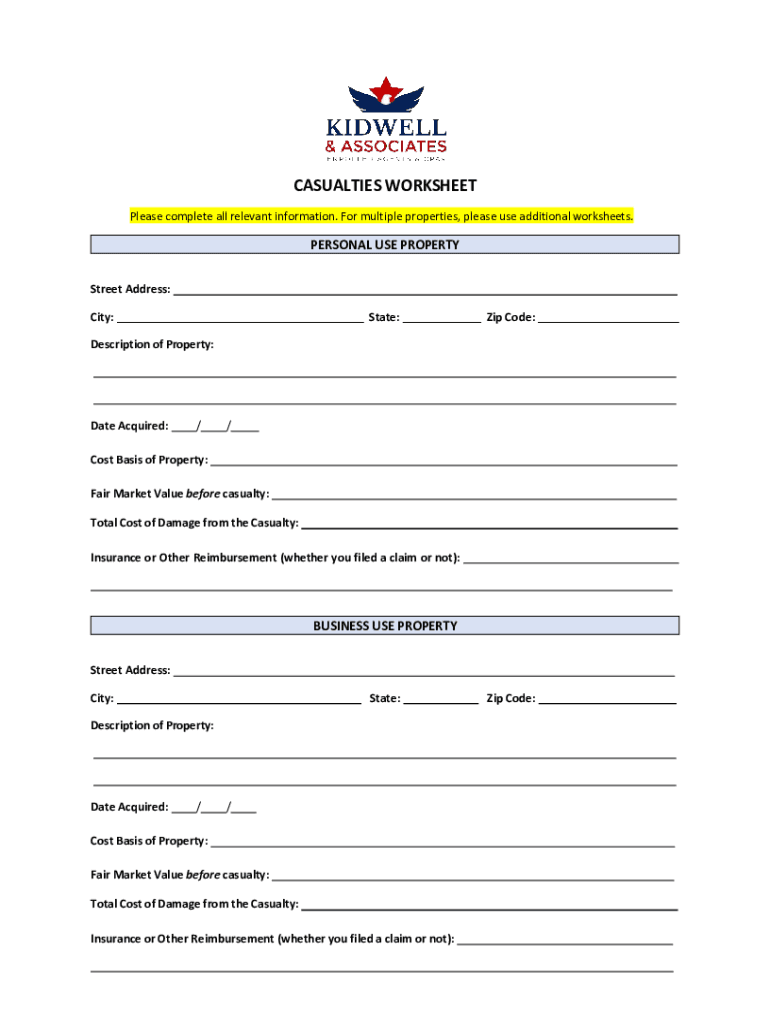

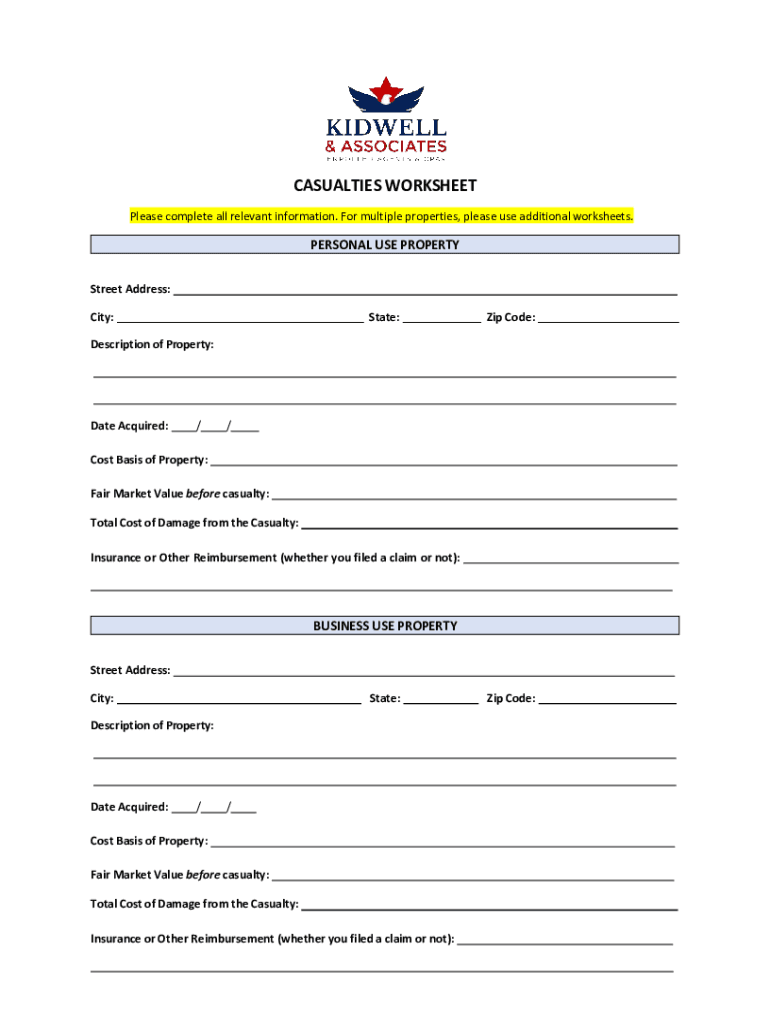

CASUALTIES WORKSHEET Please complete all relevant information. For multiple properties, please use additional worksheets.PERSONAL USE PROPERTY Street Address: City:State:Zip Code:Description of Property:Date

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sale of rental property

Edit your sale of rental property form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sale of rental property form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sale of rental property online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sale of rental property. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sale of rental property

How to fill out sale of rental property

01

Gather all the necessary documents related to the rental property, such as lease agreements, property tax records, and maintenance records.

02

Determine the fair market value of the property by researching similar properties in the area and consulting with a real estate agent or appraiser.

03

Calculate the capital gains or losses you will incur from the sale by subtracting the property's adjusted basis (purchase price plus improvements minus depreciation) from the sale price.

04

Report the sale on your tax return by filling out Form 4797 if you have a capital gain, or Form 8824 if you plan to defer the gain through a 1031 exchange.

05

Consider hiring a real estate attorney or tax professional to assist you with the legal and financial aspects of the sale.

06

Advertise the property for sale through various channels, such as online listings, print ads, and word of mouth.

07

Screen potential buyers and negotiate the terms of the sale, including the purchase price, financing arrangements, and any contingencies.

08

Complete the required paperwork, such as the purchase agreement, disclosure forms, and any additional documents required by your state or municipality.

09

Coordinate with the buyer, their lender, and any other involved parties to ensure a smooth closing process.

10

Transfer ownership of the rental property to the buyer by signing the necessary deed and other transfer documents at the closing.

11

Consider the tax implications of the sale and consult with a tax professional to determine if any potential tax strategies can minimize your tax liability.

12

After the sale, distribute any remaining funds, pay off any outstanding mortgages or liens, and close all related accounts associated with the rental property.

Who needs sale of rental property?

01

Landlords who no longer want to manage rental properties and wish to cash out their investments.

02

Property owners looking to diversify their real estate portfolio by selling a rental property and investing in other properties or assets.

03

Individuals facing financial difficulties or needing to generate cash quickly may need to sell their rental property.

04

Property owners who want to take advantage of the current real estate market conditions to maximize their profits.

05

Estate executors who need to sell rental properties as part of the probate process.

06

Property owners who want to relocate or downsize and no longer require the rental property.

07

Investors who have identified better investment opportunities and want to sell their rental property to fund those investments.

08

Property owners who have experienced negative cash flow or high vacancy rates and want to sell the rental property to avoid further losses.

09

Divorcing couples who need to divide their assets, including rental properties, as part of the divorce settlement.

10

Property owners who want to take advantage of tax benefits, such as 1031 exchanges, by selling their rental property.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit sale of rental property online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your sale of rental property and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I make edits in sale of rental property without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your sale of rental property, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I edit sale of rental property on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share sale of rental property from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is sale of rental property?

The sale of rental property refers to the process of selling a property that has been leased or rented out, which may involve the transfer of ownership and the potential realization of capital gains or losses.

Who is required to file sale of rental property?

Individuals or entities that have sold a rental property during the tax year are required to report the sale on their tax returns, particularly if they have realized a gain or incurred a loss.

How to fill out sale of rental property?

To fill out the sale of rental property, you should report the transaction on Form 4797, which includes details such as the selling price, purchase price, any improvements made, and related costs associated with the sale.

What is the purpose of sale of rental property?

The purpose of reporting the sale of rental property is to accurately determine and declare any capital gains or losses for tax obligations to the Internal Revenue Service.

What information must be reported on sale of rental property?

The information that must be reported includes the property's selling price, purchase price, depreciation taken, expenses related to the sale, and any capital improvements made to the property.

Fill out your sale of rental property online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sale Of Rental Property is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.