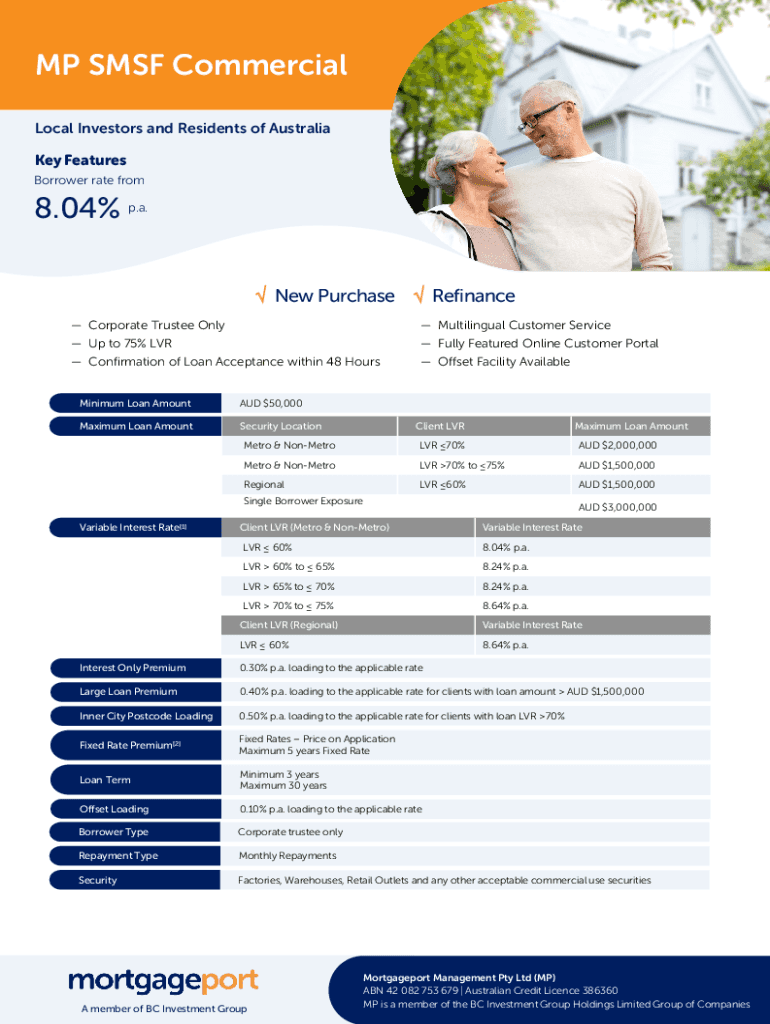

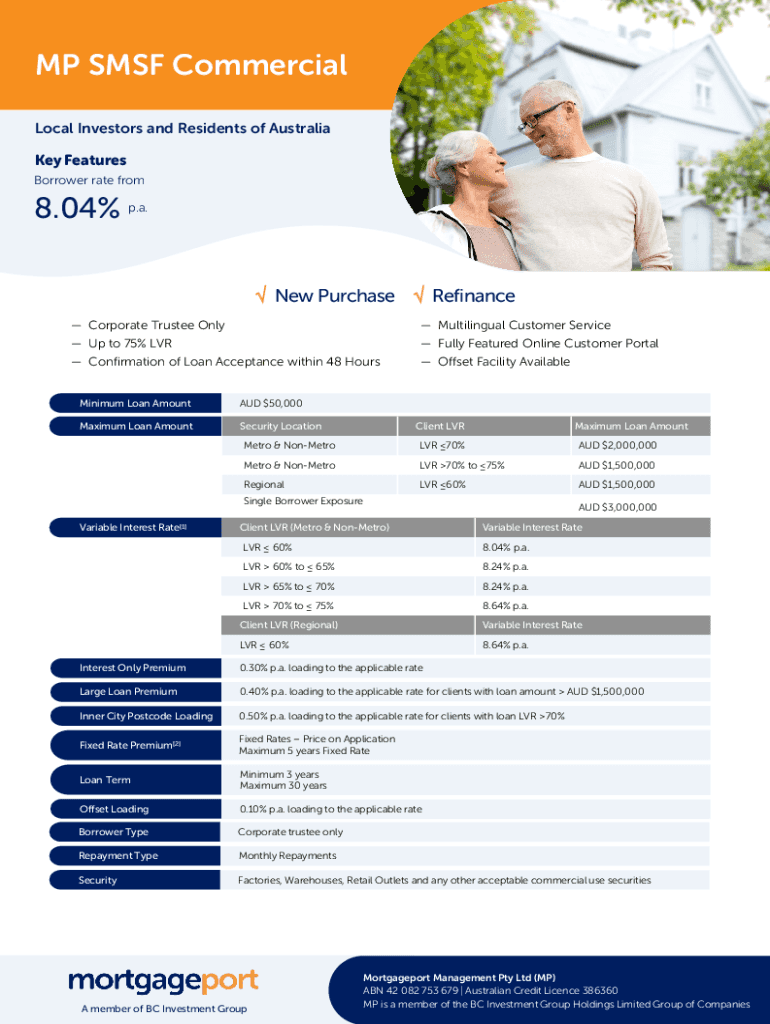

Get the free SMSF Commercial LoansMax 75% LVR And Low Rates

Show details

MP SMSF Commercial Local Investors and Residents of Australia Key Features Borrower rate from8.04% p.a. New Purchase Refinance Corporate Trustee Only Multilingual Customer Service Up to 75% LVR Fully

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign smsf commercial loansmax 75

Edit your smsf commercial loansmax 75 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your smsf commercial loansmax 75 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit smsf commercial loansmax 75 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit smsf commercial loansmax 75. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out smsf commercial loansmax 75

How to fill out smsf commercial loansmax 75

01

To fill out smsf commercial loansmax 75, follow these steps:

02

Gather all the necessary documents such as financial statements, bank statements, tax returns, and loan application forms.

03

Review the loan requirements and eligibility criteria to ensure that you meet all the necessary qualifications.

04

Complete the loan application form accurately, providing all the required information such as personal details, financial information, and loan purpose.

05

Attach all the necessary supporting documents with your application form.

06

Submit your completed application form and supporting documents to the designated loan provider, either through online submission or in-person at their office.

07

Wait for the loan provider to process your application and conduct necessary verifications.

08

Cooperate with the loan provider if any additional information or documentation is required during the verification process.

09

Once your loan application is approved, carefully review the loan terms and conditions, including the interest rate, repayment schedule, and any associated fees.

10

Sign the loan agreement, acknowledging your acceptance of the terms and conditions.

11

Follow the loan repayment schedule and ensure timely payments to avoid any penalties or defaults.

Who needs smsf commercial loansmax 75?

01

Smsf commercial loansmax 75 are typically needed by individuals or businesses who are looking to finance commercial properties through their self-managed superannuation fund (SMSF).

02

This type of loan is specifically designed for SMSF trustees who want to invest in commercial real estate properties within the limit of 75% of the property value.

03

Smsf commercial loansmax 75 are suitable for those who want to diversify their investment portfolio and take advantage of potential rental income and capital appreciation from commercial properties.

04

It is important to consult with a financial advisor or mortgage broker who specializes in SMSF loans to assess your eligibility and determine if this type of loan suits your investment goals and financial circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete smsf commercial loansmax 75 online?

Completing and signing smsf commercial loansmax 75 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an eSignature for the smsf commercial loansmax 75 in Gmail?

Create your eSignature using pdfFiller and then eSign your smsf commercial loansmax 75 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out the smsf commercial loansmax 75 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign smsf commercial loansmax 75 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is smsf commercial loansmax 75?

SMSF Commercial Loans Max 75 refers to a type of lending service that allows Self-Managed Super Funds (SMSFs) to borrow up to 75% of the value of a commercial property to fund the purchase or investment in that property.

Who is required to file smsf commercial loansmax 75?

Trustees of Self-Managed Super Funds (SMSFs) who have taken out a commercial loan that involves borrowing up to 75% of the property's value are required to file SMSF Commercial Loans Max 75.

How to fill out smsf commercial loansmax 75?

To fill out SMSF Commercial Loans Max 75, trustees must provide detailed information about the SMSF, the loan, the commercial property being purchased, and any other required financial documentation as specified by the lender or regulatory authority.

What is the purpose of smsf commercial loansmax 75?

The purpose of SMSF Commercial Loans Max 75 is to enable SMSFs to leverage their investment capacity to acquire commercial properties, therefore, enhancing their investment portfolio and potentially increasing retirement savings.

What information must be reported on smsf commercial loansmax 75?

The information that must be reported includes the details of the SMSF, loan amount, property details, valuation of the property, and compliance with superannuation laws.

Fill out your smsf commercial loansmax 75 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Smsf Commercial Loansmax 75 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.