Get the free RAPORT DE CONSULTANTA FISCALA

Show details

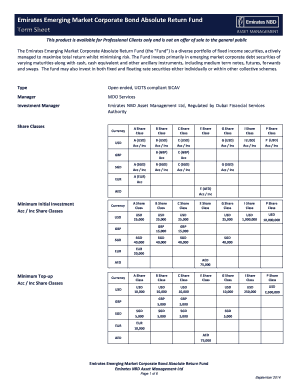

RAPORT DE CONSULTANTA FISCALA ___ELABORAT DE: GHEORGHE STRESNA LAURENTIU STANCIUWWW.ACCOUNTINGLEADER.RO CONSULTANTA@ACCOUNTINGLEADER.RO___De la: Accounting Leader SRL In attn: ............... Email:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign raport de consultanta fiscala

Edit your raport de consultanta fiscala form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your raport de consultanta fiscala form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing raport de consultanta fiscala online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit raport de consultanta fiscala. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out raport de consultanta fiscala

How to fill out raport de consultanta fiscala

01

To fill out a raport de consultanta fiscala, follow these steps:

02

Start by gathering all the necessary information and documents related to the fiscal situation you are consulting on.

03

Begin by providing the basic details of the client or business for whom the report is being prepared. This includes their name, address, contact information, and tax identification number.

04

Clearly state the purpose and scope of the fiscal consultancy report.

05

Analyze the current fiscal situation and identify any issues or areas of concern.

06

Provide a detailed overview of the relevant tax laws and regulations applicable to the case.

07

Present your findings, recommendations, and proposed solutions for resolving any identified issues.

08

Include supporting documentation and calculations to substantiate your conclusions and recommendations.

09

Conclude the report by summarizing the key points and highlighting any additional suggestions or considerations.

10

Double-check the report for accuracy and clarity before finalizing it.

11

Sign and date the completed raport de consultanta fiscala, and make sure it is properly filed and delivered to the client or appropriate authorities as needed.

Who needs raport de consultanta fiscala?

01

A raport de consultanta fiscala is typically required by individuals, businesses, or organizations facing complex or challenging fiscal situations. This may include:

02

- Entrepreneurs or business owners who want to ensure compliance with tax laws and minimize risks.

03

- Companies undergoing tax audits or investigations by tax authorities.

04

- Individuals or businesses planning major financial transactions or investments.

05

- Organizations seeking expert advice on tax planning and optimization strategies.

06

- Professionals or consultants providing fiscal guidance or representing clients in tax-related matters.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit raport de consultanta fiscala on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing raport de consultanta fiscala, you need to install and log in to the app.

How do I fill out the raport de consultanta fiscala form on my smartphone?

Use the pdfFiller mobile app to fill out and sign raport de consultanta fiscala. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit raport de consultanta fiscala on an iOS device?

Use the pdfFiller mobile app to create, edit, and share raport de consultanta fiscala from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is raport de consultanta fiscala?

Raport de consultanta fiscala is a financial consulting report that provides an analysis of an individual's or entity's tax situation and offers recommendations for compliance and optimization of tax liabilities.

Who is required to file raport de consultanta fiscala?

Entities and individuals engaging in specific investment activities, high-net-worth individuals, or those with complex financial situations may be required to file raport de consultanta fiscala, particularly when seeking professional tax advice.

How to fill out raport de consultanta fiscala?

To fill out raport de consultanta fiscala, one must gather all relevant financial documentation, provide detailed information about income, expenses, and assets, and include any specific advice or strategies recommended by the tax consultant.

What is the purpose of raport de consultanta fiscala?

The purpose of raport de consultanta fiscala is to provide a comprehensive assessment of tax obligations, enhance compliance with tax laws, and identify potential savings and planning opportunities.

What information must be reported on raport de consultanta fiscala?

The report must include personal or corporate financial data, specific details on income sources, deductions, tax credits, and any other pertinent tax-related information that could impact the tax liability.

Fill out your raport de consultanta fiscala online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Raport De Consultanta Fiscala is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.