Get the free Encumbrances - Accounting and Fiscal Services - ripuc ri

Show details

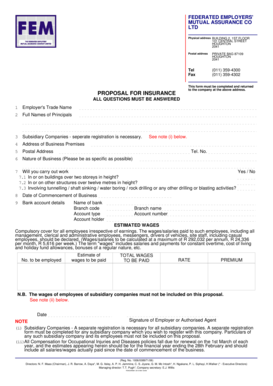

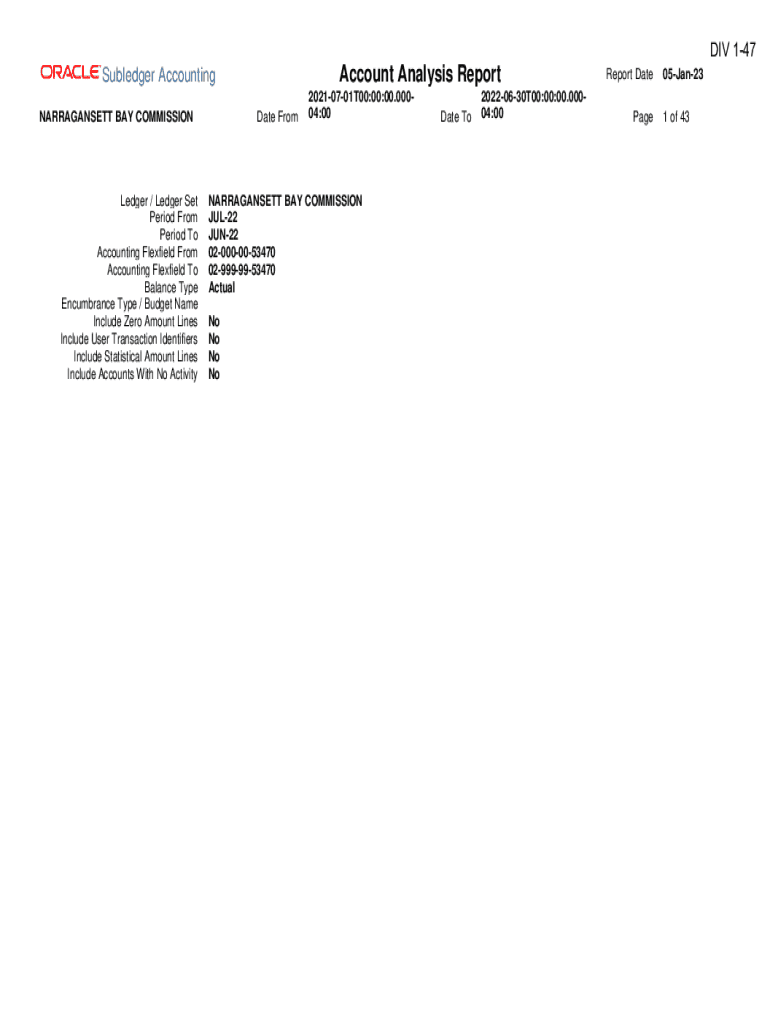

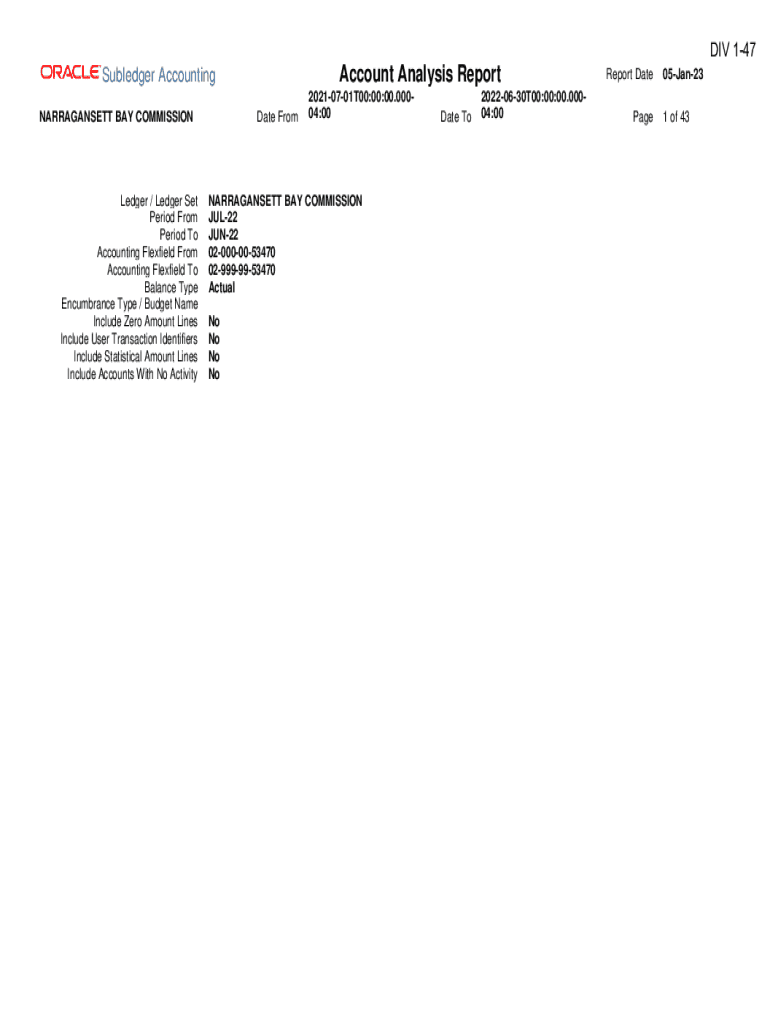

DIV 147Account Analysis ReportSubledger Accounting NARRAGANSETT BAY COMMISSIONLedger / Ledger Set Period From Period To Accounting Flexfield From Accounting Flexfield To Balance Type Encumbrance Type

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign encumbrances - accounting and

Edit your encumbrances - accounting and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your encumbrances - accounting and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing encumbrances - accounting and online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit encumbrances - accounting and. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out encumbrances - accounting and

How to fill out encumbrances - accounting and

01

To fill out encumbrances in accounting, follow these steps:

02

Identify the encumbrances: Determine the financial obligations or commitments that will require future payment.

03

Gather the necessary information: Collect all the relevant documentation, such as purchase orders, contracts, or service agreements, that contain encumbrance information.

04

Classify the encumbrances: Categorize the encumbrances based on their type and purpose (e.g., salaries, supplies, equipment, etc.).

05

Create encumbrance entries: Input the encumbrances into the accounting system, allocating them to the appropriate accounting periods.

06

Update encumbrance records: Regularly review and update the encumbrance records to reflect any changes or adjustments.

07

Monitor encumbrances: Continuously track the encumbrances to ensure accurate financial reporting and budget management.

08

Reconcile encumbrances: Periodically reconcile the encumbrances with actual transactions to identify any discrepancies.

09

Close encumbrances: Once the encumbrances are fulfilled, close them by updating the accounting records and removing the outstanding obligations.

10

Audit encumbrances: Conduct internal or external audits to verify the accuracy and completeness of the encumbrance records.

11

By following these steps, you can effectively fill out encumbrances in accounting.

Who needs encumbrances - accounting and?

01

Encumbrances in accounting are typically needed by:

02

- Organizational entities: Businesses, companies, and organizations of all sizes utilize encumbrances to manage their financial obligations and budgetary commitments.

03

- Government agencies: Federal, state, and local government agencies use encumbrances to ensure compliance with budgetary restrictions and monitor expenditure control.

04

- Non-profit organizations: Non-profit entities rely on encumbrances to track fund allocations, manage grants, and maintain financial transparency.

05

- Financial institutions: Banks and other financial institutions employ encumbrances to assess credit risk, monitor collateral, and manage loan provisions.

06

- Accounting professionals: Accountants, auditors, and financial analysts utilize encumbrances to analyze financial statements, identify financial commitments, and assess budget performance.

07

Overall, encumbrances in accounting are relevant and necessary for various entities and professionals involved in financial management and reporting.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send encumbrances - accounting and for eSignature?

When you're ready to share your encumbrances - accounting and, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I sign the encumbrances - accounting and electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I create an electronic signature for signing my encumbrances - accounting and in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your encumbrances - accounting and directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is encumbrances - accounting and?

Encumbrances in accounting refer to obligations or commitments that an organization has incurred, but for which payment has not yet been made. This concept is used primarily in governmental and non-profit accounting to ensure that budgetary control is maintained.

Who is required to file encumbrances - accounting and?

Entities that are required to file encumbrances include government agencies, non-profits, and organizations that need to track their budget constraints and commitments. Typically, these organizations must follow specific accounting guidelines that mandate the tracking of encumbrances.

How to fill out encumbrances - accounting and?

To fill out encumbrances in accounting, organizations should record details such as the amount of the commitment, the date it was incurred, the purpose of the encumbrance, and the relevant budget category. This information is often recorded in an encumbrance journal or ledger.

What is the purpose of encumbrances - accounting and?

The purpose of encumbrances in accounting is to prevent overspending by tracking funds that have been allocated for specific purposes but not yet spent. This helps organizations manage their budgets effectively and ensures that financial resources are used appropriately.

What information must be reported on encumbrances - accounting and?

Information that must be reported on encumbrances includes the amount of each encumbrance, its status (open or closed), the budget category associated with the encumbrance, and any relevant dates (e.g., date incurred, anticipated payment date).

Fill out your encumbrances - accounting and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Encumbrances - Accounting And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.