Get the free MIDDLE LLC

Show details

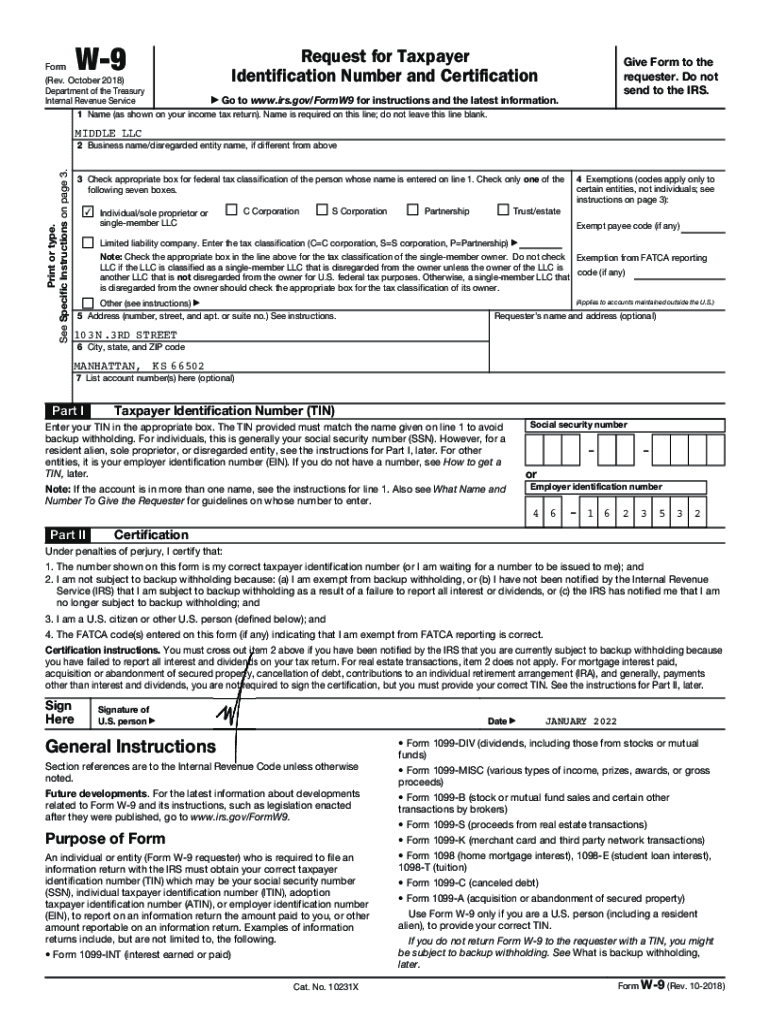

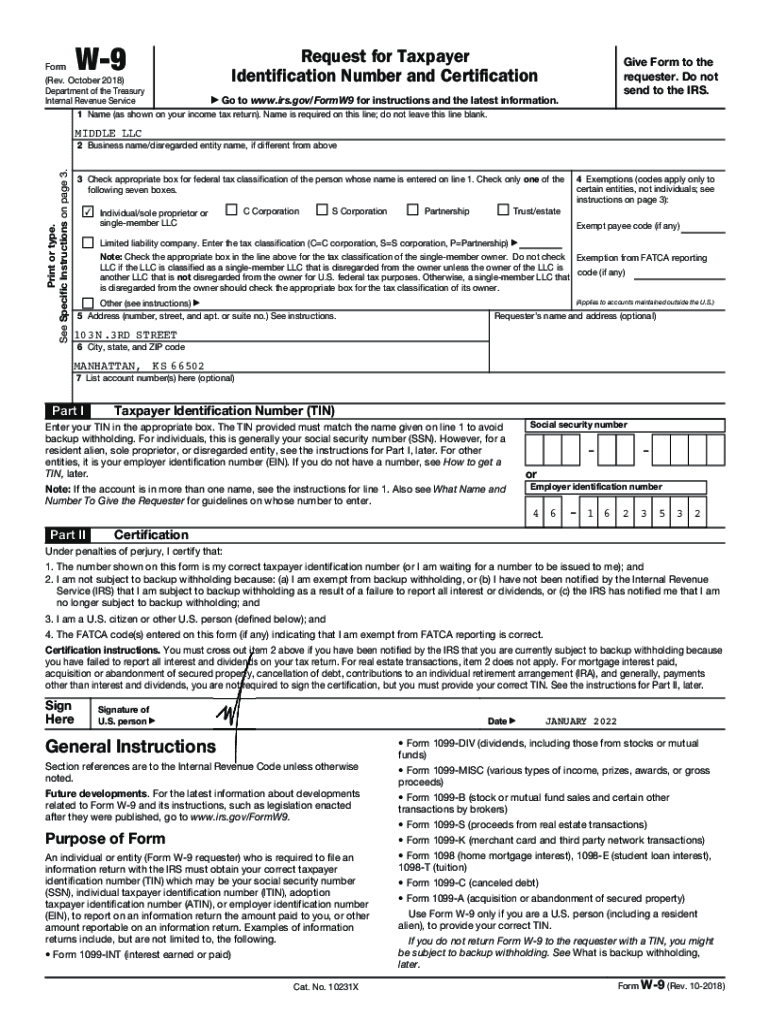

W9Form

(Rev. October 2018)

Department of the Treasury

Internal Revenue ServiceRequest for Taxpayer

Identification Number and Certification

give Form to the

requester. Do not

send to the IRS. Go to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign middle llc

Edit your middle llc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your middle llc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit middle llc online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit middle llc. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out middle llc

How to fill out middle llc

01

To fill out a Middle LLC form, follow the steps below:

1. Start by entering the name of your LLC. Make sure the name you choose is unique and complies with your state's naming requirements.

02

Provide the address of your LLC's principal place of business. This can be your office address or a registered agent's address.

03

Indicate the purpose of your LLC. Are you starting a consulting firm, a retail business, or something else? Clearly state the activities your LLC will be engaged in.

04

Determine the management structure of your LLC. Will it be member-managed or manager-managed? If member-managed, the owners will handle day-to-day operations. If manager-managed, you'll need to appoint a manager to oversee the LLC's affairs.

05

Specify the duration of your LLC. Most LLCs are formed with a perpetual duration, but you may choose a specific end date if desired.

06

Outline the powers and limitations of your LLC. This section defines what your LLC can and cannot do.

07

Enter the names and addresses of your LLC's members. If your LLC has multiple members, include each member's information.

08

State the amount of capital each member has contributed to the LLC. This helps determine each member's ownership percentage.

09

Determine the taxation method for your LLC. By default, LLCs are pass-through entities, meaning profits and losses are reported on the members' personal tax returns. However, you can elect for your LLC to be taxed as a corporation if it better suits your needs.

10

Sign and date the Middle LLC form. Depending on your state's requirements, you may need to have it notarized or filed with a government agency.

Who needs middle llc?

01

Middle LLC is suitable for individuals or businesses who want to establish a legal entity that provides limited liability protection. This type of structure is commonly chosen by small businesses, startups, freelancers, consultants, and professionals such as doctors or lawyers. Middle LLC offers liability protection for its members' personal assets and allows for flexible management and taxation options. It also provides a more formal and professional image compared to a sole proprietorship or partnership.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find middle llc?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific middle llc and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an electronic signature for signing my middle llc in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your middle llc and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I edit middle llc straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing middle llc.

What is middle llc?

Middle LLC refers to a specific type of Limited Liability Company that operates in the middle market segment, often characterized by moderate revenue and employee size, but with unique structure and legal obligations.

Who is required to file middle llc?

Entities operating as Middle LLCs must file, including businesses that fall within the specified revenue and employee size range as defined by state law.

How to fill out middle llc?

To fill out Middle LLC, you must complete the required state forms, providing pertinent business details such as name, address, ownership structure, and financial information.

What is the purpose of middle llc?

The purpose of Middle LLC is to provide limited liability protection for business owners while allowing for flexibility in management and tax treatment.

What information must be reported on middle llc?

Information required includes business name, principal address, member/manager details, financial statements, and compliance with state regulations.

Fill out your middle llc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Middle Llc is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.