Get the free Penalty Relief due to First Time Abate or Other ...

Show details

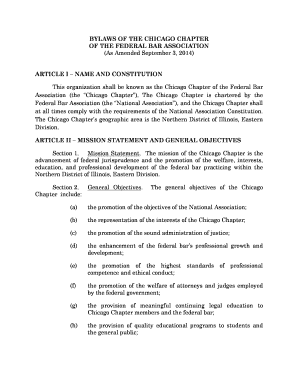

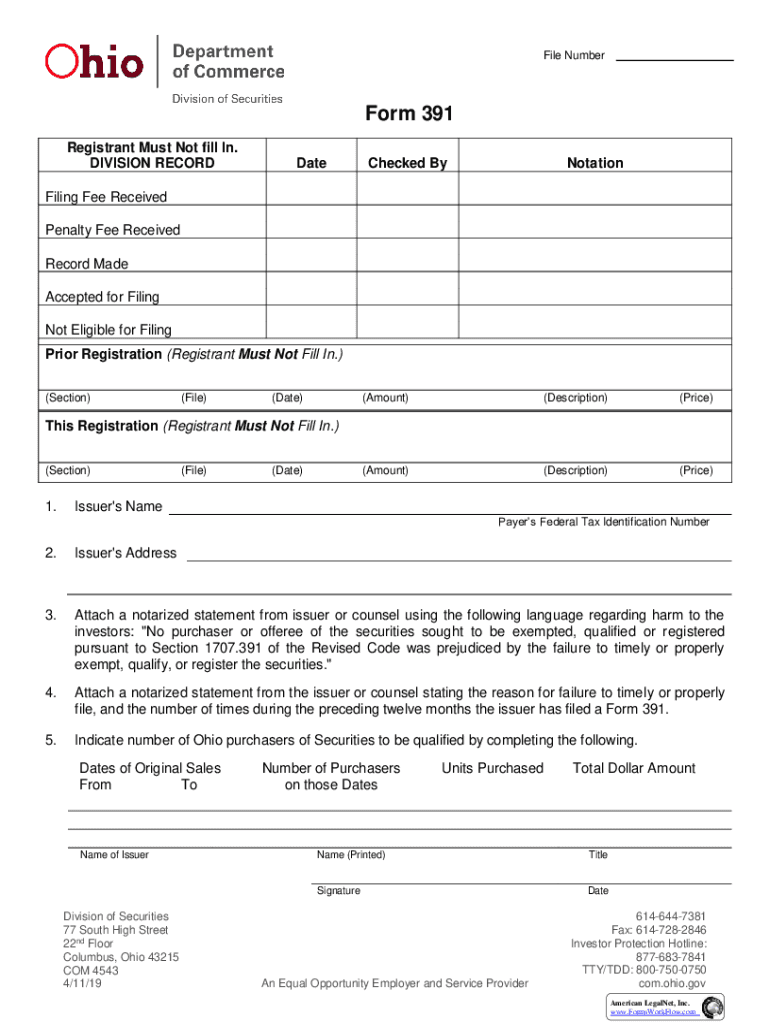

File NumberForm 391 Registrant Must Not fill In. DIVISION RECORDDateChecked ByNotationFiling Fee Received Penalty Fee Received Record Made Accepted for Filing Not Eligible for Filing Prior Registration

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign penalty relief due to

Edit your penalty relief due to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your penalty relief due to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing penalty relief due to online

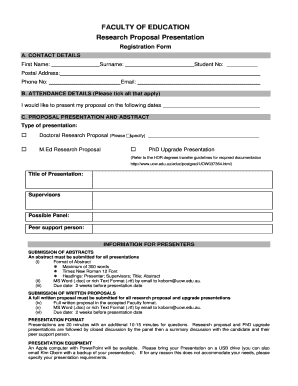

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit penalty relief due to. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out penalty relief due to

How to fill out penalty relief due to

01

To fill out penalty relief due to, follow these steps:

1. Obtain Form 843, Claim for Refund and Request for Abatement, from the IRS website or local IRS office.

02

Fill out your personal information, including name, address, and Social Security number, in the top section of the form.

03

Indicate the tax period and type of tax in question. For example, if you are requesting penalty relief for late payment of income taxes for the tax year 2020, indicate 'Income Tax' and '2020' in the appropriate sections.

04

Provide a detailed explanation of the reason for your penalty relief request. This could include circumstances beyond your control that caused the delay or non-compliance, such as a natural disaster, serious illness, or unavoidable absence.

05

Attach any supporting documentation to substantiate your claim. This may include medical records, accident reports, or other evidence that supports your explanation.

06

Calculate the total penalty amount you are requesting relief for and indicate it on the form. This should be the specific dollar amount of penalties you are seeking abatement for.

07

Sign and date the form.

08

Mail the completed Form 843 and any supporting documentation to the appropriate IRS address as provided in the form's instructions.

09

Keep a copy of the form and supporting documentation for your records.

10

Wait for a response from the IRS. It may take some time for them to review and process your request. If approved, you may receive a refund of the penalties you requested relief for.

Who needs penalty relief due to?

01

Anyone who has incurred penalties from the IRS may need penalty relief due to. This could include individuals, businesses, or organizations who have failed to comply with tax filing or payment requirements. Common situations where penalty relief may be sought include late filing or late payment of taxes, failure to deposit payroll taxes, or underpayment of estimated taxes. It is important to note that penalty relief is not automatically granted and each case is evaluated on its merits. It is advisable to consult with a tax professional or refer to IRS guidelines to determine eligibility and how to proceed with requesting penalty relief due to.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit penalty relief due to in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing penalty relief due to and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How can I edit penalty relief due to on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing penalty relief due to, you can start right away.

How do I edit penalty relief due to on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as penalty relief due to. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is penalty relief due to?

Penalty relief is typically due to circumstances that prevent a taxpayer from meeting their tax obligations, such as personal hardship, natural disasters, or miscommunication with the IRS.

Who is required to file penalty relief due to?

Taxpayers who have incurred penalties for failing to file or pay on time are required to file for penalty relief.

How to fill out penalty relief due to?

To fill out penalty relief forms, taxpayers should provide detailed information about their situation, including specific circumstances that led to the penalties, and submit the appropriate IRS forms, such as Form 843.

What is the purpose of penalty relief due to?

The purpose of penalty relief is to provide taxpayers an opportunity to reduce or eliminate penalties when they have genuine reasons for their non-compliance.

What information must be reported on penalty relief due to?

Taxpayers must report details such as their tax identification number, the tax periods associated with the penalties, and a clear explanation of the reasons for seeking relief.

Fill out your penalty relief due to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Penalty Relief Due To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.