Get the free Financial Statements and Requirements for a Commercial ...

Show details

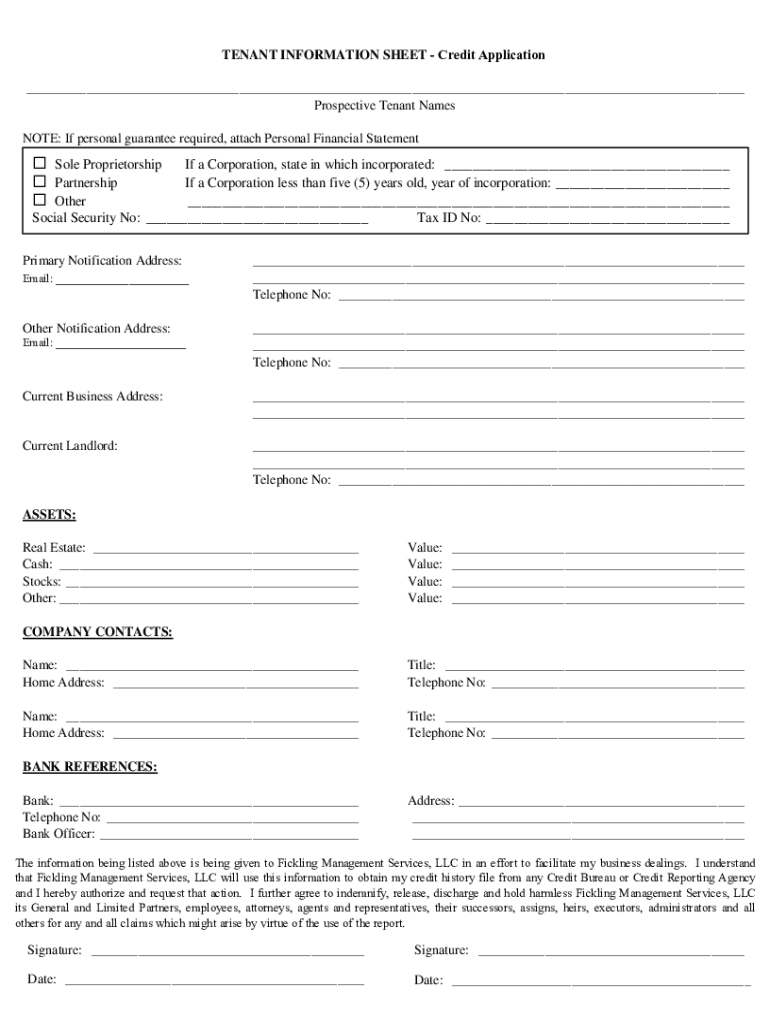

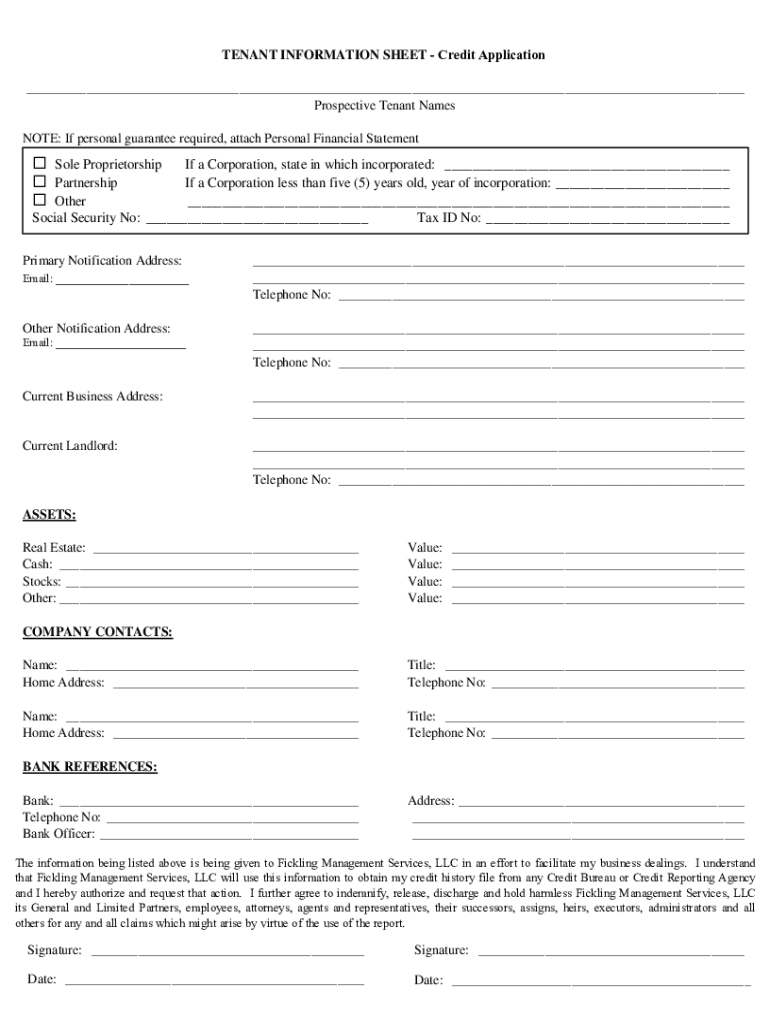

TENANT INFORMATION SHEET Credit Application

___

Prospective Tenant Names

NOTE: If personal guarantee required, attach Personal Financial Statement Sole Proprietorship

Partnership

Other a Corporation,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial statements and requirements

Edit your financial statements and requirements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial statements and requirements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing financial statements and requirements online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit financial statements and requirements. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial statements and requirements

How to fill out financial statements and requirements

01

To fill out financial statements and requirements, follow these steps:

02

Determine which financial statements are required: This can vary depending on the purpose and audience of the financial statements. Common financial statements include balance sheets, income statements, and cash flow statements.

03

Gather the necessary financial data: This includes information about the company's assets, liabilities, revenue, expenses, and cash flows. It may be necessary to review financial records, bank statements, and other relevant documentation.

04

Choose a format for the financial statements: There are various templates and software available to help create professional-looking financial statements. Select a format that best meets your needs and is compliant with any regulatory requirements.

05

Start with the balance sheet: This statement provides a snapshot of the company's financial position at a specific point in time. List all assets, liabilities, and shareholders' equity in a systematic and organized manner.

06

Move on to the income statement: This statement summarizes the company's revenues, expenses, and net income over a specific period. Calculate the gross profit, operating profit, and net profit by subtracting the corresponding expenses from the revenue.

07

Prepare the cash flow statement: This statement shows how cash flows in and out of the company during a specific period. Categorize cash flows into operating, investing, and financing activities.

08

Include any additional required disclosures: Depending on the jurisdiction and industry, there may be specific requirements for additional disclosures in the financial statements. Make sure to research and comply with all applicable regulations.

09

Review and reconcile the financial statements: Double-check all calculations, verify the accuracy of the data, and ensure that the statements balance. Any discrepancies should be investigated and resolved.

10

Understand and interpret the financial statements: Once the financial statements are completed, it is crucial to analyze and interpret the information they provide. This can help identify financial trends, evaluate performance, and make informed decisions.

11

Share and utilize the financial statements: Financial statements are primarily used by stakeholders such as investors, lenders, regulators, and internal management. Make sure to distribute the statements as required and leverage them for decision-making purposes.

Who needs financial statements and requirements?

01

Financial statements and requirements are needed by various individuals and entities, including:

02

- Businesses: Companies of all sizes and types need financial statements to monitor their financial performance, assess profitability, attract investors, secure loans, and comply with legal and regulatory obligations.

03

- Investors: Individuals and institutions investing in companies or securities rely on financial statements to evaluate the financial health and prospects of potential investments.

04

- Lenders: Banks and financial institutions use financial statements to assess the creditworthiness and repayment capacity of borrowers before extending loans or credit facilities.

05

- Regulators: Government agencies and regulatory bodies require financial statements to ensure compliance with accounting standards, tax regulations, and disclosure requirements.

06

- Shareholders: Owners and shareholders of a company use financial statements to gauge the profitability and value of their investments.

07

- Analysts and Advisors: Financial analysts, accountants, and financial advisors utilize financial statements to perform financial modeling, ratio analysis, and provide insights and recommendations.

08

- Potential buyers or acquirers: When purchasing a business or considering a merger or acquisition, potential buyers and acquirers review financial statements to evaluate the target company's performance and financial position.

09

- Managers and Executives: Internal managers and executives rely on financial statements to make strategic decisions, set goals, allocate resources, and assess the overall financial health of the organization.

10

- Auditors: Independent auditors review financial statements to express an opinion on their fairness, accuracy, and compliance with accounting principles.

11

- Researchers and Academicians: Researchers and academicians utilize financial statements to conduct financial research, analyze economic trends, and contribute to the body of knowledge in finance and accounting.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute financial statements and requirements online?

Completing and signing financial statements and requirements online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How can I edit financial statements and requirements on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing financial statements and requirements.

Can I edit financial statements and requirements on an iOS device?

Create, modify, and share financial statements and requirements using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is financial statements and requirements?

Financial statements are formal records that show the financial activity and position of a business, person, or entity. They typically include the balance sheet, income statement, cash flow statement, and statement of changes in equity. Requirements may vary based on jurisdiction and the specific reporting standards being followed, such as GAAP or IFRS.

Who is required to file financial statements and requirements?

Generally, publicly traded companies, private companies meeting certain size thresholds, non-profit organizations, and financial institutions are required to file financial statements. Specific requirements vary by jurisdiction and regulatory body.

How to fill out financial statements and requirements?

To fill out financial statements, an entity must first gather all relevant financial data, organize it according to the required format, perform the necessary calculations, and ensure compliance with the applicable accounting standards. It often involves the use of accounting software or the assistance of financial professionals.

What is the purpose of financial statements and requirements?

The purpose of financial statements is to provide stakeholders, including investors, creditors, and management, with a clear and accurate picture of the financial health and performance of an entity. They assist in decision-making and compliance with regulations.

What information must be reported on financial statements and requirements?

Financial statements must report information such as assets, liabilities, equity, revenues, expenses, cash flows, and comprehensive income. Additional notes may also provide further details on accounting policies and contingencies.

Fill out your financial statements and requirements online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Statements And Requirements is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.