Get the free JTH Tax, Inc. d/b/a Liberty Tax Service

Show details

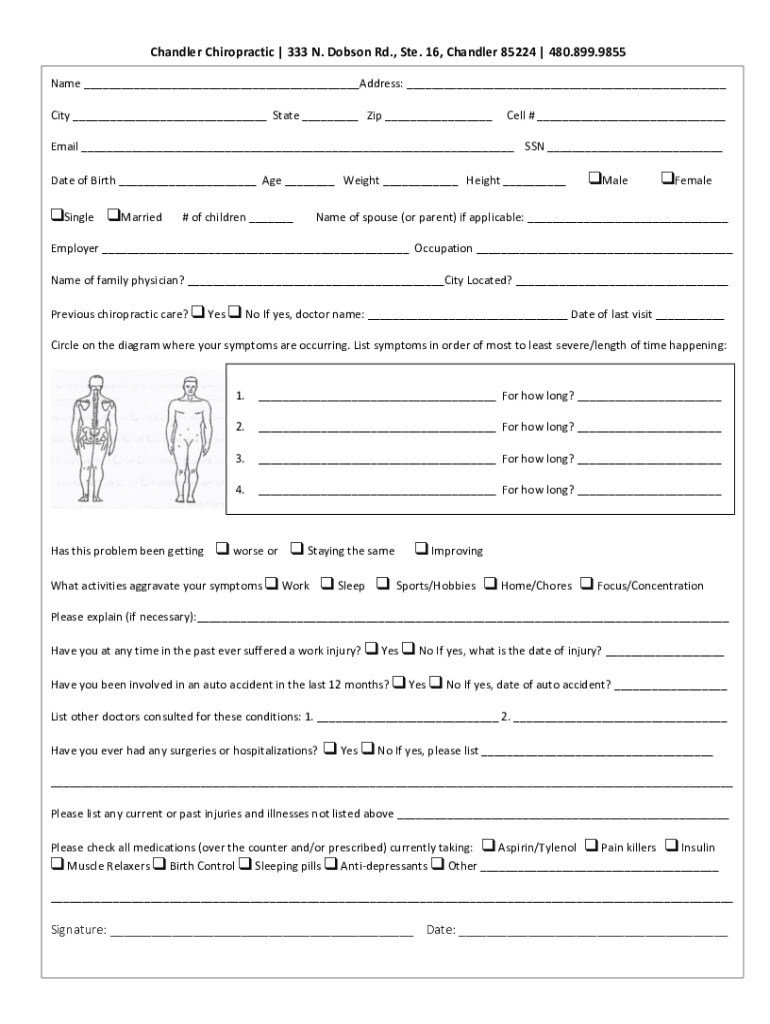

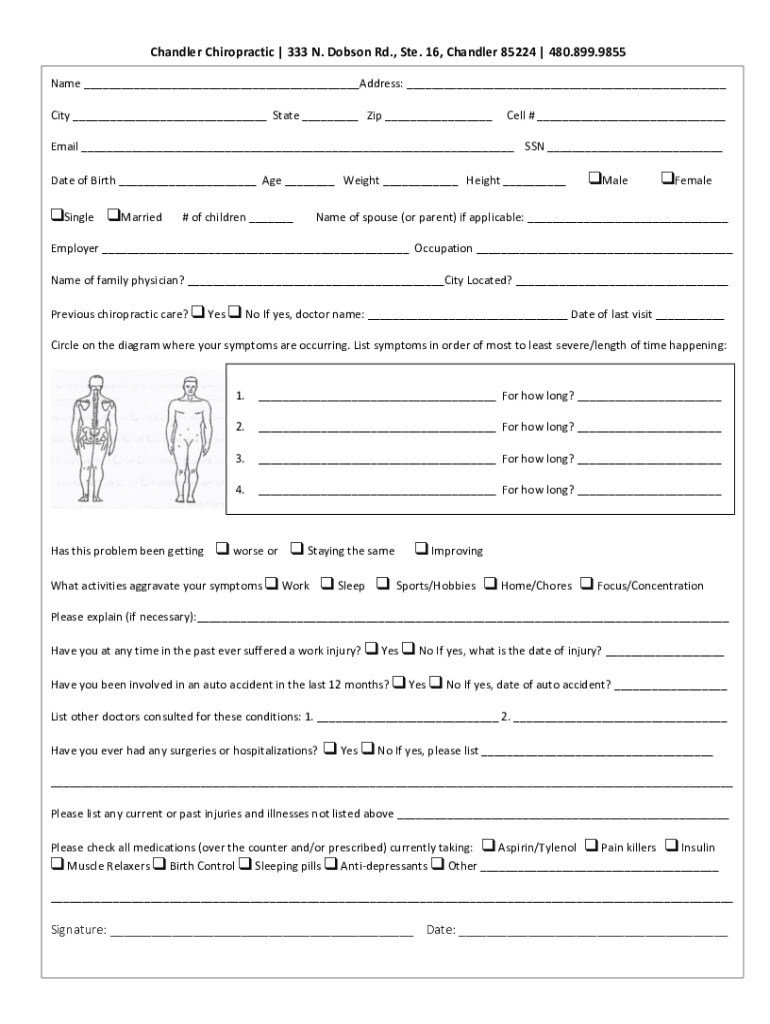

Chandler Chiropractic | 333 N. Dobson Rd., Ste. 16, Chandler 85224 | 480.899.9855Name ___Address: ___City ___State ___Zip ___Cell # ___Email ___SSN ___Date of Birth ___Age ___Weight ___Height ___MaleFemaleSingleMarried# of children ___Name of spouse (or parent) if applicable: ___Employer ___Occupation ___Name of family physician? ___City Located? ___Previous chiropractic care? Yes No If yes, doctor name: ___ Date of last vis.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign jth tax inc dba

Edit your jth tax inc dba form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your jth tax inc dba form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit jth tax inc dba online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit jth tax inc dba. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out jth tax inc dba

How to fill out jth tax inc dba

01

To fill out the jth tax inc dba form, follow these steps:

02

Start by entering the name of the business or individual filing for the DBA (Doing Business As). This is usually the jth tax inc.

03

Provide the address and contact information of the jth tax inc. This includes the physical address, phone number, and email address.

04

Indicate the purpose of filing for a DBA. Specify the reasons why jth tax inc wants to operate under a different name.

05

Verify whether the chosen DBA name is already registered or in use by another entity. Conduct a thorough search to ensure uniqueness.

06

Include any additional information or documents required by the relevant jurisdiction. This may vary depending on the specific requirements of the location.

07

Review the completed jth tax inc DBA form for accuracy and completeness. Make any necessary edits or corrections before submitting.

08

Submit the filled-out form along with any required fees to the appropriate authority. This may be a local government office, county clerk, or another relevant entity.

09

Wait for confirmation and approval of the jth tax inc DBA filing. This may take some time, so be patient.

10

Once approved, ensure all necessary parties are notified of the new DBA name. This includes clients, customers, suppliers, and any other relevant stakeholders.

11

Keep copies of the filed DBA form and any associated documents for future reference or potential audits.

Who needs jth tax inc dba?

01

jth tax inc or any individual or business entity seeking to operate under a different name (DBA) may need to file for a jth tax inc DBA.

02

This could be necessary for a variety of reasons, such as branding purposes, expanding into new markets, separating different lines of business, or complying with local regulations.

03

Other scenarios where someone might need to file for a jth tax inc DBA include changing the legal structure of the business, combining multiple businesses under one name, or rebranding an existing business.

04

Ultimately, anyone who wants to conduct business under a name other than their legal business name may need to file for a jth tax inc DBA.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the jth tax inc dba electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your jth tax inc dba in seconds.

How do I edit jth tax inc dba straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing jth tax inc dba right away.

How do I complete jth tax inc dba on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your jth tax inc dba by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is jth tax inc dba?

jth tax inc dba refers to a tax identification or business filing name used by JTH Tax Inc, which operates under the assumed business name (DBA) for tax purposes.

Who is required to file jth tax inc dba?

Individuals and businesses that operate under a fictitious name or assumed business name, including sole proprietors and partnerships, are required to file jth tax inc dba.

How to fill out jth tax inc dba?

To fill out jth tax inc dba, individuals must provide their personal information, business details, the assumed name they wish to use, and any additional required documentation as specified by state regulations.

What is the purpose of jth tax inc dba?

The purpose of jth tax inc dba is to legally register the business name used by JTH Tax Inc for tax reporting and identification purposes, ensuring compliance with local laws.

What information must be reported on jth tax inc dba?

Information that must be reported on jth tax inc dba includes the business owner's name, business address, assumed name, type of business structure, and any other state-specific information.

Fill out your jth tax inc dba online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Jth Tax Inc Dba is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.