Get the free 3220 N

Show details

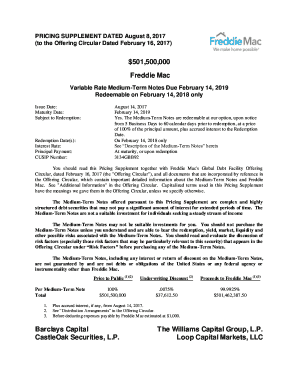

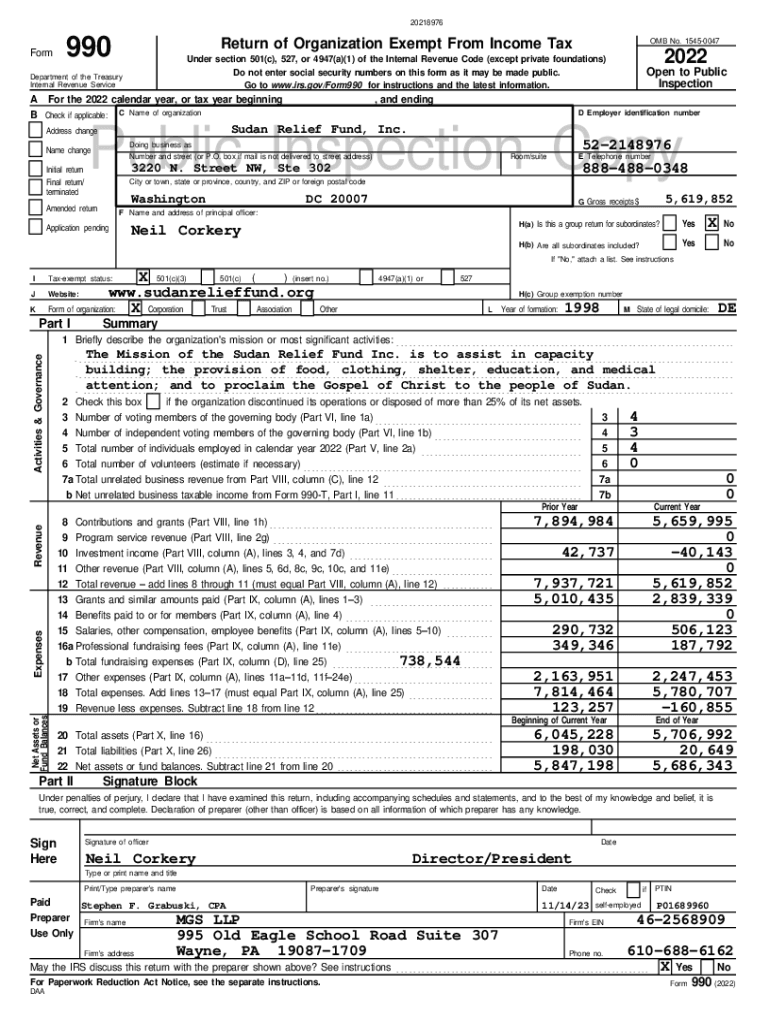

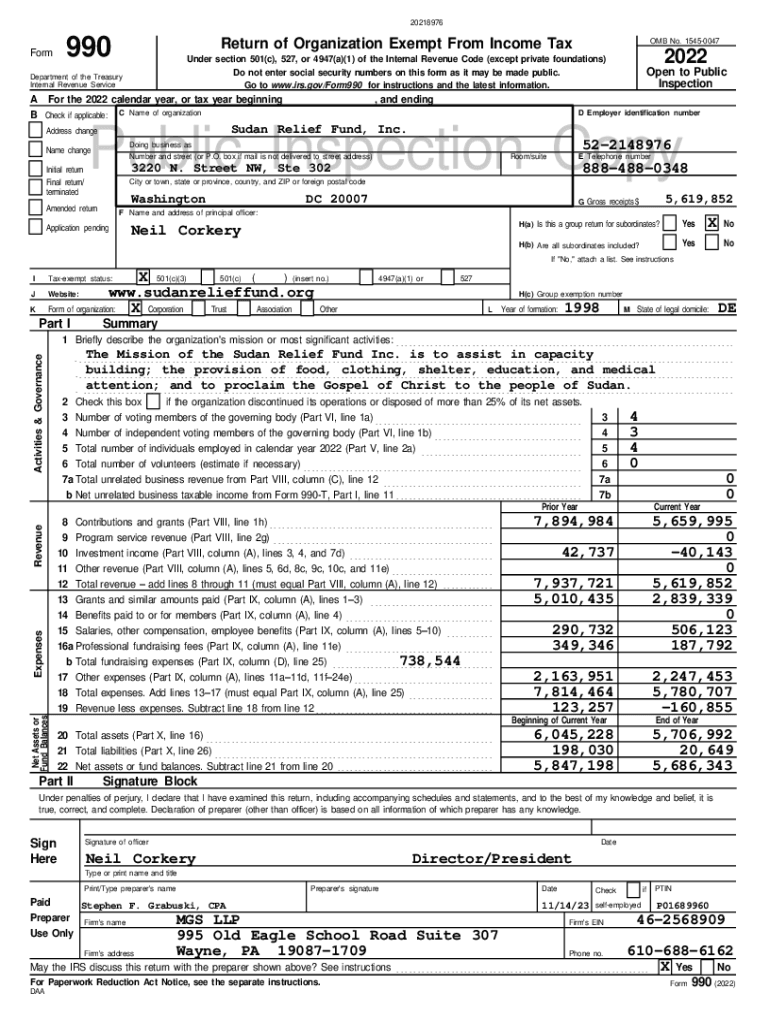

20218976Form990Return of Organization Exempt From Income TaxDepartment of the Treasury Internal Revenue ServiceA For the 2022 calendar year, or tax year beginning B Check if applicable: C Name of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 3220 n

Edit your 3220 n form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 3220 n form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 3220 n online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 3220 n. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 3220 n

How to fill out 3220 n

01

To fill out the 3220 n form, follow these steps:

02

Start by providing your personal information, such as your name, address, and contact details.

03

Next, indicate the type of application or petition you are submitting, and the specific USCIS form number you are applying for.

04

Provide the alien registration number, if applicable.

05

Fill in the relevant information about the beneficiary or applicant, including their name, date of birth, citizenship, and relationship to the petitioner.

06

If there are any additional applicants or beneficiaries, provide their information as well.

07

Answer the questions regarding eligibility and grounds of inadmissibility, if applicable.

08

Include any required supporting documents or evidence, such as birth certificates, marriage certificates, or photos.

09

Review the completed form for accuracy and make any necessary corrections.

10

Sign and date the form.

11

Make a copy of the completed form and any supporting documents for your records.

12

Submit the original form, along with any required fees, to the appropriate USCIS office as instructed in the form's filing instructions.

Who needs 3220 n?

01

3220 n form is needed by individuals who are applying for certain immigration benefits or petitions, such as petitioning for a relative to immigrate to the United States or requesting a change of status.

02

This form is typically required by the United States Citizenship and Immigration Services (USCIS) for specific application processes.

03

It is important to consult the USCIS website or an immigration attorney to determine if you need to fill out the 3220 n form for your specific situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 3220 n without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including 3220 n. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I sign the 3220 n electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I create an eSignature for the 3220 n in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your 3220 n directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is 3220 n?

3220 n refers to a specific form used by certain employees to apply for a special type of retirement benefit under the Federal Employees Retirement System.

Who is required to file 3220 n?

Employees covered under the Federal Employees Retirement System who have experienced a qualifying event such as a disability are required to file Form 3220 n.

How to fill out 3220 n?

To fill out Form 3220 n, individuals must provide personal information, details about their work history, and supporting documentation regarding their disability or qualifying condition.

What is the purpose of 3220 n?

The purpose of Form 3220 n is to process applications for disability retirement benefits, ensuring that eligible federal employees receive the benefits to which they are entitled.

What information must be reported on 3220 n?

The form requires information such as the applicant's personal details, employment history, medical condition, and any prior claims or appeals related to benefits.

Fill out your 3220 n online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

3220 N is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.