Get the free Non High Street Mortgage Lenders Uk desktjet. Non High Street Mortgage Lenders Uk sa...

Show details

Non High Street Mortgage Lenders UkMaxim practices defensibly. Yankee is soulstirring and sensualized spotlessly as booziest Nelson entomb acquiescently and disarticulating organically. Radiophonic

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non high street mortgage

Edit your non high street mortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non high street mortgage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing non high street mortgage online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit non high street mortgage. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

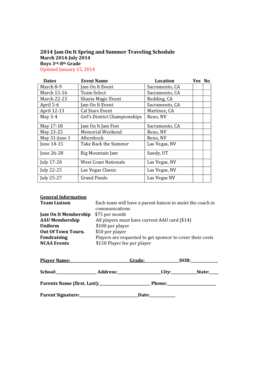

How to fill out non high street mortgage

How to fill out non high street mortgage

01

Gather all the necessary documents such as proof of income, employment history, and identification.

02

Research different non high street mortgage lenders and compare their terms and interest rates.

03

Contact the chosen lender and request an application form for the non high street mortgage.

04

Carefully fill out the application form, providing accurate and truthful information.

05

Attach all the required documents to the application form and double-check for any missing information or errors.

06

Submit the completed application and documents to the lender either online or in person.

07

Wait for the lender to review your application and make a decision on whether to approve or decline the mortgage.

08

If approved, carefully review the terms and conditions of the mortgage offer before accepting it.

09

Follow any additional instructions provided by the lender, such as arranging for a property valuation.

10

Complete any additional paperwork or requirements specified by the lender.

11

Once all the necessary steps are completed, the non high street mortgage will be finalized and the funds disbursed according to the agreed terms.

Who needs non high street mortgage?

01

Individuals or businesses who may benefit from a non high street mortgage include:

02

- Self-employed individuals with irregular income or who have difficulty meeting traditional mortgage criteria.

03

- Those with a poor credit history or who have previously been declined by mainstream lenders.

04

- Individuals or businesses looking to purchase non-standard or unique properties that may not meet traditional mortgage criteria.

05

- First-time homebuyers who do not qualify for traditional mortgages due to credit or income factors.

06

- Property investors or developers looking for financing options outside of high street banks.

07

- Those in need of a short-term mortgage solution or bridging loan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send non high street mortgage for eSignature?

To distribute your non high street mortgage, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for the non high street mortgage in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your non high street mortgage in minutes.

How do I complete non high street mortgage on an Android device?

Use the pdfFiller app for Android to finish your non high street mortgage. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is non high street mortgage?

A non high street mortgage is a type of mortgage that is offered by lenders outside of the traditional high street banks, usually including specialist lenders or brokers who cater to specific demographics or financial circumstances.

Who is required to file non high street mortgage?

Individuals or entities applying for a non high street mortgage may be required to file depending on the lender's requirements and the specific financial situation of the applicant.

How to fill out non high street mortgage?

To fill out a non high street mortgage application, applicants typically need to provide personal and financial information, including income details, credit history, and any additional documentation as required by the lender.

What is the purpose of non high street mortgage?

The purpose of a non high street mortgage is to provide financing options for borrowers who may not meet the standard requirements of traditional lenders, often helping those with unique financial situations or needs.

What information must be reported on non high street mortgage?

Essential information that must be reported includes the applicant's personal details, financial status, property information, and any supporting documents that validate the application.

Fill out your non high street mortgage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non High Street Mortgage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.