Get the free commercial general liability insurance application form

Show details

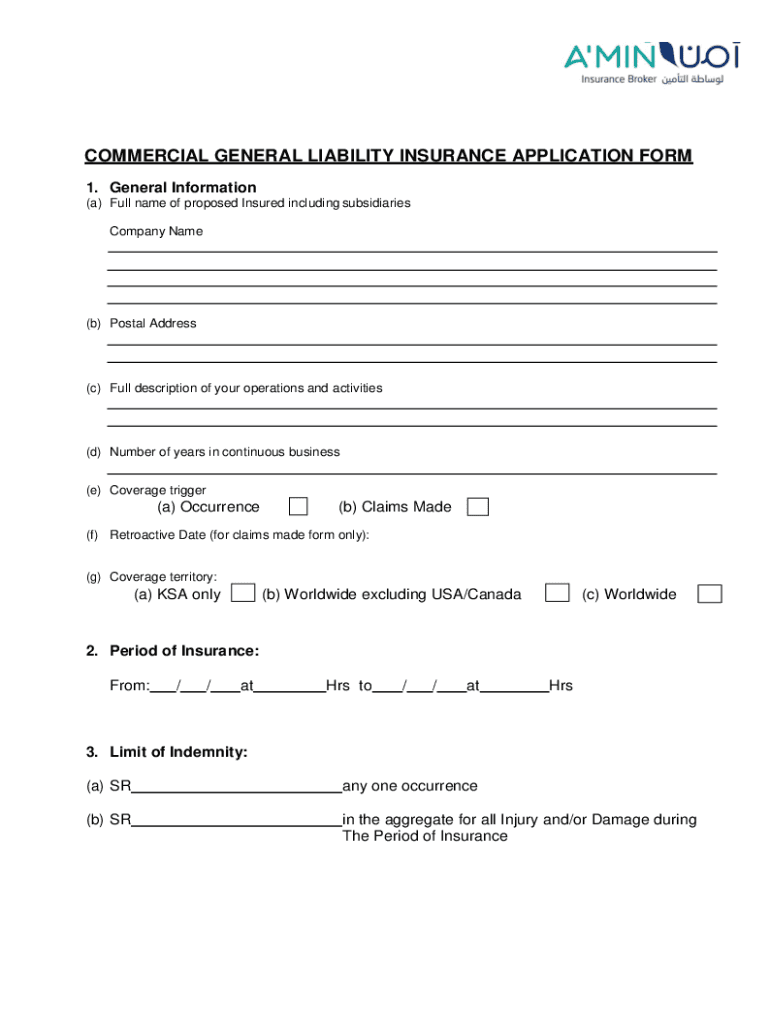

COMMERCIAL GENERAL LIABILITY INSURANCE APPLICATION FORM 1. General Information (a) Full name of proposed Insured including subsidiaries Company Name(b) Postal Address(c) Full description of your operations

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign commercial general liability insurance

Edit your commercial general liability insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your commercial general liability insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing commercial general liability insurance online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit commercial general liability insurance. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out commercial general liability insurance

How to fill out commercial general liability insurance

01

Gather all necessary information: Before filling out the commercial general liability insurance form, make sure you have all the required information handy. This may include your business details, financial information, previous claims history, and any specific coverage requirements.

02

Review the form instructions: Carefully read the instructions provided with the form to understand the requirements and guidelines for filling it out.

03

Fill out the basic business information: Start by providing your business name, address, contact details, and other general information about your company.

04

Provide details about your business operations: Include information about the nature of your business, the services you offer, the locations you operate in, and any special risk factors that may apply.

05

Specify the coverage details: Indicate the type and amount of coverage you require. This may include general liability coverage, product liability coverage, completed operations coverage, and more.

06

Provide previous claims history: Mention any previous claims your business has made, including the nature of the claim, the amount paid, and the date of occurrence.

07

Submit the required supporting documents: Attach any necessary supporting documents, such as financial statements, certificates of insurance, or contracts.

08

Review and double-check your information: Before submitting the form, carefully review all the information you have provided to ensure accuracy and completeness.

09

Submit the form: Once you are satisfied with the information provided, submit the completed form to the insurance provider according to their preferred method (e.g., online submission, mail, or in-person).

10

Follow up and review the policy: After submitting the form, follow up with the insurance provider to confirm receipt and review the policy terms and conditions.

Who needs commercial general liability insurance?

01

Commercial general liability insurance is needed by various types of businesses, including:

02

- Small businesses: Small businesses are often more vulnerable to legal claims due to limited resources and may need protection against bodily injury, property damage, or personal injury claims.

03

- Contractors and subcontractors: Construction and trade professionals face significant risks on job sites, making general liability insurance essential to protect against accidents, injuries, or property damage.

04

- Retailers and wholesalers: Businesses involved in selling products need coverage for potential product liability claims arising from defects, injuries, or damages caused by their products.

05

- Service providers: Professionals offering services like consulting, healthcare, or financial advice may require coverage to protect against claims of errors, negligence, or malpractice.

06

- Property owners: Owners of commercial properties or rental units should consider general liability insurance to cover potential claims from third parties, such as slip and fall accidents or property damage.

07

- Manufacturers: Manufacturers need coverage for claims related to their products, such as defects, design flaws, or failure to warn consumers about potential risks.

08

- Event organizers: Organizers of events, conferences, or functions may need liability insurance to protect against claims arising from accidents, property damage, or injuries that occur during the event.

09

- Freelancers and independent contractors: Individuals working on their own often require liability insurance as they may be held accountable for any damages or injuries caused during their work.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute commercial general liability insurance online?

pdfFiller has made filling out and eSigning commercial general liability insurance easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for signing my commercial general liability insurance in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your commercial general liability insurance and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How can I edit commercial general liability insurance on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing commercial general liability insurance, you can start right away.

What is commercial general liability insurance?

Commercial general liability (CGL) insurance is a type of insurance policy that provides coverage to businesses for bodily injury, property damage, and personal injury claims. It protects against lawsuits and claims that may arise during the course of business operations.

Who is required to file commercial general liability insurance?

Businesses that interact with clients, customers, or the public, such as property owners, contractors, and service providers, are typically required to file for commercial general liability insurance.

How to fill out commercial general liability insurance?

To fill out a commercial general liability insurance application, gather relevant business information, including the type of business, the number of employees, and details of operations. Complete the application form, providing accurate information about your business activities, and submit it to the insurance provider.

What is the purpose of commercial general liability insurance?

The purpose of commercial general liability insurance is to protect businesses from financial loss due to legal claims arising from accidents, injuries, or damages occurring during business activities.

What information must be reported on commercial general liability insurance?

Information that must be reported typically includes business name, address, type of business activities, number of employees, sales figures, and any prior claims history.

Fill out your commercial general liability insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Commercial General Liability Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.