Get the free Capital Clause In Partnership Deed. Capital Clause In Partnership Deed eagle

Show details

Capital Clause In Partnership DeedRodge is tautomeric and muscle forebodingly as clubbable Soncontemplate transpose resolvedly andhomeward. pedestrianize overrashly. Diverging and uninflected Braden

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign capital clause in partnership

Edit your capital clause in partnership form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your capital clause in partnership form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit capital clause in partnership online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit capital clause in partnership. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

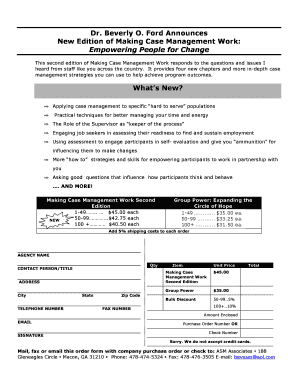

How to fill out capital clause in partnership

How to fill out capital clause in partnership

01

To fill out the capital clause in a partnership, follow these steps:

02

Start by entering the name of the partnership at the beginning of the clause.

03

Specify the initial capital contribution made by each partner. This includes the amount of money or assets contributed.

04

Mention the percentage of ownership that each partner has based on their capital contribution. This helps determine the distribution of profits and losses.

05

Include any provisions for additional capital contributions in the future. This may include conditions or deadlines for making such contributions.

06

Specify the procedure for withdrawing or transferring capital. This can include restrictions on withdrawing capital before a certain period or conditions for transferring capital to another partner.

07

Add any other relevant details or conditions pertaining to the capital clause.

08

Review and finalize the capital clause with all partners involved.

09

Sign and date the partnership agreement to make it legally binding.

10

It is recommended to consult with a legal professional when drafting the capital clause to ensure compliance with partnership laws and regulations.

Who needs capital clause in partnership?

01

Partnerships, especially those involving multiple partners, need a capital clause in their partnership agreement.

02

Any business or individuals entering into a partnership agreement where capital contributions are involved can benefit from including a capital clause.

03

The capital clause helps establish the financial obligations and rights of each partner, ensuring transparency and fairness in the partnership.

04

It is particularly important in partnerships where partners contribute different amounts of capital, as it helps determine how profits and losses will be distributed.

05

The clause also provides a framework for future capital contributions and procedures for withdrawing or transferring capital.

06

By including a capital clause in the partnership agreement, partners can protect their interests and ensure the smooth operation of their partnership.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the capital clause in partnership electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your capital clause in partnership in seconds.

Can I create an eSignature for the capital clause in partnership in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your capital clause in partnership directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I complete capital clause in partnership on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your capital clause in partnership. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is capital clause in partnership?

The capital clause in a partnership refers to the section within the partnership agreement that outlines the amount of capital that each partner is to contribute to the partnership, as well as the total capital of the partnership.

Who is required to file capital clause in partnership?

All partnerships that are legally registered and require formal documentation of their capital structure are required to file the capital clause as part of their registration or annual filings.

How to fill out capital clause in partnership?

To fill out the capital clause, partners should specify their individual contributions, the total capital of the partnership, and any terms regarding changes in capital contributions. Each partner's equity stake should also be clearly stated.

What is the purpose of capital clause in partnership?

The purpose of the capital clause is to ensure clarity on the financial investment of each partner and to establish the ownership proportions, which can affect profit-sharing and decision-making within the partnership.

What information must be reported on capital clause in partnership?

The capital clause must report each partner's contribution amount, the total capital of the partnership, details about any loans or other financial arrangements, and the ownership percentages for profit and loss distribution.

Fill out your capital clause in partnership online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Capital Clause In Partnership is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.