Get the free Critical Illness Insurance - What Is It...

Show details

Critical Illness Insurance can pay money directly to you when youre diagnosed with certain serious illnesses.How does it work? Critical Illness Insurance can pay you a lumpsum benefit at the first

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign critical illness insurance

Edit your critical illness insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your critical illness insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

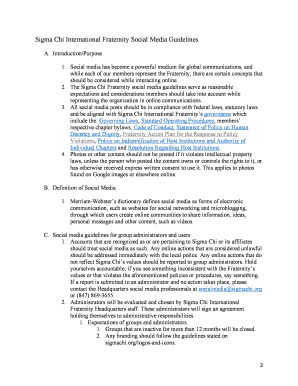

How to edit critical illness insurance online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit critical illness insurance. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out critical illness insurance

How to fill out critical illness insurance

01

To fill out critical illness insurance, follow these steps:

02

Understand the coverage: Read through the policy documents to understand what illnesses are covered, what are the exclusions, and the maximum payout amount.

03

Assess your needs: Determine the level of coverage you require based on your medical history, lifestyle, and financial situation.

04

Research providers: Research different insurance providers and compare their offerings, including coverage, premium rates, and reputation.

05

Gather necessary information: Collect all relevant personal and medical information, such as medical records, previous diagnosis, and current medications.

06

Contact insurance provider: Get in touch with the insurance provider or an agent to get detailed information about the application process and any specific requirements.

07

Fill out the application form: Fill out the application form accurately and provide all requested information. Double-check the form to ensure accuracy.

08

Provide medical information: Submit any required medical information, such as medical reports, test results, or doctor's statements.

09

Pay the premium: Pay the required premium amount as per the policy terms. This can usually be done online or through a bank transfer.

10

Wait for underwriting: The insurance provider will review your application and may request additional information or medical examinations.

11

Receive policy documents: Once the application is approved, you will receive the critical illness insurance policy documents. Review them carefully to ensure they align with your requirements.

12

Keep the policy accessible: Store the policy documents in a safe place and make sure they are easily accessible when needed.

13

Seek professional advice if needed: If you have any doubts or questions during the application process, consult with a financial advisor or insurance expert to make an informed decision.

Who needs critical illness insurance?

01

Critical illness insurance is beneficial for individuals who:

02

- Have a family history of serious illnesses or genetic predispositions.

03

- Follow a lifestyle that increases the risk of critical illnesses, such as smoking, excessive drinking, or poor diet.

04

- Work in high-stress or physically demanding occupations that may pose health risks.

05

- Want financial protection in case of a major illness or medical event that may result in high medical expenses and loss of income.

06

- Don't have sufficient savings or alternative financial resources to cover the costs associated with a critical illness.

07

- Have dependents or family members who rely on their income and need financial support if they become critically ill.

08

- Want to have peace of mind knowing they have a safety net in case of a critical illness.

09

It is important to assess individual circumstances and consult with a financial advisor or insurance professional to determine if critical illness insurance is suitable for specific needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete critical illness insurance online?

pdfFiller has made filling out and eSigning critical illness insurance easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I fill out the critical illness insurance form on my smartphone?

Use the pdfFiller mobile app to fill out and sign critical illness insurance on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete critical illness insurance on an Android device?

Complete critical illness insurance and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is critical illness insurance?

Critical illness insurance is a type of insurance policy that provides financial support to policyholders who are diagnosed with specific critical illnesses. This can help cover medical treatment costs, living expenses, or other financial obligations during a challenging time.

Who is required to file critical illness insurance?

Typically, individuals who have purchased critical illness insurance policies may need to file claims when diagnosed with a covered condition. Employers offering group critical illness insurance may also have specific filing requirements.

How to fill out critical illness insurance?

To fill out critical illness insurance, policyholders usually need to complete a claims form provided by the insurance company, detailing the diagnosis, relevant medical information, and other required documentation.

What is the purpose of critical illness insurance?

The purpose of critical illness insurance is to provide financial relief to the policyholder in the event of a serious health condition. It helps ensure that the individual can maintain financial stability and cover expenses during recovery.

What information must be reported on critical illness insurance?

Information that must be reported typically includes personal identification details, the nature of the diagnosed illness, medical records, treatment details, and any other documentation requested by the insurer.

Fill out your critical illness insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Critical Illness Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.