Get the free PLANNED GIVING & TRUST SERVICES CERTIFICATION CLASS

Show details

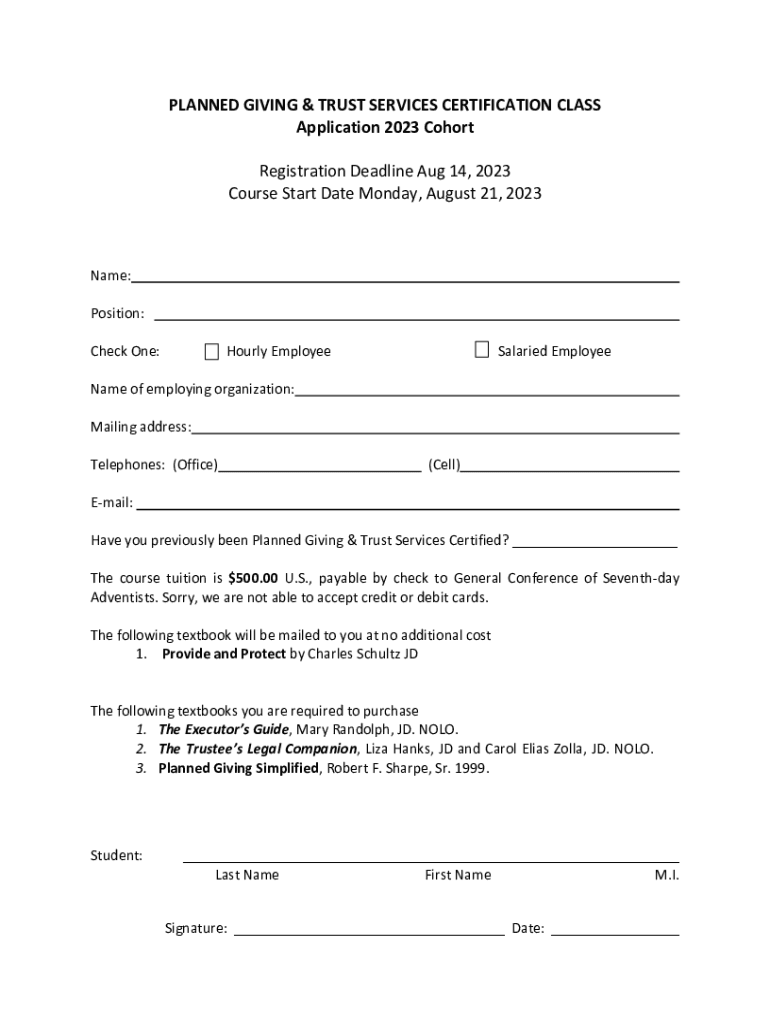

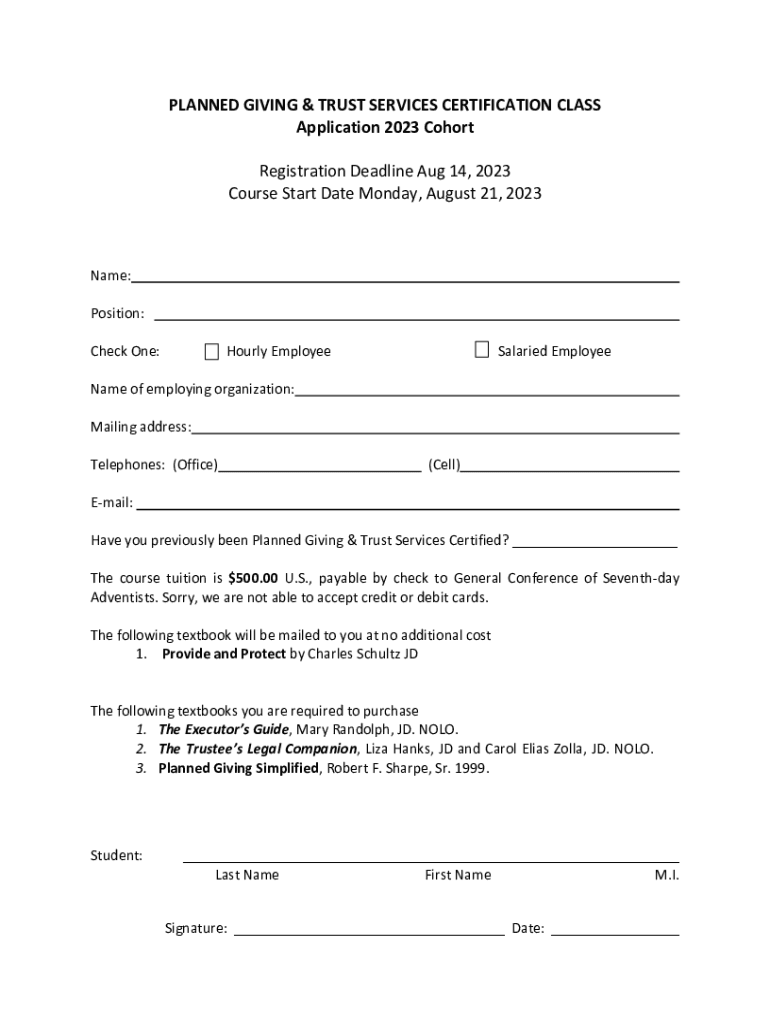

PLANNED GIVING & TRUST SERVICES CERTIFICATION CLASS Application 2023 Cohort Registration Deadline Aug 14, 2023 Course Start Date Monday, August 21, 2023Name: Position: Check One:Hourly EmployeeSalaried

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign planned giving trust services

Edit your planned giving trust services form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your planned giving trust services form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing planned giving trust services online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit planned giving trust services. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out planned giving trust services

How to fill out planned giving trust services

01

To fill out planned giving trust services, follow these steps:

02

Begin by identifying the type of planned giving trust you require. The common types include charitable remainder trusts, charitable lead trusts, and pooled income funds.

03

Understand the specific requirements and restrictions of each type of trust. This may involve consulting a financial advisor or attorney knowledgeable in trust law.

04

Gather the necessary documentation, such as identification documents, financial statements, and asset information.

05

Consult with the intended beneficiaries or charities that will receive the trust assets.

06

Complete the trust agreement form, ensuring all necessary information is provided accurately.

07

Review the trust agreement carefully, making sure all terms and conditions align with your intentions.

08

Sign the trust agreement in the presence of witnesses or a notary public, depending on local legal requirements.

09

Submit the completed trust agreement to the relevant trust services provider or institution.

10

Keep copies of the trust agreement for your records.

11

Periodically review and update the trust agreement as circumstances or your intentions change.

Who needs planned giving trust services?

01

Planned giving trust services are beneficial for individuals or organizations who:

02

- Wish to support charitable causes and leave a lasting legacy.

03

- Desire to reduce estate tax liabilities.

04

- Want to provide for the financial security of loved ones while also supporting charitable organizations.

05

- Have significant assets and want to ensure their proper distribution according to their wishes.

06

- Seek to maximize the impact of their charitable donations through tax-efficient strategies.

07

- Are interested in creating a steady stream of income for themselves or their beneficiaries.

08

- Value professional management and oversight of their planned giving arrangements.

09

- Require the expertise and guidance of professionals in trust law and financial planning.

10

- Want to establish a structured and formalized plan for their charitable giving.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete planned giving trust services online?

With pdfFiller, you may easily complete and sign planned giving trust services online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit planned giving trust services straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing planned giving trust services right away.

How do I complete planned giving trust services on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your planned giving trust services from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is planned giving trust services?

Planned giving trust services refer to financial arrangements that allow individuals to make charitable contributions while providing themselves with income during their lifetime and/or ensuring that certain assets are managed and distributed according to their wishes after their death.

Who is required to file planned giving trust services?

Individuals or entities managing a planned giving trust that generates income or has tax implications are typically required to file planned giving trust services.

How to fill out planned giving trust services?

To fill out planned giving trust services, one must first gather all relevant financial information, including details about the trust, beneficiaries, and income generated. Then, follow the required forms and guidelines provided by the governing tax authority or trust administration entity.

What is the purpose of planned giving trust services?

The purpose of planned giving trust services is to facilitate the process of making charitable donations while allowing donors to retain income and control over assets, ultimately benefiting both the donor and the charitable organization.

What information must be reported on planned giving trust services?

The information that must be reported includes the trust's financial activities, details of contributions made, income generated, distributions to beneficiaries, and any relevant tax information.

Fill out your planned giving trust services online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Planned Giving Trust Services is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.