Get the free Professionals for Association Revenue: Home

Show details

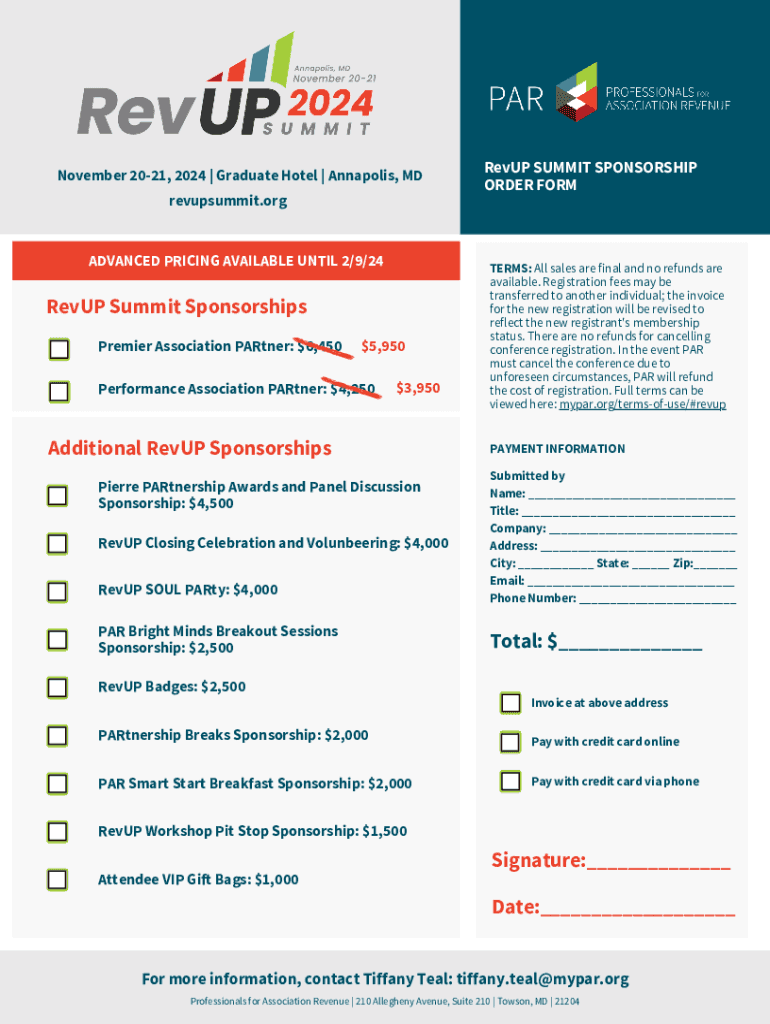

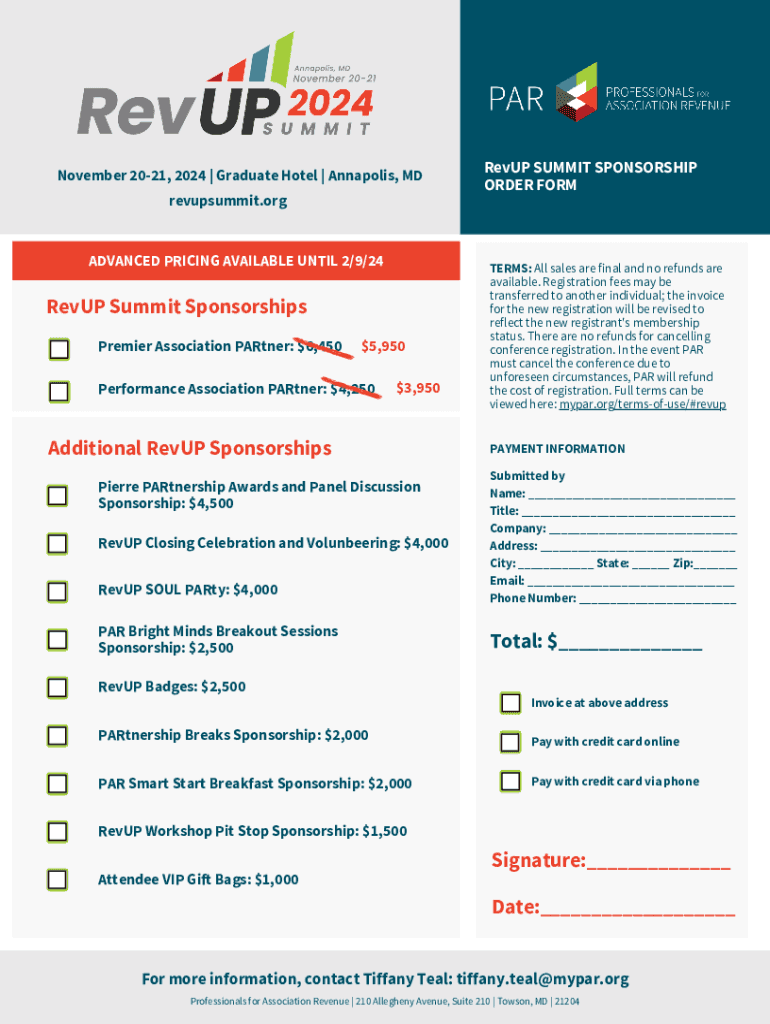

ANNAPOLIS, 2024EXHIBITORPROSPECTUSAnnapolis, MD November 2021ASSOCIATION BUSINESS ISOUR MISSIONJoin the Professionals for Association Revenue for the 3rd Annual RevUP Summit in Annapolis, Maryland.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign professionals for association revenue

Edit your professionals for association revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your professionals for association revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing professionals for association revenue online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit professionals for association revenue. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out professionals for association revenue

How to fill out professionals for association revenue

01

Start by gathering all necessary financial information and documents related to the association's revenue.

02

Identify the various sources of revenue for the association, such as membership fees, donations, sponsorships, and event earnings.

03

Create a spreadsheet or use accounting software to record and track the association's revenue.

04

Ensure that each revenue source is properly categorized and labeled for easy identification and analysis.

05

Be thorough and accurate when entering revenue data into the spreadsheet or accounting software.

06

Regularly reconcile the recorded revenue with the actual deposits and financial statements to ensure the accuracy of the information.

07

Generate reports on the association's revenue, including income statements, cash flow statements, and balance sheets, to gain a comprehensive understanding of the organization's financial performance.

08

Review and analyze the revenue data to identify trends, patterns, and areas for improvement.

09

Seek professional assistance or expertise if needed, especially for complex aspects of revenue management, tax considerations, or financial forecasting for the association.

Who needs professionals for association revenue?

01

Non-profit organizations

02

Trade associations

03

Professional societies

04

Charitable foundations

05

Business associations

06

Membership-based organizations

07

Organizations relying on diverse revenue streams

08

Any entity interested in effectively managing and maximizing their association's revenue

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the professionals for association revenue in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your professionals for association revenue.

Can I create an eSignature for the professionals for association revenue in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your professionals for association revenue and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Can I edit professionals for association revenue on an Android device?

You can make any changes to PDF files, such as professionals for association revenue, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is professionals for association revenue?

Professionals for association revenue refers to revenue generated by professionals who provide services to associations, such as membership organizations, non-profits, and trade associations. This revenue may include fees collected from members, sponsorships, and event revenues.

Who is required to file professionals for association revenue?

Typically, organizations that generate revenue through professional services and must report their income to tax authorities are required to file professionals for association revenue. This may include associations and non-profits offering professional services.

How to fill out professionals for association revenue?

To fill out professionals for association revenue, organizations should gather all relevant financial information related to their professional services, accurately report their income and expenses, and follow the specific guidelines provided by the tax authority for the associated forms.

What is the purpose of professionals for association revenue?

The purpose of professionals for association revenue is to accurately report income generated from professional services provided by associations, ensuring compliance with tax regulations and providing transparency regarding the financial health of the organization.

What information must be reported on professionals for association revenue?

Organizations must report total revenue from professional services, expenses associated with generating that revenue, any separate income from membership dues, sponsorships, and specific details as mandated by tax regulations.

Fill out your professionals for association revenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Professionals For Association Revenue is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.