Get the free Taxes and divorce: What to know and plan for for 2023, 2024

Show details

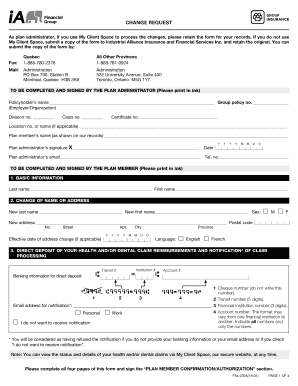

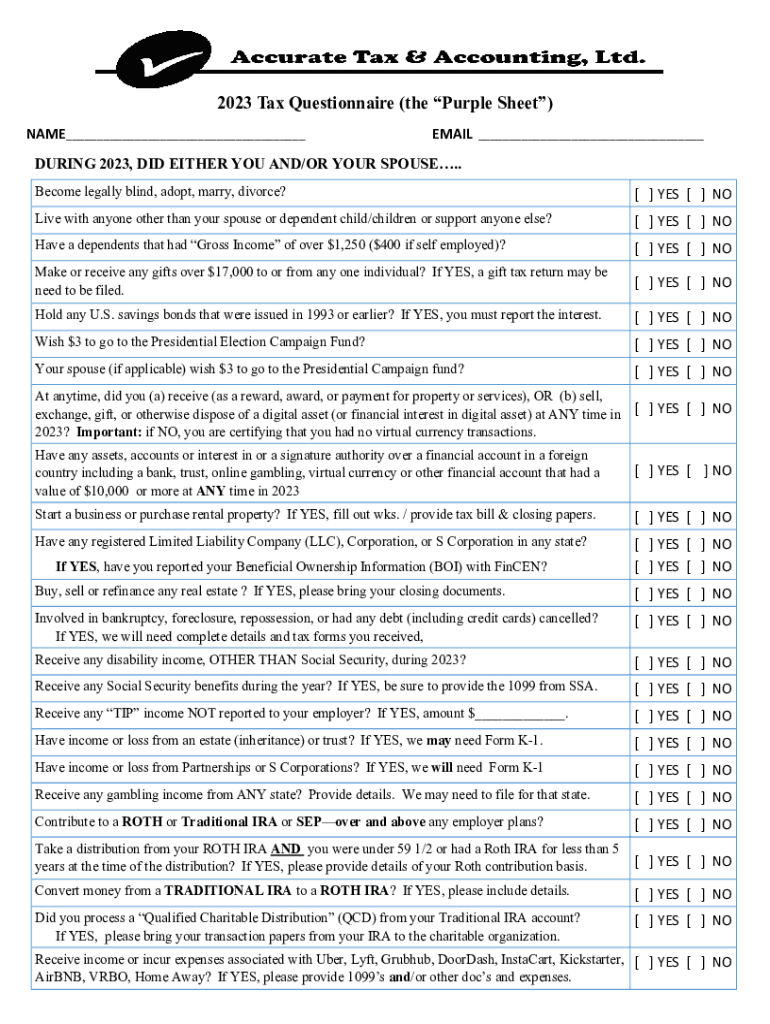

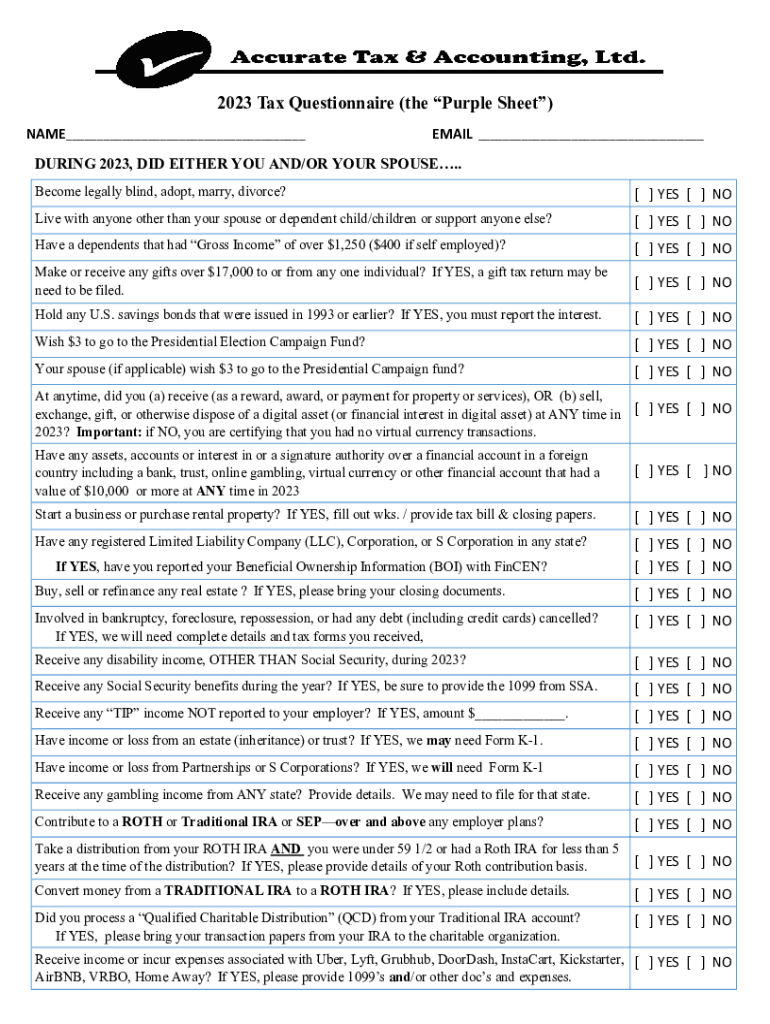

2023 Tax Questionnaire (the Purple Sheet) NAME___EMAIL ___DURING 2023, DID EITHER YOU AND/OR YOUR SPOUSE.. Become legally blind, adopt, marry, divorce?[ ] YES [ ] NOLive with anyone other than your

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign taxes and divorce what

Edit your taxes and divorce what form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxes and divorce what form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit taxes and divorce what online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit taxes and divorce what. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out taxes and divorce what

How to fill out taxes and divorce what

01

To fill out taxes, follow these steps:

1. Gather all necessary tax documents, such as W-2 forms, 1099 forms, and receipts.

2. Determine your filing status, whether single, married filing jointly, or another category.

3. Calculate your income, including wages, self-employment income, interest, and any other sources.

4. Deduct eligible expenses, such as mortgage interest, student loan interest, and qualified business expenses.

5. Determine if you qualify for any tax credits or deductions.

6. Complete the appropriate tax forms or use tax software to file your taxes.

7. Double-check all calculations and review for accuracy.

8. Submit your tax return by the designated deadline.

02

To handle a divorce, consider the following steps:

1. Consult with an attorney to understand your legal rights and options.

2. Gather important documents, such as marriage certificates, financial statements, and records of assets and debts.

3. Discuss child custody and support arrangements if applicable.

4. Determine the division of assets and debts with your spouse.

5. Create a comprehensive financial plan for post-divorce life.

6. Complete and file the necessary legal forms to initiate the divorce process.

7. Attend mediation or court hearings as required to resolve disputes.

8. Finalize the divorce settlement and ensure all legal requirements are fulfilled.

Who needs taxes and divorce what?

01

Everyone who earns an income needs to file taxes as per their respective country's laws.

02

Divorce is needed by individuals who are unable to maintain a healthy and functional marriage and have exhausted all other options for reconciliation. It is a legal process that allows them to legally separate and dissolve their marital union.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send taxes and divorce what for eSignature?

When you're ready to share your taxes and divorce what, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an electronic signature for the taxes and divorce what in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your taxes and divorce what.

How do I edit taxes and divorce what on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share taxes and divorce what on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is taxes and divorce what?

Taxes in the context of divorce refer to the financial implications and responsibilities that arise when a couple separates, including the filing of joint or individual tax returns and the handling of any tax liabilities related to assets and alimony.

Who is required to file taxes and divorce what?

Both individuals in a marriage may be required to file taxes. After a divorce, each individual will need to file their own tax return, but considerations may include joint returns filed for the year prior to the divorce if applicable.

How to fill out taxes and divorce what?

Filling out taxes after a divorce involves reporting income, deductions, and credits as an individual. It may also require splitting assets and liabilities based on the divorce agreement and calculating any alimony payments.

What is the purpose of taxes and divorce what?

The purpose of addressing taxes in divorce is to ensure compliance with tax laws, to accurately report income and expenses after the separation, and to correctly allocate any tax benefits or responsibilities stemming from the division of assets.

What information must be reported on taxes and divorce what?

Information that must be reported includes income from all sources, any alimony or child support received or paid, deductions related to divorce expenses, and the division of assets or property in accordance with the divorce agreement.

Fill out your taxes and divorce what online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taxes And Divorce What is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.