Get the free Executive Compensation and Federal Securities Legislation

Show details

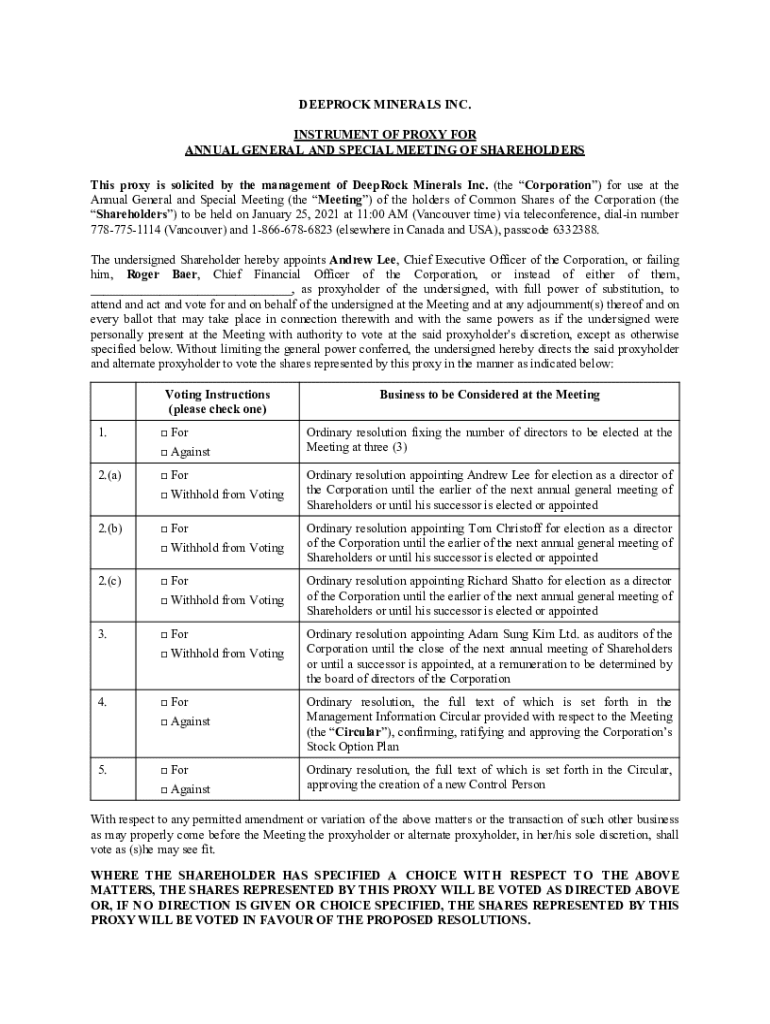

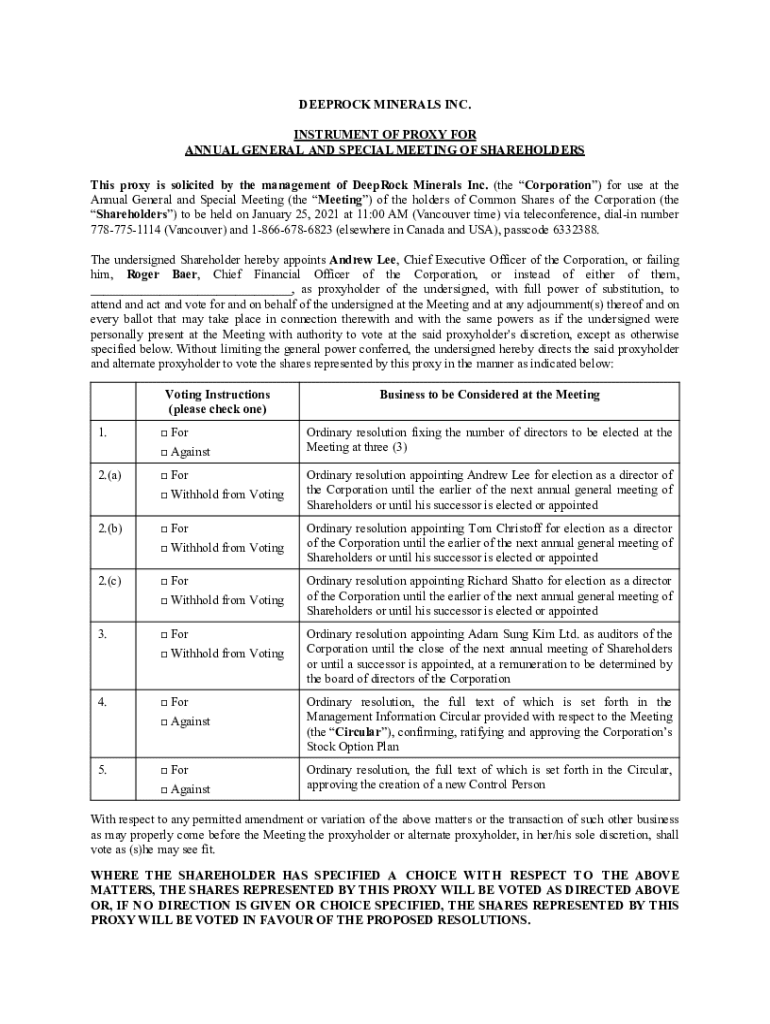

DEEPROCK MINERALS INC. INSTRUMENT OF PROXY FOR ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS This proxy is solicited by the management of DeepRock Minerals Inc. (the Corporation) for use at the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign executive compensation and federal

Edit your executive compensation and federal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your executive compensation and federal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit executive compensation and federal online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit executive compensation and federal. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out executive compensation and federal

How to fill out executive compensation and federal

01

To fill out executive compensation and federal forms, follow these steps:

02

Begin by gathering all necessary information and documentation, such as executive compensation agreements, financial statements, and tax records.

03

Familiarize yourself with the specific forms required for reporting executive compensation and federal taxes. These may include Form 990 or Form 990-EZ for non-profit organizations, or Form 1120 for corporate entities.

04

Ensure that you have accurate and up-to-date records of all executive compensation, including salaries, bonuses, stock options, and other forms of remuneration.

05

Complete the relevant sections of the forms, providing detailed information on each executive's compensation package, including the amount, type, and timing of payments.

06

Review the completed forms for accuracy and completeness, ensuring that all required information has been provided.

07

If necessary, consult with a tax professional or legal advisor to ensure compliance with applicable laws and regulations.

08

Once you are confident that the forms are accurately filled out, submit them to the appropriate government agency or tax authority, along with any required fees.

09

Retain copies of the forms and supporting documentation for your records, as well as any acknowledgement or confirmation of filing received from the relevant authorities.

Who needs executive compensation and federal?

01

Executive compensation and federal forms are needed by organizations and individuals who are required to report and disclose executive compensation information, as well as fulfill their federal tax obligations.

02

Some of the entities that may need to fill out these forms include:

03

- Non-profit organizations

04

- Corporations

05

- Government agencies

06

- Executive employees or stakeholders

07

These forms help ensure transparency, accountability, and compliance with tax laws and regulations. They provide a clear record of executive compensation and assist in preventing fraudulent activities or misuse of funds.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute executive compensation and federal online?

Filling out and eSigning executive compensation and federal is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How can I edit executive compensation and federal on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing executive compensation and federal right away.

How do I complete executive compensation and federal on an Android device?

Use the pdfFiller mobile app to complete your executive compensation and federal on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is executive compensation and federal?

Executive compensation refers to the financial payment and benefits provided to top executives in an organization, including salaries, bonuses, stock options, and other incentives. Federal refers to the regulations and standards set by the federal government regarding how such compensation must be reported and taxed.

Who is required to file executive compensation and federal?

Public companies are required to file information related to executive compensation with the federal government, specifically the Securities and Exchange Commission (SEC). This includes disclosures in annual proxy statements and filings like Form 10-K.

How to fill out executive compensation and federal?

Filling out executive compensation disclosures typically involves compiling information about salaries, bonuses, stock awards, option awards, and other compensation. This information is then documented in specific SEC forms and must be reported according to GAAP (Generally Accepted Accounting Principles) guidelines.

What is the purpose of executive compensation and federal?

The purpose is to ensure transparency in how companies compensate their top officials, allowing shareholders and the public to assess whether the compensation is aligned with company performance and to promote accountability in corporate governance.

What information must be reported on executive compensation and federal?

Companies must report details on total compensation, including base salary, bonuses, stock options, non-equity incentives, retirement plan contributions, and other perquisites for each of their top executives.

Fill out your executive compensation and federal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Executive Compensation And Federal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.