Get the free In community property states, a guaranty for a commercial ...

Show details

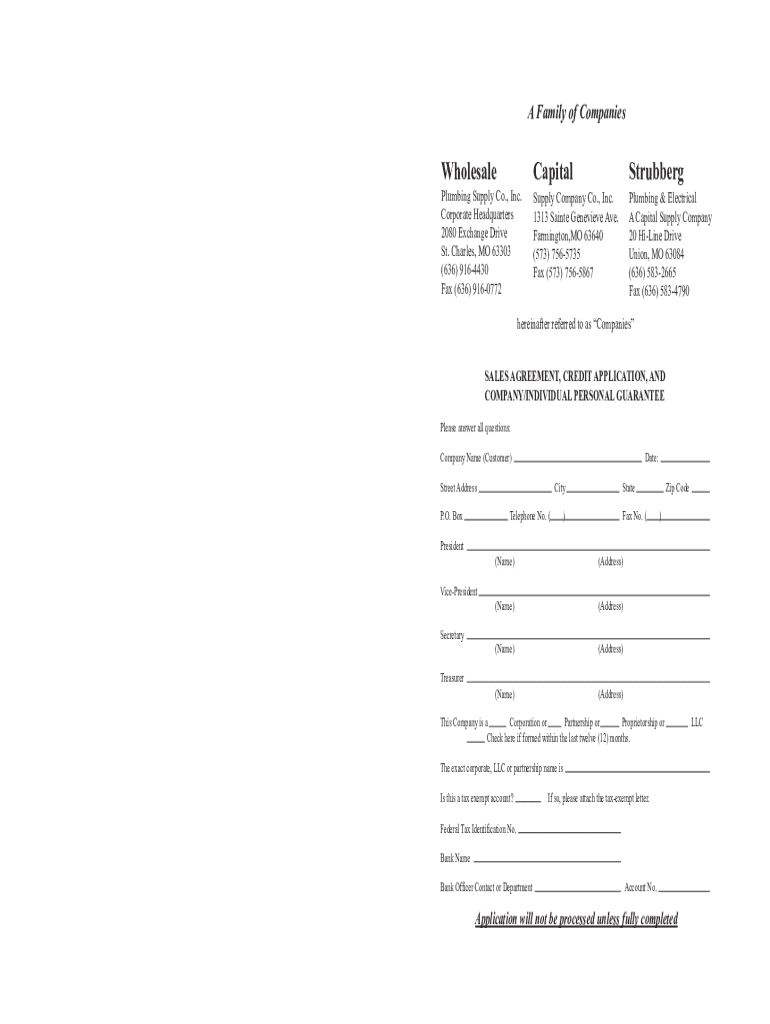

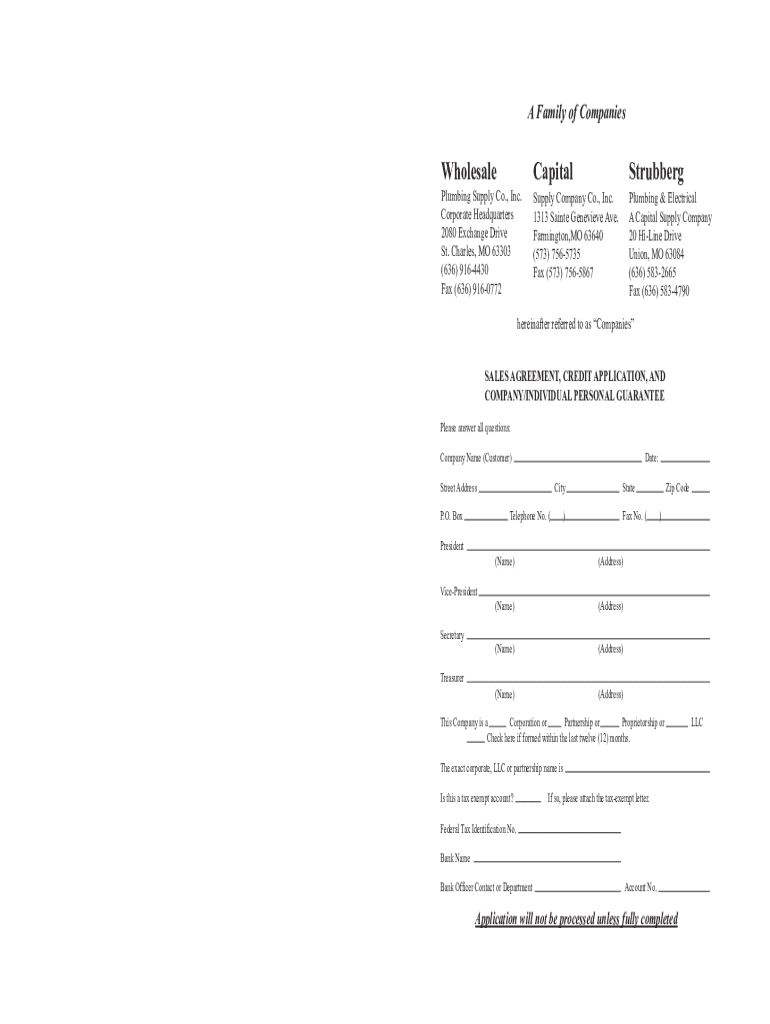

A Family of CompaniesJOINT PERSONAL GUARANTY Date20andWe,, hiswife/her husband residing at for and in consideration of your extending credit and other good and valuable consideration, the receipt

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign in community property states

Edit your in community property states form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your in community property states form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit in community property states online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit in community property states. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out in community property states

How to fill out in community property states

01

Gather all the necessary financial information, including bank statements, investment records, and property documents.

02

Determine the classification of each asset and debt as community property or separate property. Community property is generally anything acquired during the marriage, while separate property is what each spouse brought into the marriage or received as a gift or inheritance.

03

Fill out the required forms, such as a community property inventory and a community property agreement if necessary.

04

Consult with an attorney or a qualified professional to ensure you are correctly identifying and valuing the community property.

05

Complete the necessary paperwork for filing your taxes, taking into account the community property laws of your state.

06

Submit the completed forms and relevant documentation to the appropriate authorities, such as the court or tax agencies.

07

Keep copies of all documents and forms for your records.

Who needs in community property states?

01

Anyone who is married or entering into a marriage in a community property state needs to understand the rules and procedures of community property.

02

Any individual or couple who owns assets or has debts acquired during the marriage can benefit from knowing how to handle community property.

03

Divorcing couples or those going through legal separations in community property states also need to navigate the division of property according to community property laws.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit in community property states from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including in community property states, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make edits in in community property states without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your in community property states, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I fill out in community property states using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign in community property states and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is in community property states?

Community property states are jurisdictions where most property acquired during marriage is owned jointly by both spouses and is divided equally in the event of divorce or death.

Who is required to file in community property states?

Both spouses are generally required to file in community property states if they are married and both have income or property that is considered community property.

How to fill out in community property states?

When filing in community property states, both spouses must report their combined income and expenses, and they may need to fill out specific forms that reflect community property laws.

What is the purpose of in community property states?

The purpose of community property laws is to ensure an equitable distribution of property and income acquired during marriage, recognizing both spouses' contributions.

What information must be reported on in community property states?

All income earned and expenses incurred during the marriage must be reported, including wages, rental income, and any debts incurred, regardless of which spouse earned or spent the money.

Fill out your in community property states online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

In Community Property States is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.