Get the free Credit Application with Terms and Conditions 02 05 08.doc

Show details

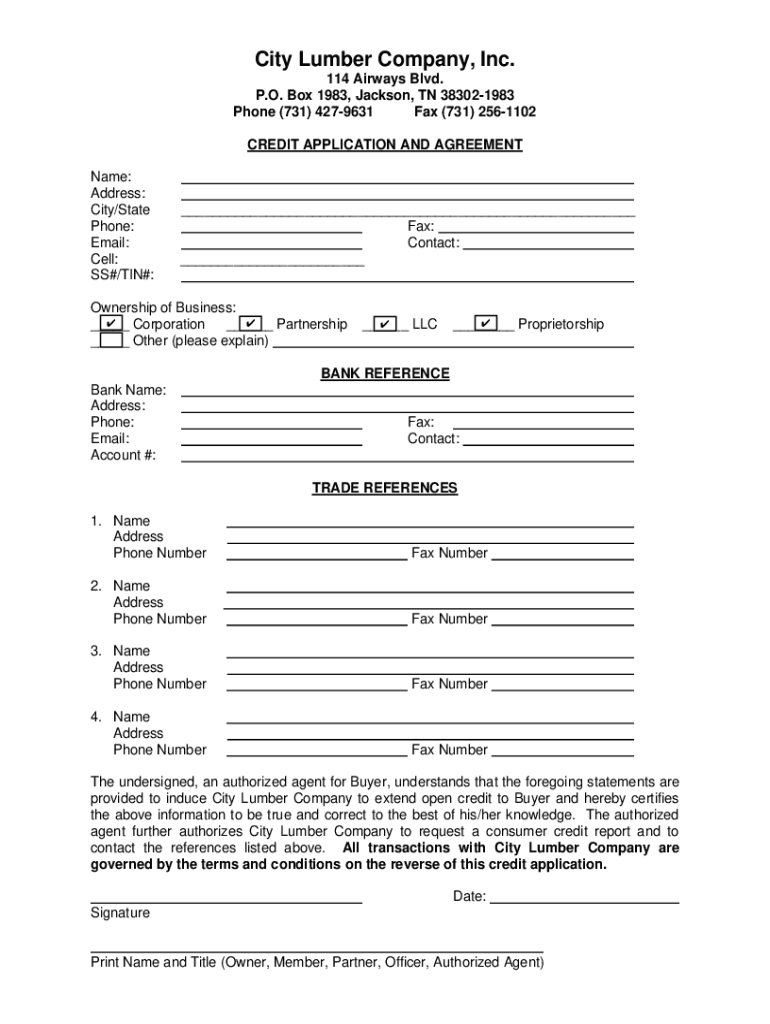

City Lumber Company, Inc. 114 Airways Blvd. P.O. Box 1983, Jackson, TN 383021983 Phone (731) 4279631 Fax (731) 2561102 CREDIT APPLICATION AND AGREEMENT Name: Address: City/State Phone: Email: Cell:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit application with terms

Edit your credit application with terms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit application with terms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit application with terms online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit application with terms. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit application with terms

How to fill out credit application with terms

01

Start by obtaining a credit application form from the financial institution you intend to apply for credit with.

02

Fill in your personal information accurately, including your full name, contact details, date of birth, and social security number.

03

Provide details about your current employment, including the name of the company, your job title, and the duration of your employment.

04

Fill out information about your income, such as your monthly salary or wages, additional sources of income if any, and any active loans or debts you may have.

05

Disclose information about your monthly expenses, including rent or mortgage payments, utilities, and any other financial obligations you have.

06

Specify the purpose for which you are requesting credit and the desired loan amount.

07

Read and understand the terms and conditions thoroughly before signing the credit application form.

08

Attach any required documents, such as proof of identity, proof of address, and income verification documents.

09

Double-check all the provided information to ensure accuracy and avoid any potential mistakes.

10

Submit the completed credit application form along with the required documents to the financial institution's designated office or through their online application portal.

11

Await the decision from the financial institution regarding your credit application.

Who needs credit application with terms?

01

Credit application with terms is needed by individuals or businesses who require access to credit facilities offered by financial institutions.

02

These individuals or businesses may require credit for various purposes such as personal expenses, purchasing assets, funding business operations, or expanding their ventures.

03

Credit application with terms helps these individuals or businesses in formalizing their request for credit and outlines the terms and conditions under which the credit will be granted.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit application with terms from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your credit application with terms into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send credit application with terms for eSignature?

To distribute your credit application with terms, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit credit application with terms online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your credit application with terms to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

What is credit application with terms?

A credit application with terms is a formal request submitted by an individual or business to receive credit, which includes specific conditions under which the credit will be granted, including payment terms and interest rates.

Who is required to file credit application with terms?

Individuals or businesses seeking credit from a lender or financial institution are typically required to file a credit application with terms.

How to fill out credit application with terms?

To fill out a credit application with terms, provide your personal or business information, financial details, employment history, requested credit amount, and agree to the specified terms outlined in the application.

What is the purpose of credit application with terms?

The purpose of a credit application with terms is to assess the creditworthiness of the applicant and to outline the conditions under which credit will be given, helping both the lender and borrower understand their obligations.

What information must be reported on credit application with terms?

Essential information typically includes personal identification details, financial information such as income and expenses, credit history, and any collateral being offered.

Fill out your credit application with terms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Application With Terms is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.