Get the free intent to reverse credit transfer form

Show details

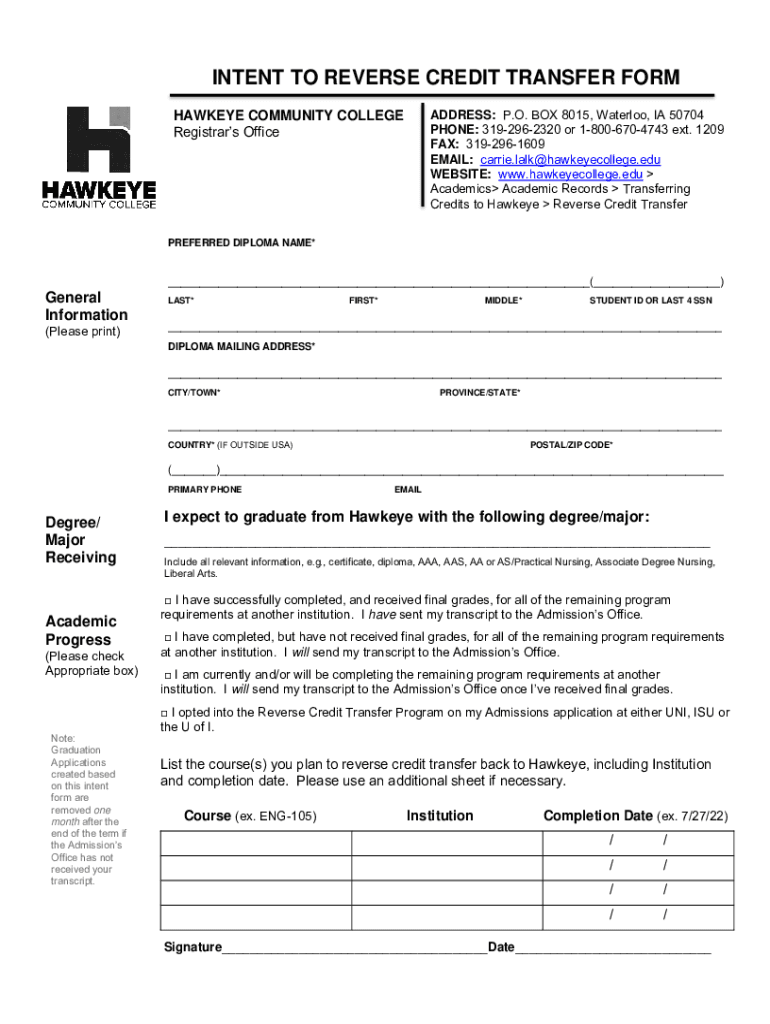

INTENT TO REVERSE CREDIT TRANSFER FORM ADDRESS: P.O. BOX 8015, Waterloo, IA 50704 PHONE: 3192962320 or 18006704743 ext. 1209 FAX: 3192961609 EMAIL: carrie.lalk@hawkeyecollege.edu WEBSITE: www.hawkeyecollege.edu

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign intent to reverse credit

Edit your intent to reverse credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your intent to reverse credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit intent to reverse credit online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit intent to reverse credit. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out intent to reverse credit

How to fill out intent to reverse credit

01

To fill out an intent to reverse credit, follow these steps:

02

Start by collecting all relevant documents and information related to the credit you want to reverse.

03

Contact the lender or financial institution from which you obtained the credit and inform them about your intention to reverse the credit.

04

Request the necessary forms or documents for reversing the credit. These may include an intent to reverse credit form or a loan reversal request form.

05

Fill out the forms or documents accurately and provide all required information, such as your personal details, the credit account number, and the reason for reversing the credit.

06

Attach any supporting documents that may be required, such as proof of payment or documentation of any issues or disputes related to the credit.

07

Double-check all the information you have provided and ensure that it is complete and accurate.

08

Submit the filled-out forms or documents to the lender or financial institution through the specified channel, which may include mail, email, or online submission.

09

Keep copies of all the forms, documents, and communication related to the intent to reverse credit for your records.

10

Follow up with the lender or financial institution to ensure that your request for credit reversal is being processed, and stay informed about any further steps or requirements.

11

If necessary, seek legal advice or assistance to navigate the process of reversing credit, especially if you encounter any challenges or complications.

Who needs intent to reverse credit?

01

Intent to reverse credit is needed by individuals who have taken a credit or loan and wish to reverse or cancel it due to various reasons such as:

02

- Discovering that the terms and conditions of the credit were misrepresented or not as agreed upon.

03

- Experiencing financial difficulties and finding it challenging to repay the credit.

04

- Identifying errors or discrepancies in the credit agreement or billing statements.

05

- Being a victim of fraudulent or unauthorized activity related to the credit.

06

- Changing financial circumstances or personal situations that make it necessary to reverse the credit.

07

It is essential to note that the specific eligibility criteria and requirements for credit reversal may vary depending on the lender or financial institution and the terms of the credit agreement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the intent to reverse credit electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your intent to reverse credit and you'll be done in minutes.

How do I edit intent to reverse credit on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign intent to reverse credit on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I edit intent to reverse credit on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share intent to reverse credit on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is intent to reverse credit?

Intent to reverse credit refers to a formal notification submitted by a taxpayer indicating their desire to reverse a previously claimed tax credit or refund.

Who is required to file intent to reverse credit?

Taxpayers who have claimed a tax credit or refund and wish to reverse it are required to file intent to reverse credit.

How to fill out intent to reverse credit?

To fill out intent to reverse credit, taxpayers must provide their personal information, details of the original credit or refund, and specify the reason for the reversal.

What is the purpose of intent to reverse credit?

The purpose of intent to reverse credit is to officially notify the tax authorities of the taxpayer’s decision to withdraw a claim for a tax credit or refund.

What information must be reported on intent to reverse credit?

Information that must be reported includes the taxpayer's identification details, the original claim amount, the reason for the reversal, and any relevant dates.

Fill out your intent to reverse credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Intent To Reverse Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.