Get the free Bridging Loan - positivelending co

Show details

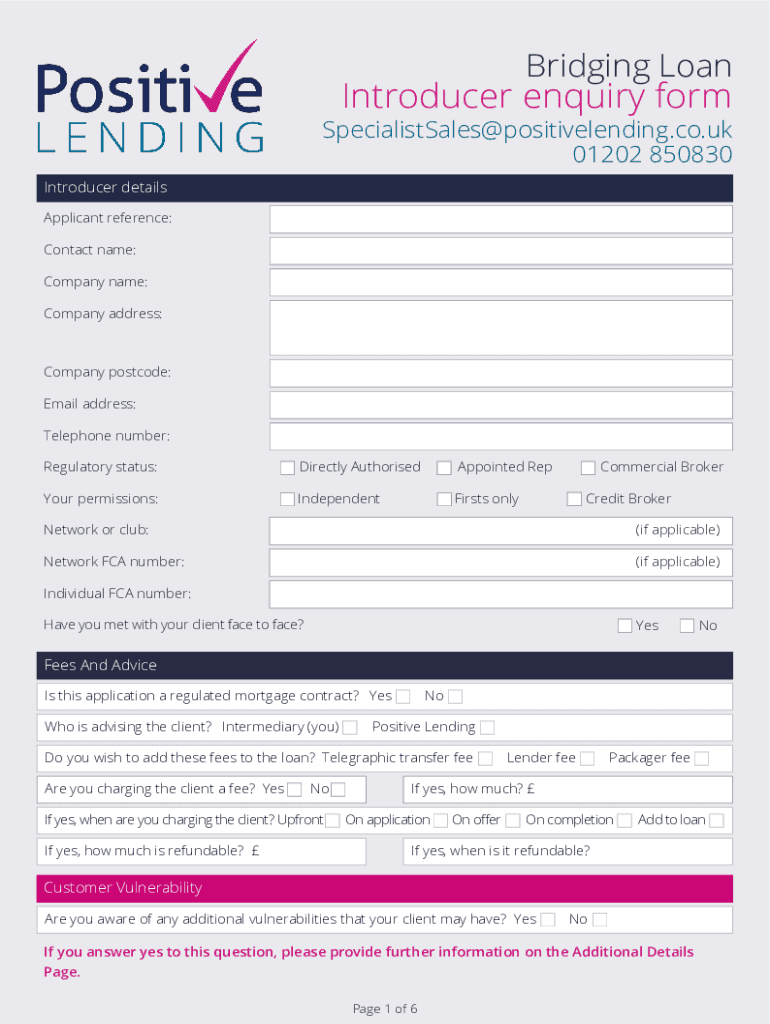

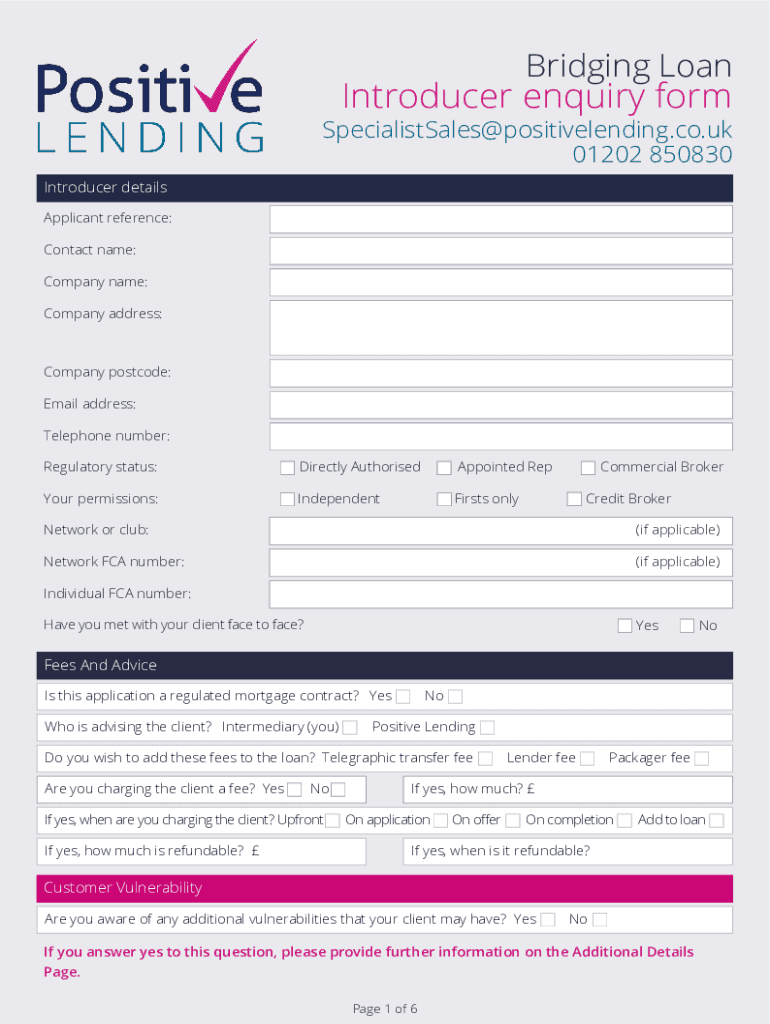

Bridging LoanIntroducer enquiry formSpecialistSales@positivelending.co.uk 01202 850830 Introducer details Applicant reference: Contact name: Company name: Company address:Company postcode: Email address:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bridging loan - positivelending

Edit your bridging loan - positivelending form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bridging loan - positivelending form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bridging loan - positivelending online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit bridging loan - positivelending. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bridging loan - positivelending

How to fill out bridging loan

01

Begin by gathering all the necessary documents that are typically required for a bridging loan application, such as identification proof, income statements, property details, and other relevant information.

02

Research and compare different bridging loan providers to find the one that offers the most suitable terms and interest rates for your needs.

03

Submit your application along with the required documents to the chosen bridging loan provider.

04

Await the approval process, which may involve a thorough assessment of your creditworthiness, property valuation, and the viability of your exit strategy for repaying the loan.

05

Once your application is approved, review the loan offer in detail, including the terms and conditions, interest rates, and any associated fees.

06

If you are satisfied with the loan offer, sign the agreement and provide any additional documentation or information requested by the lender.

07

Upon completion of the necessary legal and financial formalities, including property valuation and legal checks, the loan amount will be disbursed to you.

08

Utilize the bridging loan fund for your intended purpose, which could be bridging the financial gap between buying a new property before selling the existing one, funding property development projects, or meeting urgent financial requirements.

09

Make sure to plan your exit strategy effectively, as bridging loans are typically short-term and need to be repaid within a specific timeframe.

10

Monitor your loan repayments diligently and ensure timely payments to avoid any default or additional penalties.

Who needs bridging loan?

01

Bridging loans are typically sought after by:

02

- Individuals who are looking to buy a new property before selling their existing one, bridging the financial gap between the two transactions.

03

- Property developers who require funds to initiate or complete a construction project.

04

- Individuals or businesses in need of urgent funds for various purposes, such as paying off debts, investing in business growth, or meeting short-term financial obligations.

05

- Investors who want to secure a property quickly at an auction or a discounted price and need immediate financing until they can arrange for a long-term loan or sell the property at a profit.

06

- Anyone who requires short-term financial assistance when traditional loans are not readily available or viable due to time constraints or specific circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send bridging loan - positivelending for eSignature?

When your bridging loan - positivelending is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for signing my bridging loan - positivelending in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your bridging loan - positivelending and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Can I edit bridging loan - positivelending on an Android device?

You can make any changes to PDF files, such as bridging loan - positivelending, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is bridging loan?

A bridging loan is a short-term financing solution that is used to bridge the gap between the purchase of a new property and the sale of an existing property.

Who is required to file bridging loan?

Individuals or entities that require temporary financing for purchasing a new property before selling their current property are typically required to file for a bridging loan.

How to fill out bridging loan?

To fill out a bridging loan application, you should provide details about your current and new properties, financial information, and the duration for which the loan is needed, along with supporting documentation.

What is the purpose of bridging loan?

The purpose of a bridging loan is to provide immediate funding for a new purchase when the funds from an existing property sale are not yet available.

What information must be reported on bridging loan?

Information that must be reported on a bridging loan includes the loan amount, interest rate, duration, details of the properties involved, and borrower’s financial information.

Fill out your bridging loan - positivelending online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bridging Loan - Positivelending is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.